Polygon’s bull flag emerges as activity dips: Should buyers be cautious?

- POL appears to have formed a bull flag on its four-hour chart suggesting an upcoming uptrend.

- This uptrend could face resistance given that a majority of holders are yet to become profitable.

Polygon [POL] traded at $0.655 at press time, after an 11% gain in 24 hours. These gains are a reversal from bearish trends, given that the price remains down by 7% in the last seven days.

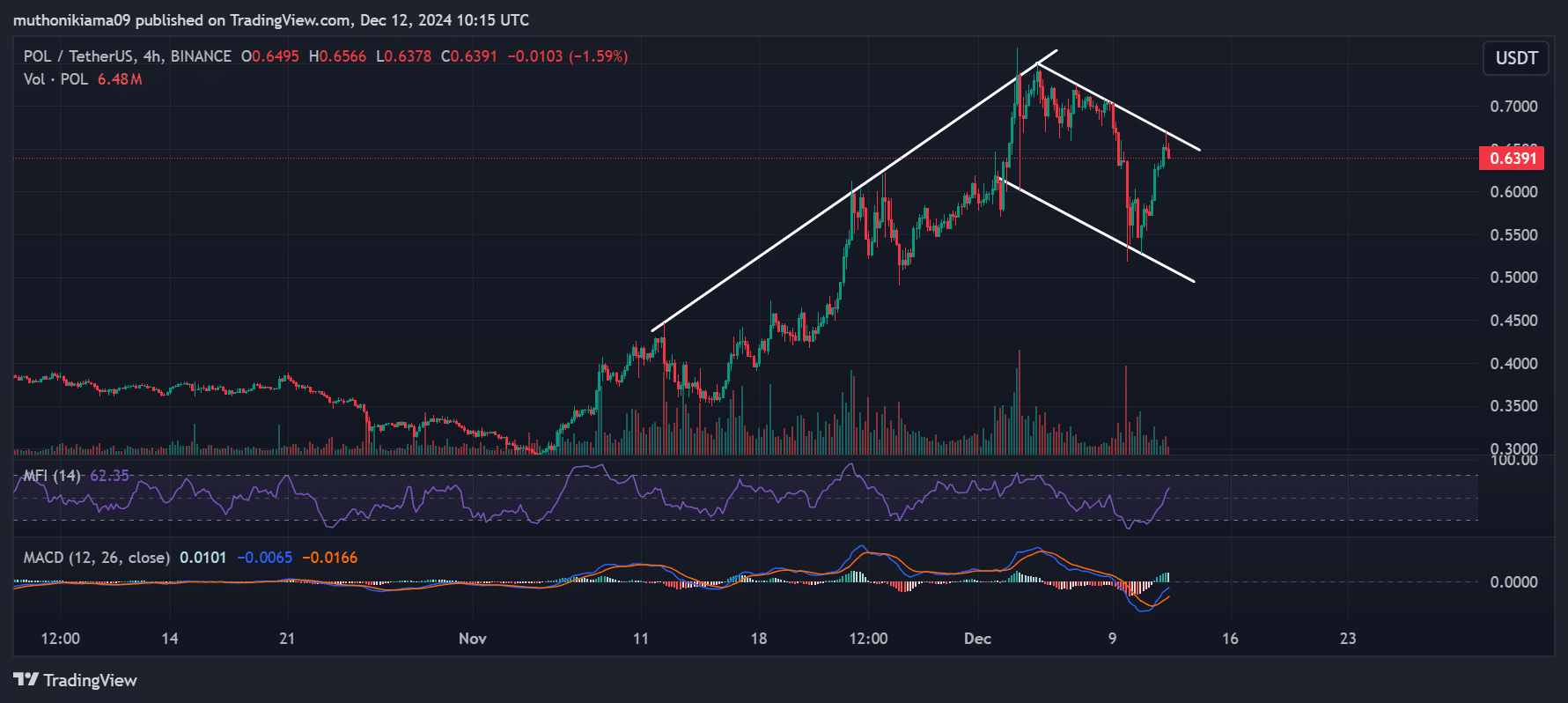

Polygon, like most altcoins, recorded a strong uptrend in late November, before hitting a snag earlier this month. This uptrend and the subsequent drop formed a bull flag on POL’s four-hour chart.

This pattern suggests that POL could continue its uptrend, but more buying volumes are needed to support a breakout.

The volume histogram bars depict minimal buying and selling activity. However, the Money Flow Index (MFI) index suggests that buying activity is increasing after a rise to 62.

The Moving Average Convergence Divergence (MACD) also shows that bulls are regaining control after the MACD histogram bars flipped green, an indication of rising buying activity.

At the same time, the MACD line on this lower timeframe is in an uptrend, and if it crosses above the signal line, it will be a confirmation of short-term bullishness.

Key levels to watch

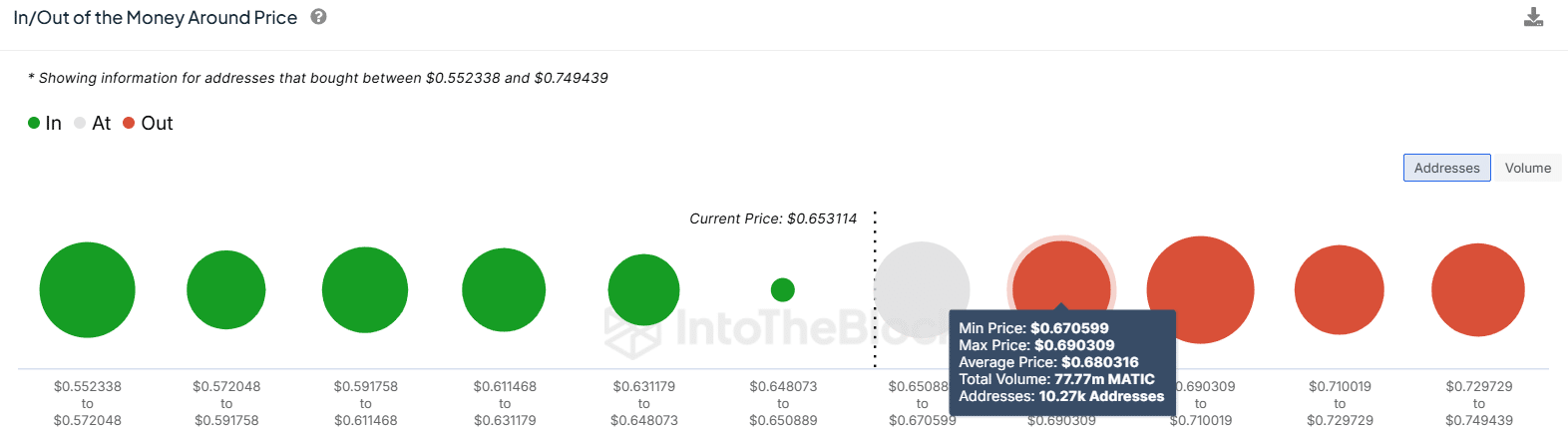

The In/Out of the Money Around Price (IOMAP) metric from IntoTheBlock shows that nearly 10,000 addresses bought POL between $0.65 and $0.67. This price zone could act as a support level, with a drop below set to cause a downturn.

The other cohort to watch is the 10,270 addresses that bought more than 31M POL tokens between $0.67 and $0.69. This zone could act as a strong resistance level as these addresses could begin to sell once they become profitable.

Polygon’s dApp activity could impact price

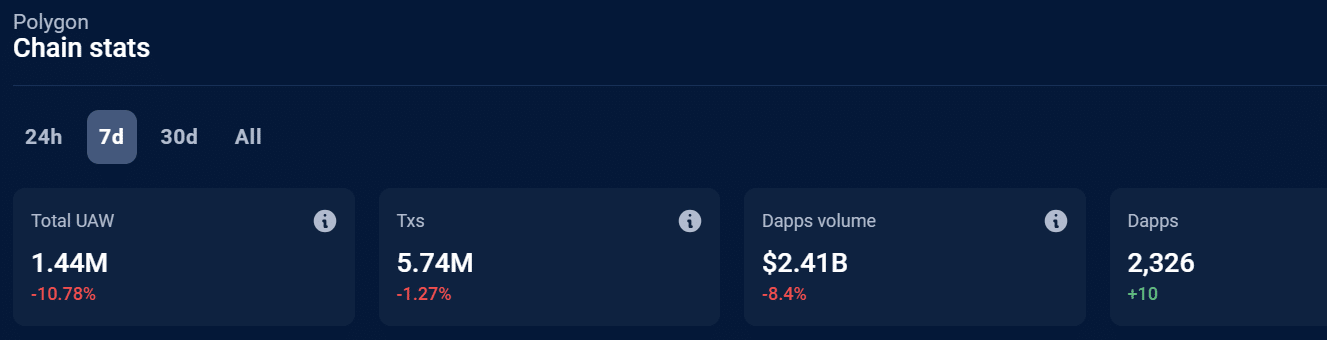

Data from DappRadar shows a notable drop of more than 8% in Polygon’s seven-day dApp volumes, which stood at $2.41 billion at press time. The Unique Active Wallets (UAWs) also dropped by 10%.

However, on the decentralized finance (DeFi) front, Polygon has staged a strong recovery, with the Total Value Locked (TVL) surging to $1.195 billion per DeFiLlama. The TVL is now at its highest level in more than one month.

If the Polygon network continues to show strength and growth, it could bode well for POL.

Is your portfolio green? Check out the POL Profit Calculator

Long/short ratio shows a shift in sentiment

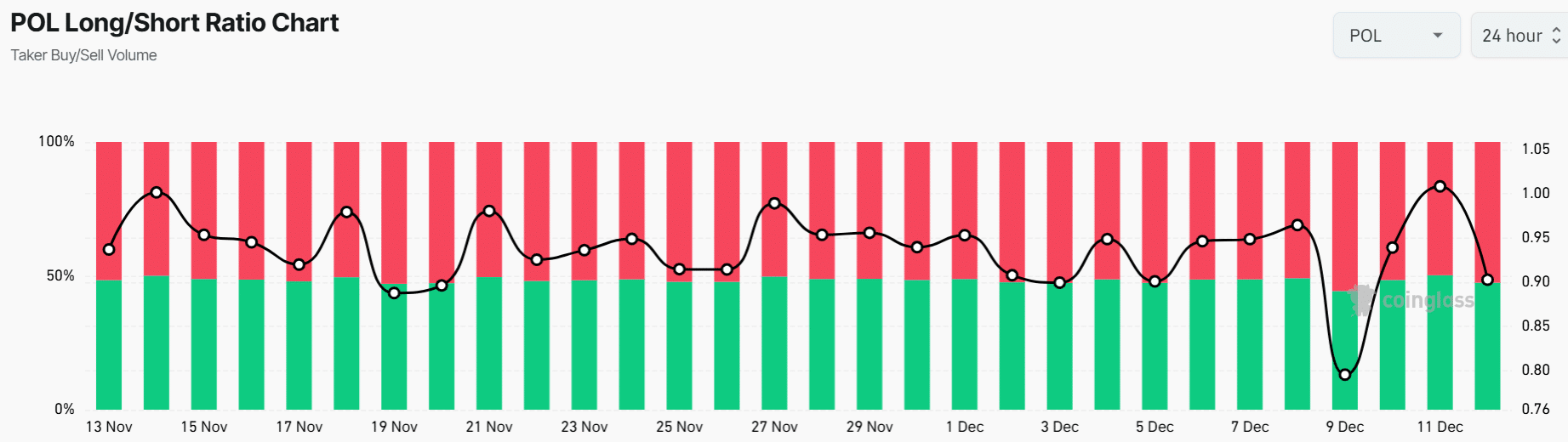

Polygon’s long/short ratio dropped to a monthly low of 0.79 on the 9th of December after a rise in short-selling activity. However, this ratio has since surged to 0.90.

POL’s long/short ratio still shows bearish sentiment, given that 52% of traders are short sellers. This indicates that there are fewer traders who are optimistic about a continued uptrend.