Analysis

POPCAT price prediction – Where are the buying opportunities now?

POPCAT investors are in a unique position right now. Here’s what you should know…

- POPCAT had a strongly bullish market structure at press time

- A retest of the $0.71 demand zone would yield buying opportunities, if it plays out

Popcat [POPCAT] bulls were able to defend the $0.722 interim support and push prices higher. At the time of writing, the market price was $0.933. The memecoin sector has done well over the past week, with the most popular ones posting double-digit percentage gains.

In fact, the bullish expectations in a recent report were vindicated too. However, after nearly testing the $1 resistance zone, is it worth questioning if the rally has run of out steam or not?

Should traders brace for a pullback?

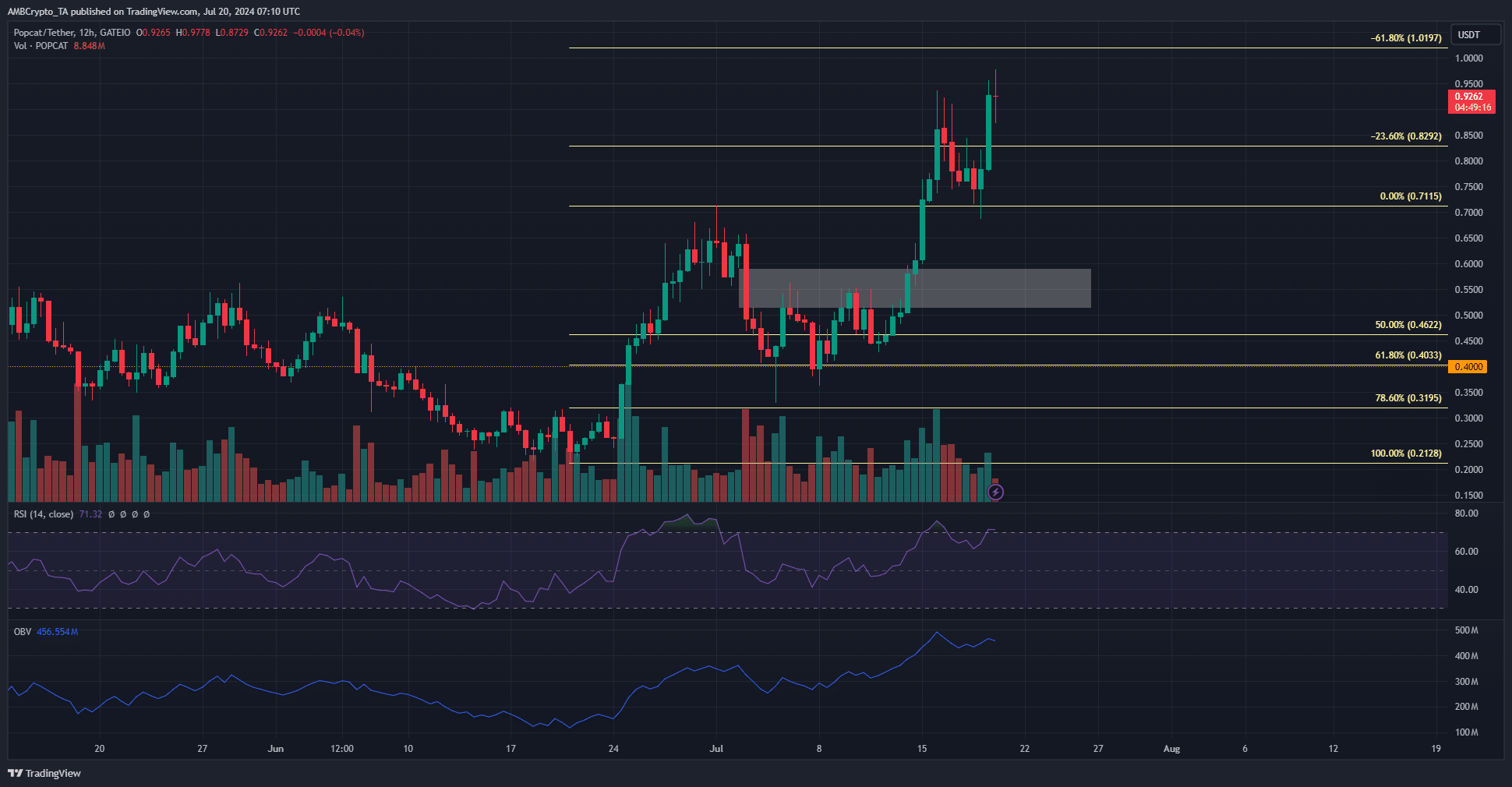

Based on the mid-June rally from $0.2128 to $0.711, a set of Fibonacci retracement and extension levels were plotted. On Monday, 15 July, POPCAT managed to burst out past the $0.5-$0.55 resistance zone.

This bullish gusto was enough to propel the price to $0.9778, just short of the 61.8% extension level at $1.02. Over the weekend, a retracement from the $0.98-$1.02 region appeared likely too.

The technical indicators were firmly bullish. The RSI reading of 71 showed high upward momentum and the OBV did not cease its uptrend over the past three weeks, reflecting steady buying pressure.

Usually, after a test of the 23.6% or 61.8% extension level, prices tend to drop towards the previous local highs. In this case, that would be $0.711.

Data supports an extended rally for POPCAT

Source: Coinalyze

The Open Interest rose from $29.4 million on 13 July to $63.28 million at press time. This rapid increase in price and OI signaled eager speculators and outlined conviction in the rally. The spot CVD also advanced to reflect demand in the spot markets.

Realistic or not, here’s POPCAT’s market cap in BTC’s

termsFinally, the funding rate pushed higher as more long positions piled on.

This might lead to a long squeeze and a retracement. Buyers can look to rein in FOMO and wait for a retest of key support levels before entering.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.