Polygon’s POL migration: Can it reverse MATIC’s downtrend?

- Polygon’s POL migration on September 4th could be the catalyst MATIC needs to break free from its current downtrend.

- With MATIC trading near its multi-year low, the upcoming upgrade is a critical test for Polygon’s market resilience.

Polygon [MATIC] has been under pressure recently, with its price experiencing a steady decline. Trading at $0.4001 at press time, MATIC has seen a -2.08% drop in the last 24 hours and a -21.95% decline over the past week.

This downturn reflects the broader bearish sentiment in the crypto market, which has impacted many digital assets.

Despite the ongoing challenges, the upcoming transition from MATIC to POL is generating cautious optimism among investors. Scheduled for September 4th, this upgrade is part of Polygon’s strategy to enhance network performance and efficiency.

Market participants are closely watching to see if this shift can reverse the current negative trend and boost Polygon’s market position.

Key levels and potential price movement

As MATIC prepares for its migration to POL, the token’s price is hovering around a critical support level at $0.40, which corresponds to its multi-year low. Maintaining this support is crucial for MATIC’s short-term stability.

If the price holds, the next major resistance to watch is at $1.50. A break above this level could pave the way for a substantial rally, with the potential to reach $3.00, representing a 100% gain.

Source: TradingView

Technical indicators also suggest a possible rebound. The Relative Strength Index (RSI) is currently at 35.95, indicating that MATIC is near oversold territory. This could signal a buying opportunity, especially if the POL token migration triggers renewed interest from buyers.

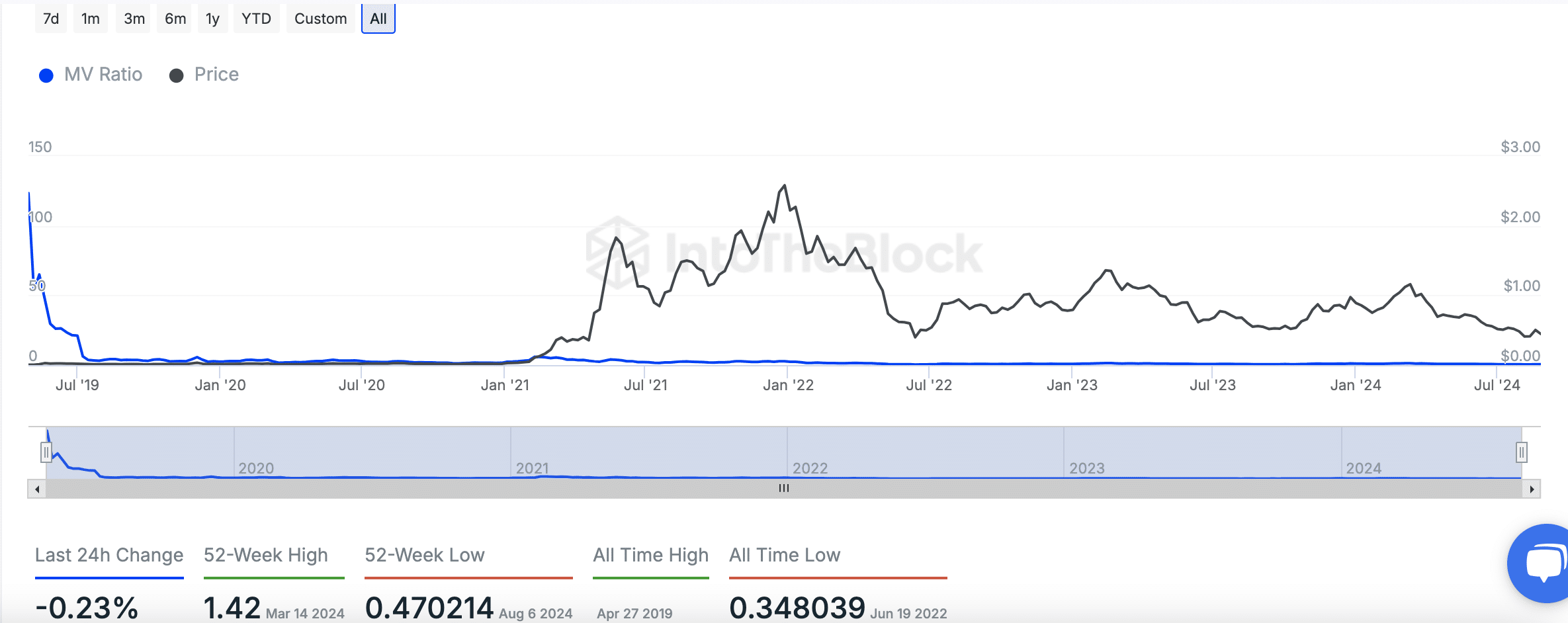

MVRV ratio and on-chain signals

The Market Value to Realized Value (MVRV) ratio for MATIC has shown considerable fluctuations over time. After a sharp decline in mid-2019, the MVRV ratio has remained relatively flat.

Recently, it has hovered close to zero, reflecting minimal profitability for MATIC holders.

As of press time, the MVRV ratio was at -0.23%, indicating slightly negative returns for recent investors and suggesting limited price appreciation potential in the short term.

Source: IntoTheBlock

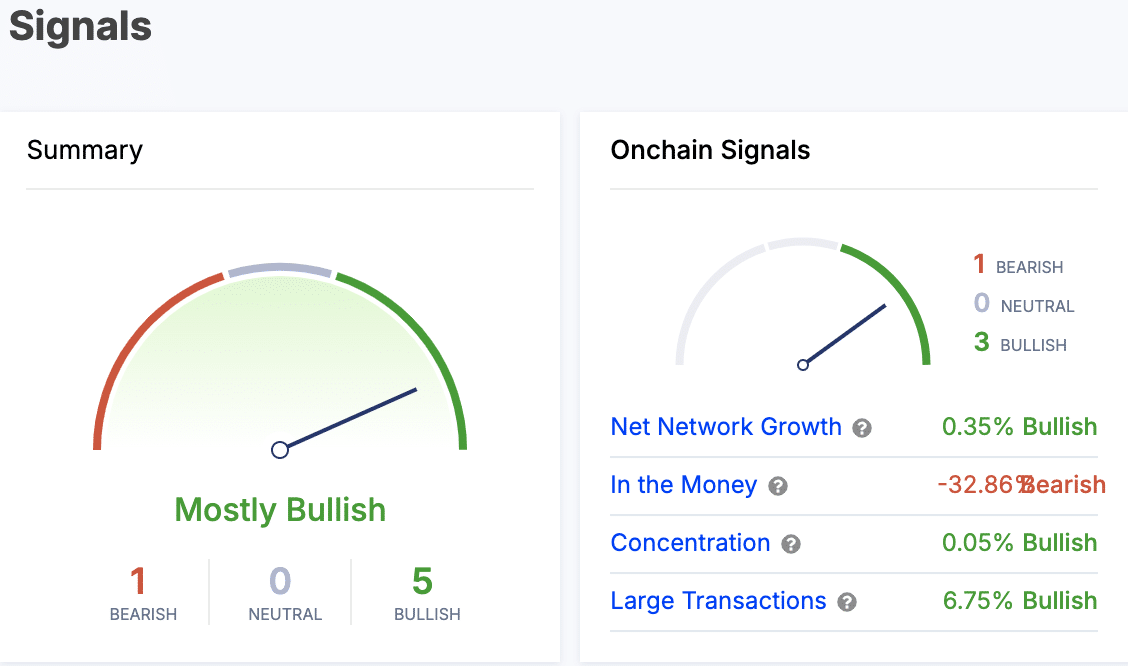

Moreover, on-chain signals for MATIC are “Mostly Bullish,” with three bullish indicators, per IntoTheBlock data. Net network growth is at 0.35%, and large transactions have increased by 6.75%, pointing to growing activity on the Polygon network.

However, the “In the Money” metric, which was at -32.86% at press time, showed a bearish sentiment, signaling that many investors are experiencing losses.

Source: IntoTheBlock

DeFi activity on Polygon

According to data from DefiLlama, Polygon’s Total Value Locked (TVL) stands at $876.12 million. This figure reflects the total capital held within DeFi protocols on the Polygon network.

Additionally, the market capitalization of stablecoins on Polygon is $2.026 billion, indicating robust activity in the ecosystem.

Is your portfolio green? Check out the MATIC Profit Calculator

Active addresses on the network in the last 24 hours totaled 576,621, demonstrating strong user engagement. As the POL migration approaches, these metrics will be closely monitored to gauge the upgrade’s impact on the network’s overall health and growth.

The upcoming POL migration represents a pivotal moment for Polygon.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)