POPCAT eyes $2: How speculation over fundamentals could hold it back

- POPCAT has risen to become the 8th largest memecoin by market cap, surpassing Mog Coin.

- Yet, it still has a long road ahead to reach key psychological targets.

Unlike most memecoins, Popcat [POPCAT] has shown striking price volatility in the post-election cycle.

Just two months ago, POPCAT made a splash by reaching the $1 mark, leaving its competitors in the dust. However, it failed to attract the same capital inflow in November, and some may have written it off. But don’t count it out just yet.

Despite recent setbacks, POPCAT has climbed to become the 8th largest memecoin by market cap. Even more intriguing, the token it overtook saw a near 80% surge last month.

Now with a razor-thin gap between the two, could POPCAT be primed for a parabolic rally to an all-time high? The next target is $2. What are the odds?

Intense accumulation is the need of the hour

Much of the gains POPCAT made during the initial phase of the election rally, which propelled it to a new all-time high of $2.08 in under two weeks, have since been erased due to heavy profit-taking. As of now, the token is valued at $1.50 (at the time of writing).

As a result, POPCAT stands out as the only token among the top 10 meme-coins to have dipped into the red in the 30-day percentage surge.

However, looking closer, POPCAT has shown signs of recovery over the past 7 days, outperforming its rivals with a 13% jump and a neutral RSI, suggesting potential momentum for a rebound.

Yet, there is a twist. In the mid-November cycle, POPCAT faced significant resistance around its current value, leading to a pullback near $1.20. Clearly, the meme-token is now standing at a crucial juncture.

To prevent history from repeating itself, the $1.50 level must turn into solid support.

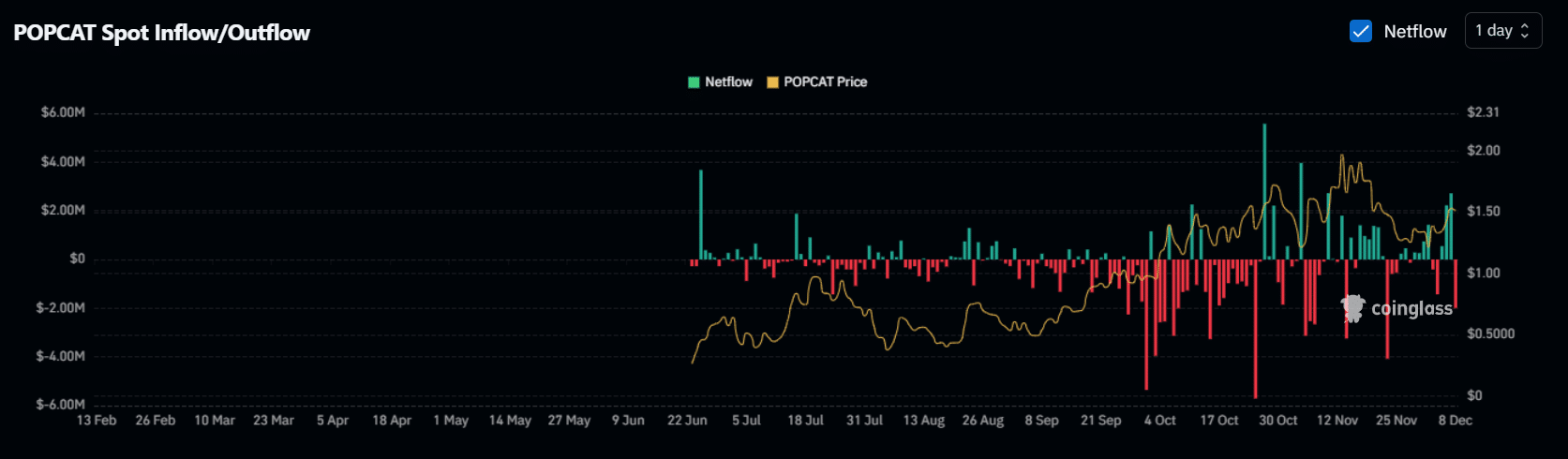

The red stick, showing around $2 million worth of POPCAT tokens being withdrawn by spot traders, signals a positive sign and suggests that the market views the current price band as a potential bottom.

However, to confirm this, it will be crucial to monitor this metric in the coming days and assess how the market is responding to the current price. If the bottom holds, a potential rise to $2 could be on the horizon.

Still, the inherent risks of POPCAT remains

The aforementioned analysis clearly shows that POPCAT’s recent price action is highly speculative, with erratic swings signaling significant fear among investors, all chasing quick, outsized returns in a short time.

So, without a stabilizing force to absorb this volatility, predicting a smooth path for POPCAT to reach $2 becomes a tough bet, no matter how bullish the broader market may be.

Here’s where it gets concerning. According to another AMBCrypto report, whale addresses holding 100K+ POPCAT have noticeably reduced their holdings over the years, while smaller cohorts have held strong.

Realistic or not, here’s POPCAT’s market cap in BTC’s terms

This trend signals waning confidence from the big players, which could spell trouble for POPCAT’s long-term growth prospects, pushing an all-time high further out of reach.

Therefore, unless this trend reverses, POPCAT might continue attracting speculative interest, but with no strong fundamentals to guide its long-term outlook, the road ahead remains uncertain.