Analysis

Popcat up 23% in 3 days, targets THIS price level next

The increased demand for the memecoin combined with Bitcoin’s encouraging price movement meant that further gains are likely.

- Popcat saw a breakout past the $1.5 resistance zone recently.

- The high demand and trading volume outlined a bullish intent.

Popcat [POPCAT] was up 6.3% within a day and has gained 23.85% since Saturday’s lows at $1.34. The meme coin saw its momentum slow down last week, but the bulls saw a resurgence over the weekend.

With Bitcoin [BTC] breaking out of its descending channel and climbing above the $70k mark, the sentiment across the market was firmly bullish

. Popcat may surge higher, but there is potential for a correction toward $1.4.Bulls break past local highs, target $2.5

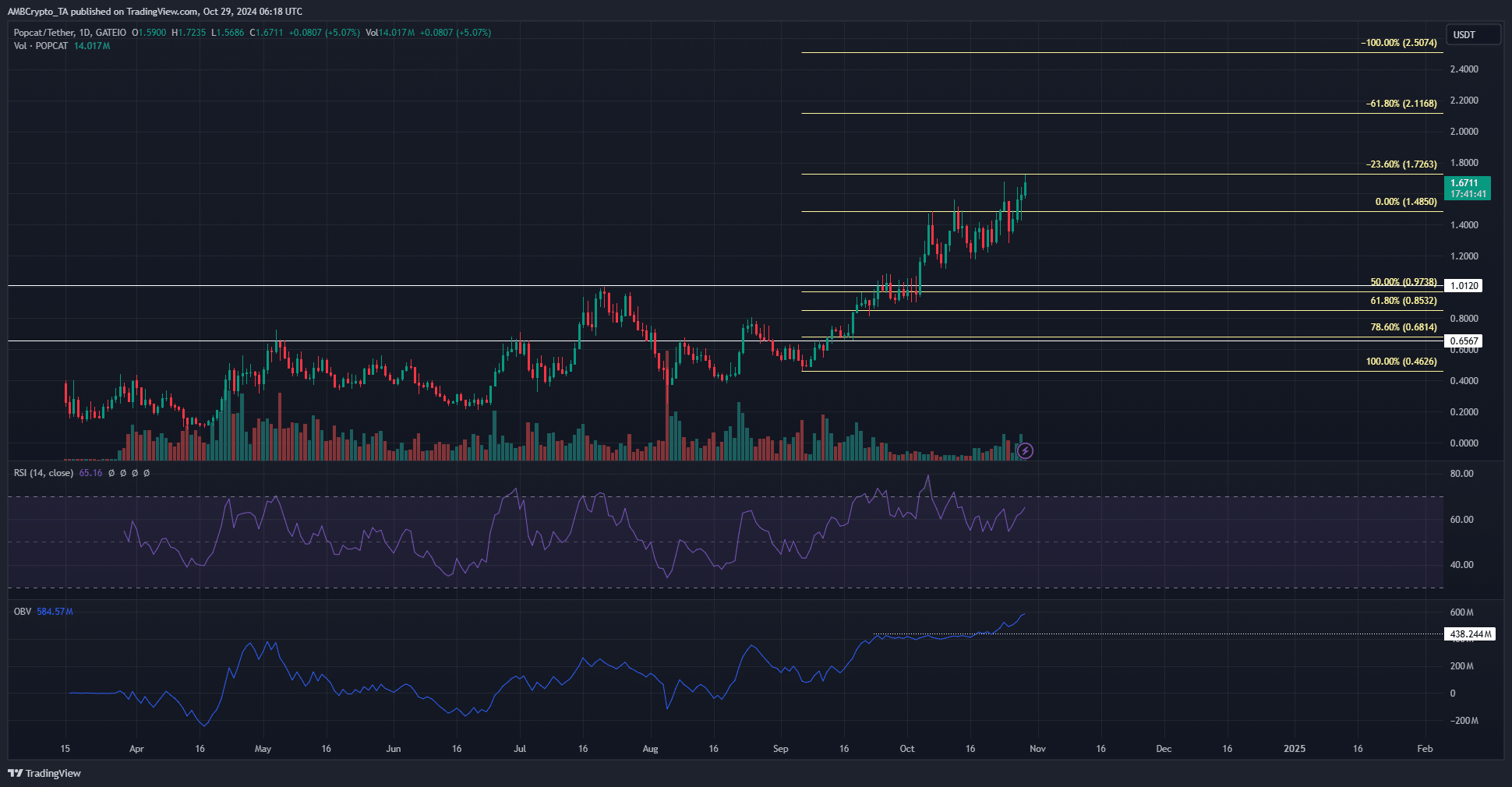

Popcat has made a series of higher highs and higher lows since the final week of August, and the token maintained this uptrend.

It saw a consolidation below the $1.5 region, at press time, but has decisively broken out over the past five days.

On the daily timeframe, the RSI had fallen toward the 50 mark but remained bullish. It began to push higher in recent days and does not show a bearish divergence yet. The OBV also shot past a local resistance level.

The increased demand for the meme combined with Bitcoin’s encouraging price movement meant that further gains were likely.

The Fibonacci extension level at $1.72 was tested in recent hours. It is likely to be broken in the coming days. This would present the $2.11 and $2.5 levels as the next bullish targets.

Potential for a short-term POPCAT correction

Source: Coinglass

The liquidation levels for the past week showed that the $1.62-$1.72 was a considerably strong magnetic zone for the prices. The bullish momentum of the past two days has brought POPCAT to this region.

Read Popcat’s [POPCAT] Price Prediction 2024-25

The next liquidity pool of note sat at the $1.4 level. As things stand, it is unlikely that such a drop will happen, as the price is not overextended yet.

However, traders should be cautious, since BTC is near its ATH and volatility is likely to be high.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion