Memecoins

POPCAT soars 30% in 24 hours: Analyst eyes $5 target next

Alongside POPCAT, MEW and MOG also registered double-digit gains over the last 24 hours.

- POPCAT hits new ATH amid a sector-wide bull run.

- The memecoin’s strong bullish momentum hints at further upside.

After dogs and frogs, cats have now taken center stage, with the top three cat-themed tokens reaching new highs.

On the 13th of November, Popcat [POPCAT] hit an all-time high [ATH] of $2, leading the pack. Following closely behind, cat in a dogs world [MEW] and Mog Coin [MOG] also reached record highs on the 14th of November.

Bulls dominate the market

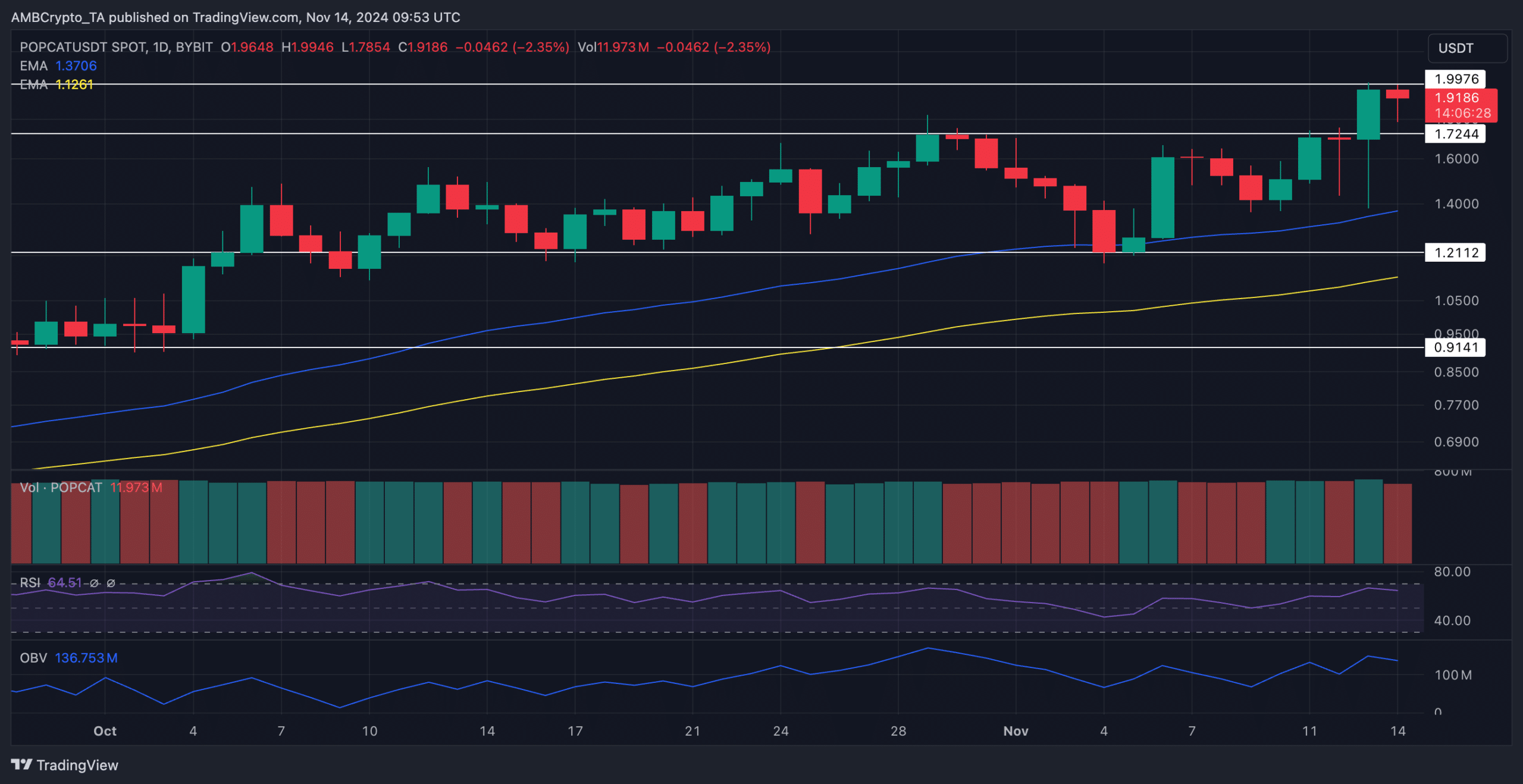

On the daily chart, POPCAT has predominantly trended higher. A rejection at $1.7 led to a slight loss of bullish momentum as the price dipped to $1.2 in early November.

Despite this setback, the bulls showed resilience, flipping the former to support while simultaneously hitting an ATH. At press time, POPCAT traded at $1.91, with CoinMarketCap

data reflecting a 24-hour gain of over 30%.Technical indicators also painted a bullish picture for the memecoin. The dominance of the 50 EMA [blue] over the 100 EMA [yellow] highlighted the broader uptrend.

Meanwhile, a slight dip in the OBV to 136.753 million, signaled a possible decrease in buying pressure.

Now, if investors cash out, prompting a rejection at the current resistance of $1.99, the price may find support at the resistance turned support of $1.7.

A drop below the 50 EMA could weaken bullish momentum, and a further decline below $1.2 might shift the sentiment toward bears.

Nonetheless, the RSI’s press time reading of 64.51 indicated the asset wasn’t overbought, leaving room for potential growth if the bullish trend persists.

What’s next for POPCAT?

Analysts also expressed strong optimism for the Solana [SOL]-based token.

Murad, a prominent crypto analyst,

asserted that POPCAT is “programmed” to reach $5, suggesting that this target is more than a possibility—it’s an expectation.He stated,

“Expecting $POPCAT to go ballistic in the coming weeks.”

Adding to the bullish sentiment, another analyst known as Muro highlighted POPCAT’s recent breakout from a descending trend line. This breakout supported the potential for further highs in the coming time.

Derivate data indicates…

The price chart wasn’t the only area showing positive indicators for this asset. Things were also looking promising on the derivatives side.

According to data reviewed by AMBCrypto on Coinglass, trading volume surged by 53.56%, reaching $2.01 billion. In addition, Open Interest rose by 29.68%.

These metrics suggested heightened activity and investor commitment.

The positive Funding Rate reinforced a market inclination toward long positions, while the close long/short ratio of 0.99 indicated a relatively balanced yet slightly long-biased sentiment over the past 24 hours.

Is your portfolio green? Check out the POPCAT Profit Calculator

Together, these trends suggested optimism in the market, further supporting the potential for additional upward movement.