Altcoin

Polygon’s performance in Q1 was promising; will it be repeated in Q2

Polygon registered growth in multiple areas, such as network usage and TVL, in Q1 2023. However, the blockchain’s NFT ecosystem stats declined marginally.

- Polygon’s gaming ecosystem boomed in Q1 with an average of 115,000 daily active gaming wallets.

- MATIC’s performance in Q2 so far has been sluggish, thanks to the market trend.

All eyes were on Polygon [MATIC] during the concluding days of the first quarter of 2023 as it launched zkEVM. However, the zkEVM launch was not the only highlight of the network in Q1. Messari’s latest report pointed out Polygon’s overall performance during Q1 2023.

— Messari (@MessariCrypto) April 27, 2023

Read Polygon’s [MATIC] Price Prediction 2023-24

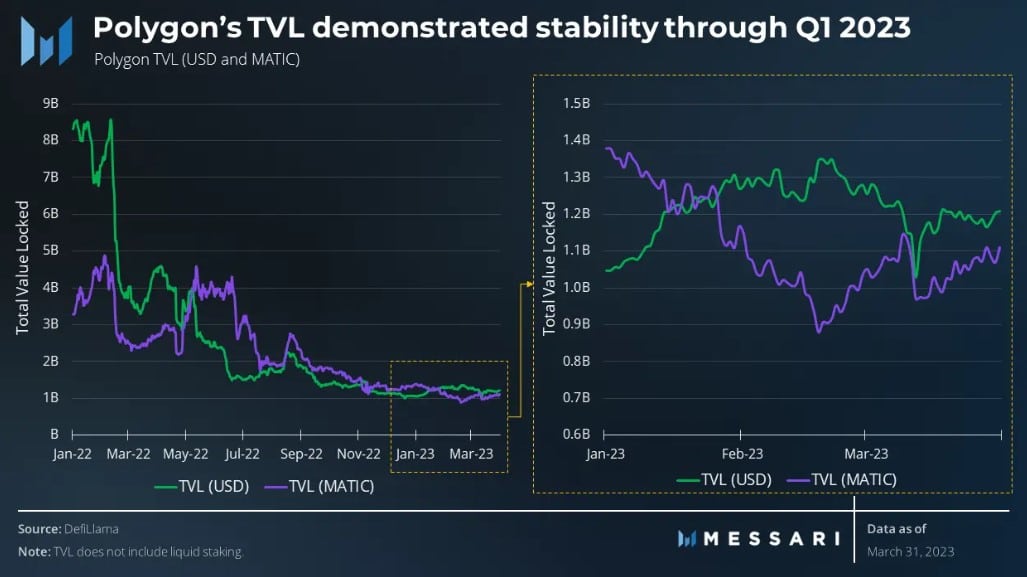

Polygon network’s value stabilized

Polygon’s total value locked (TVL) started to increase at the beginning of 2023, after decreasing during Q4 2022. Midway through the quarter, Polygon reached its peak of $1.4 billion, up from $1.1 billion at the beginning of the quarter.

Well, the blockchain ended the quarter with a TVL of $1.2 billion.

Network usage remained high

Messari’s report revealed that the blockchain’s network usage was on par in Q1 2023. A daily average of 400,000 addresses were active on the Polygon PoS chain, while also adding 22 million new addresses overall during the last quarter.

With an average of almost 3 million transactions per day since 2022, the network’s transaction volume has remained stable.

These areas registered declines in Q1

In terms of DEX volume, Uniswap dominated the space, as it enjoyed 80% of the total DEX volume in Q1 2023. Aggregators, on the other hand, made up only about 8% of the overall volume and saw a decline in their share of volume QoQ.

Not only this, but Polygon’s NFT ecosystem registered a decline in Q1. In the first quarter of 2023, Polygon saw a little fall in daily active wallets, going from 425,000 to 389,000, a QoQ drop of 8%.

Gaming on Polygon is on the rise

Furthermore, Polygon witnessed a major boost in gaming over the last quarter, as it had the most active gamers of any EVM chain.

The blockchain had an average of 115,000 daily active gaming wallets and over 40 million total gaming transactions. A few of the top games that were deployed on Polygon were Planet IX, Sunflower Land, Hunters On-Chain, Benji Bananas.

Polygon in Q2 2023

Unlike Q1, DeFiLlama’s data revealed the blockchain registered a decline in TVL on 19 April 2023. However, the good news was that the graph showed signs of recovery in the last few days. A few other statistics showed that Polygon’s performance in Q2 was not satisfactory.

For instance, the number of daily active addresses has declined since the beginning of April. MATIC’s demand in the derivatives market also fell, as evident from its Binance funding rate. Additionally, MATIC’s weighted sentiment revealed that the community’s confidence in the network was low.

Is your portfolio green? Check the

Polygon Profit CalculatorQ1 began with the bulls dominating the market, but unfortunately, the same did not happen in Q2. MATIC’s price fell victim to market conditions.

According to CoinMarketCap, MATIC was down by more than 8% in the last seven days. At press time, it was trading at $0.9909 with a market capitalization of over $9 billion.

MATIC’s latest price decline was accompanied by a massive surge in volume, which was negative. The token’s supply on exchanges increased considerably, while its supply outside of exchanges declined. This was bearish, as it suggested that MATIC was under selling pressure.