Polymarket – Why a $45M bet on Trump is raising manipulation concerns

- Polymarket claims there is no evidence of manipulation, despite significant whale bets on Trump

- Prediction market odds have diverged from traditional polls, complicating election outcome predictions

As the United States gears up for the Presidential elections in less than two weeks, the competition between Donald Trump and his opponents is intensifying. To gauge public sentiment, prediction markets like Polymarket and Kalshi have emerged as valuable tools.

Polymarket defies all allegations

Polymarket made headlines recently for claiming that there was no evidence of market manipulation, despite significant bets placed by a prominent investor, often referred to as a “whale.”

For context, this individual, a French national with a robust financial background, invested over $45 million in Trump’s electoral prospects.

Remarking on the same, Polymarket spokesperson told Bloomberg,

“Based on the investigation, we understand that this individual is taking a directional position based on personal views of the election. Further, our investigation to date has not identified any information to suggest that this user manipulated, or attempted to manipulate, the market. This user has agreed not to open further accounts without notice.”

Speculations surrounding the prediction market

For those unaware, this stemmed from ongoing suspicions that have surfaced regarding the potential manipulation of Polymarket. This suspicion was particularly specific to Trump’s leading position in the polls.

Analysts and on-chain investigators have raised alarms that certain accounts, one identified as “Fredi9999,” may be controlled by a single investor aiming to influence the odds in Trump’s favor.

This speculation has fueled concerns about the transparency of betting activities on the platform and the reliability of the predictions derived from it.

“Elon is juicing the polymarket personally under the pseudonym Fredi9999 who dropped $7 million dollars propping republican election wins on polymarket regardless of relative position.”

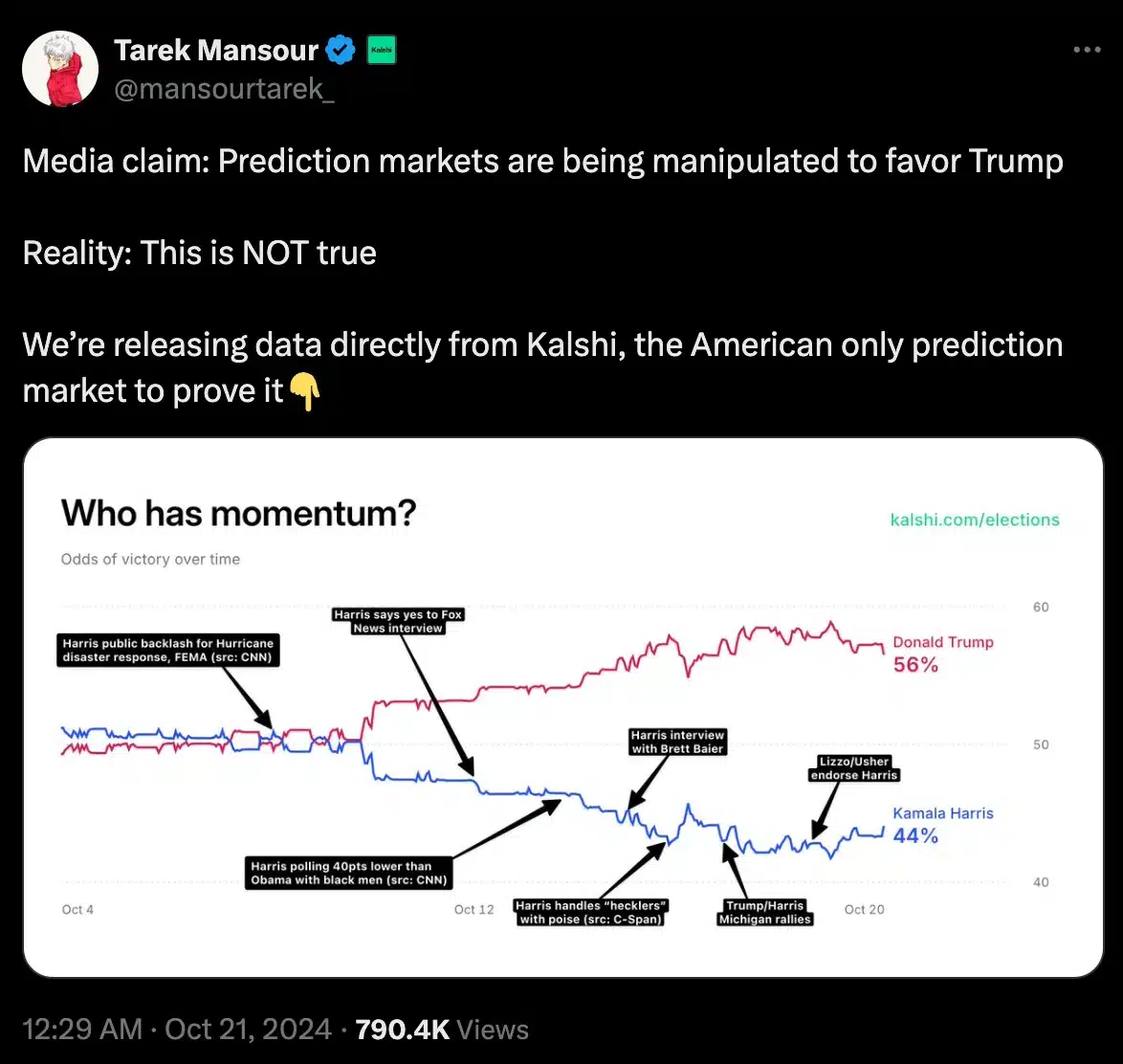

In fact, Tarek Mansour, Co-founder of Kalshi, also took to X to emphasize that media narratives often diverge significantly from the actual state of affairs.

Polymarket’s election trends

The U.S. Presidential election winner market on Polymarket has rapidly emerged as the platform’s largest segment. It has amassed over $2.4 billion in trading volume since its inception in January.

Currently, Trump holds a substantial lead over Kamala Harris, with odds reflecting a 64.3% to 35.6% advantage as per Polymarket.

Despite theoretical restrictions on U.S users, market odds on Polymarket align closely with those found on regulated platforms like Kalshi. The latter platform reported a 61% to 39% outlook for Trump at press time. On PredictIt, Trump’s odds sat at 59%, in comparison to Harris’s 45%.

This landscape is further complicated by national polling averages indicating Harris’s slight lead of 49% to 46%. This highlights the complexities and discrepancies between traditional polling data and prediction market dynamics.

Providing clarity on the same, a Kaiko analyst said,

“Furthermore, market odds shouldn’t be equated to polls. They both have different incentives. Polls aim to measure results within a margin of error, while the aim for Polymarket users is picking the winner—they don’t care if it’s by one vote or a landslide.”

With the election just days away, it will be intriguing to see whether prediction markets can withstand scrutiny.