Polygon’s underground work across Hermez EVM and everything latest

Polygon’s [MATIC] underground works across the Hermez EVM and public chain roll-ups have not resulted in glad tidings for investors. According to the project’s co-founder, Anurag Arjun, Polygon had a lineup of developments.

In summary, the integrations would be aimed at a common goal— to scale the ecosystem with cryptographic proof and seamless validation.

However, MATIC seemed to be calm about the development. In fact, the recent happenings on-chain proved the update was of almost no concern to investors.

Need a helping hand?

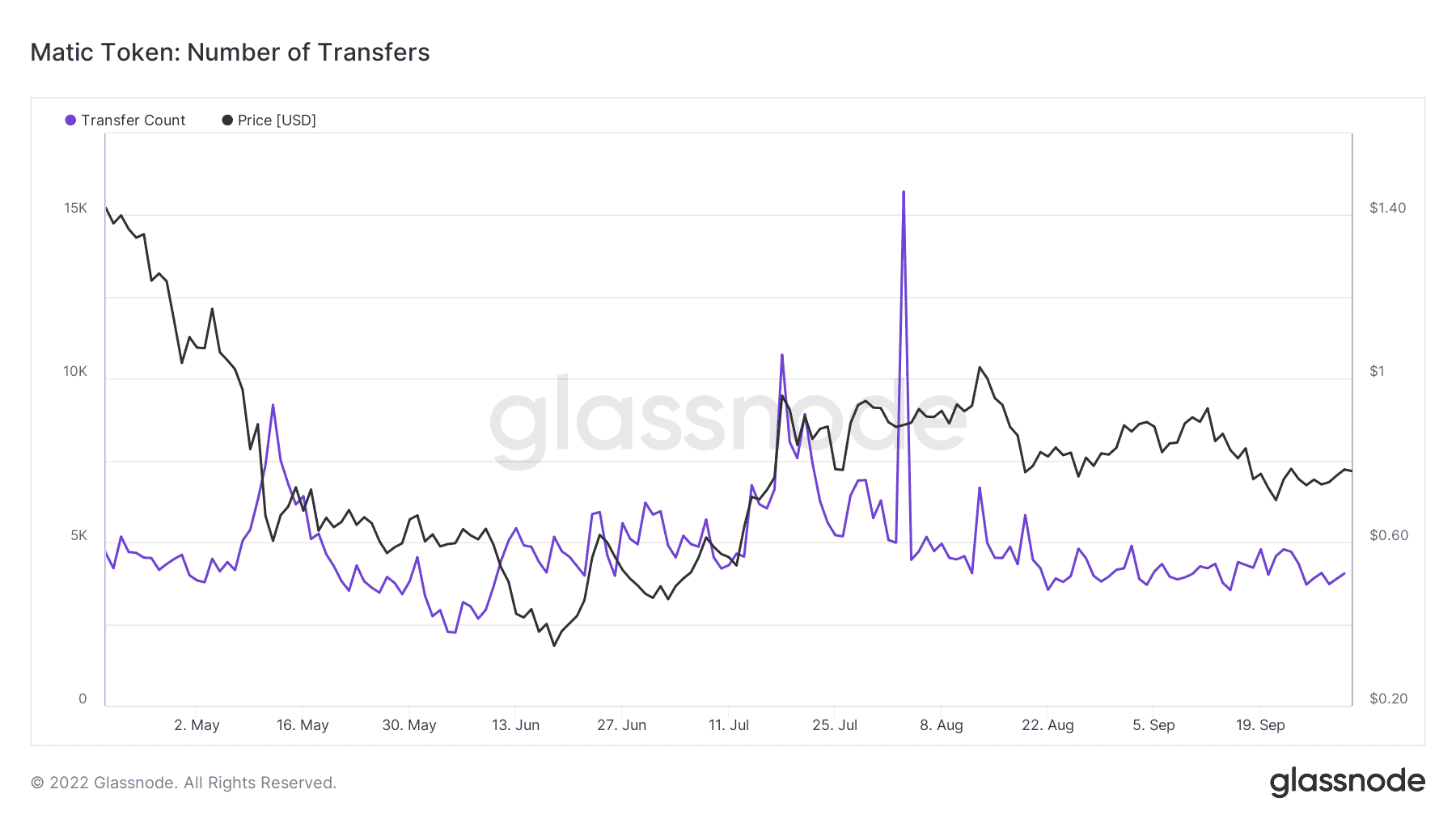

According to Glassnode, activities on the MATIC network have not been impressive. The transfer count had exited at press time, reaching peaks since August. Hence, transactions per second had declined massively for over a month.

While there was an increase lately, it was only slightly different from 30 September. Glasnode showed that the transfer count was 4045 at the time of this writing. The on-chain monitoring platform also showed the transfers were occurring at a rate of 0.0468.

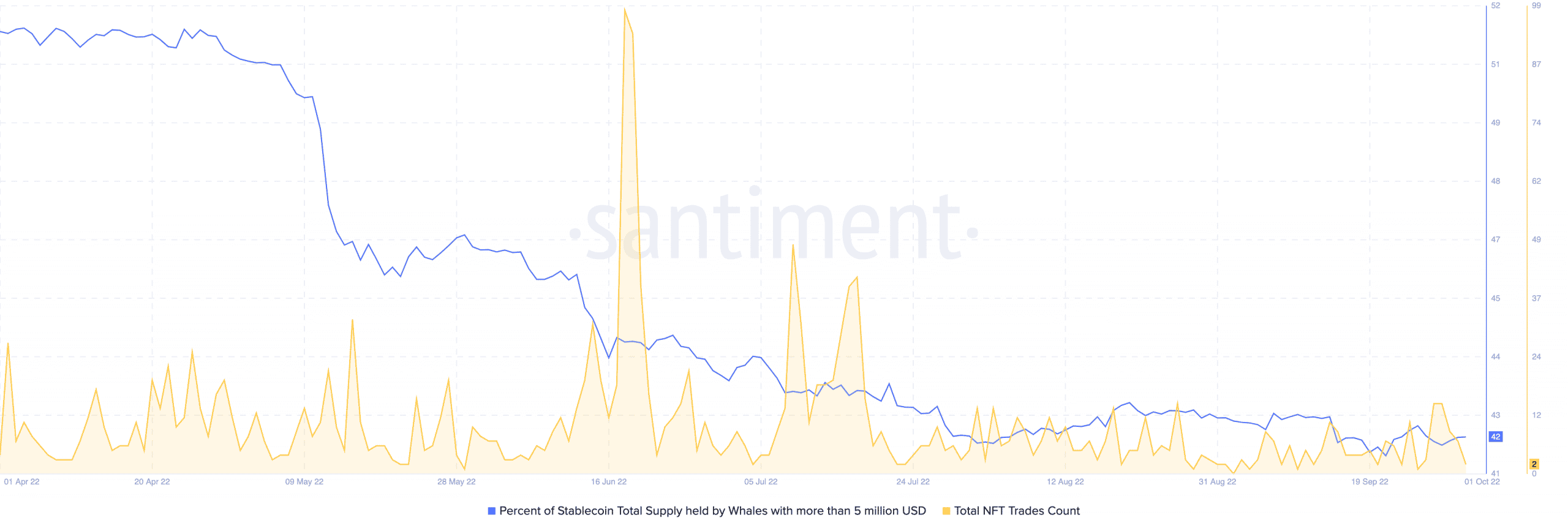

Additionally, MATIC’s whale holdings supply had reversed on 25 September. Based on Santiment data, the supply held by MATIC whales was 42. Considering this state, MATIC didn’t seem ready to take investors out of the misery of losses.

The NFT situation on its chain was not exciting either. The last time there were 100 NFT trades in a day was in June. At press time, Polygon’s daily NFT trades across several marketplaces had incredibly decreased.

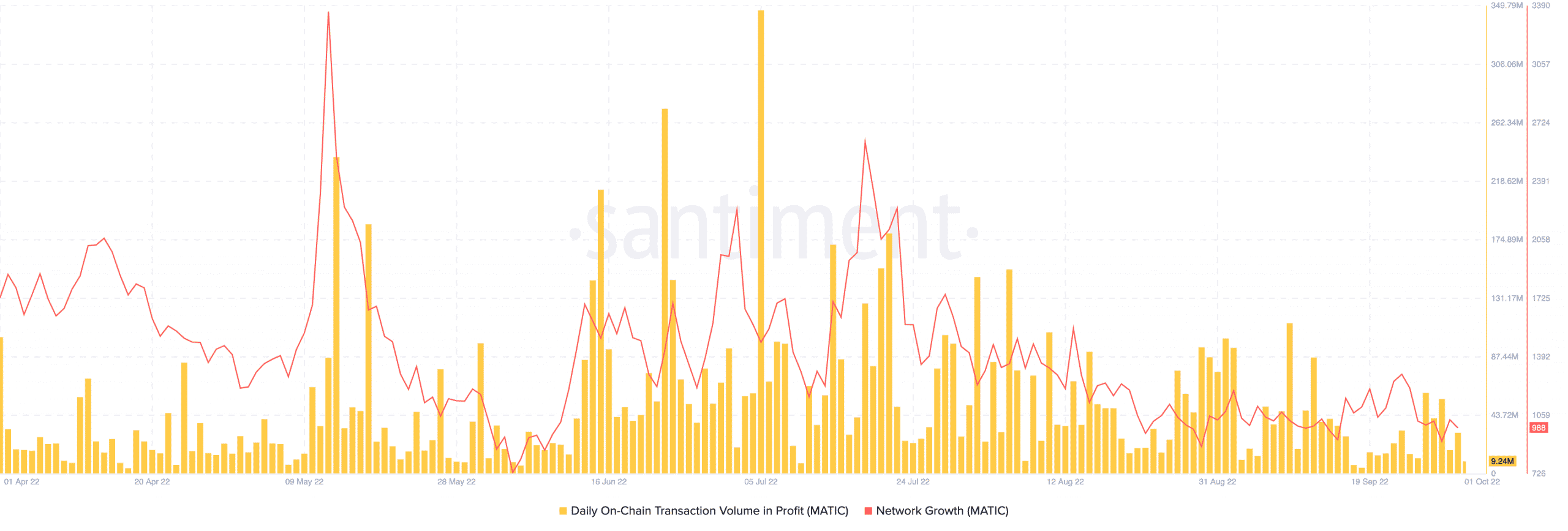

Much more was revealed upon considering the network growth. Santiment showed that MATIC’s network growth was 988, compared to 1,033 on 29 September. Hence, the plans in place didn’t manage to raise the bar on Polygon’s network just yet.

Furthermore, the profits recorded on-chain seemed lesser than what investors may have expected. Interestingly, it did not appear to increase further than 9.24 million at press time.

With all these, could it be possible that MATIC’s southward journey would be an inevitable event?

It’s no daydream

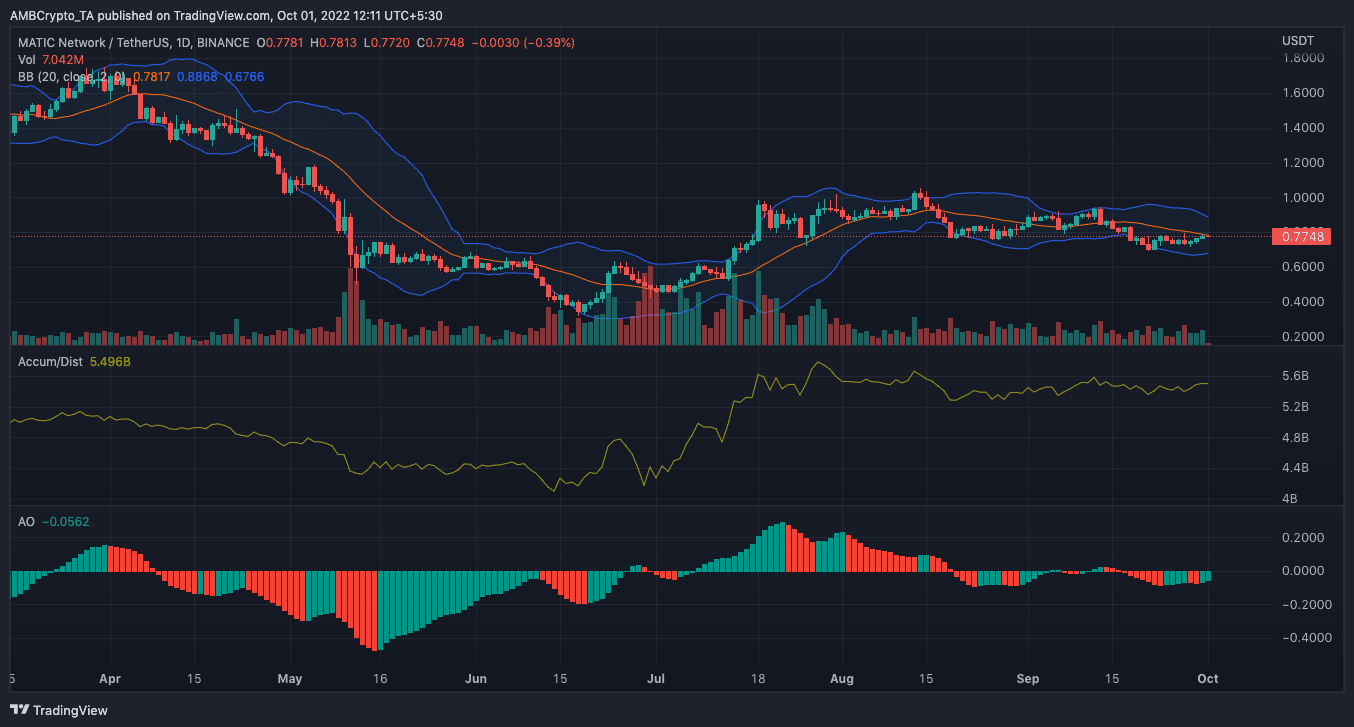

On the daily chart, MATIC’s accumulation and distribution seemed to have contrasting views with the metrics on-chain. With the Accumulation/Distribution (A/D) at 5.49 billion, MATIC investors steadied the “buying and selling ship.” So, this could signal some relief for investors expecting a short-term profit.

While MATIC traded at $0.77, the Bollinger Bands (BB) press time stance did not drive a further price uptick. At press time, the BB was showing extremely low volatility.

Hence, expecting a significant spike in price may be impossible. Indications from the Awesome Oscillator (AO) also shared the same sentiment with its value at -0.056.