Predicting Bitcoin’s Q4 moves: Insights from past market cycles show…

- Bitcoin struggles to stay above the bull market support band as Q4 approaches.

- Analysis of historical trends suggests a possible rally or further decline in Q4 2024.

Bitcoin [BTC] price experienced a notable dip last week, dropping to the $53,000 level for the first time since February. This downward trend has continued into the start of this week.

However, the cryptocurrency has managed a slight recovery, currently trading above $55,000. Despite this rebound, Bitcoin remains down 2.4% over the past 24 hours, with a trading price of $55,704 and a 24-hour low of $54,320.

Amid this, prominent crypto analyst Benjamin Cowen has recently taken to social media platform X to discuss the implications of Bitcoin’s current price movements and its potential trajectory through the end of the year.

According to Cowen, Bitcoin’s recent performance could be indicative of a “summer lull,” a pattern observed in previous cycles. His analysis suggests that the cryptocurrency’s future in Q4 hinges on its ability to regain and maintain key price levels over the coming weeks.

Bitcoin’s likely performance in Q4

Before delving deeper into the projections for Q4, it’s essential to understand what a Bull Market Support Band (BMSB) is.

This technical indicator combines the 20-week moving average and the 21-week exponential moving average, serving as a critical support region in bull markets.

A sustained position above this band is typically viewed as bullish, while dropping below it can signal bearish conditions.

Cowen points out that Bitcoin is currently testing this support band. If historical patterns hold true, Bitcoin’s behavior in relation to the BMSB during the summer could set the stage for its Q4 performance.

For instance, in 2023, after a brief dip below the BMSB, Bitcoin experienced a significant rally in the fourth quarter. Similarly, in 2013 and 2016, periods following a dip below this band saw substantial upward movements.

Exploring further, Cowen draws parallels with past years where Bitcoin faced similar downturns during the summer months. He notes that in years like 2019, when Bitcoin remained below the BMSB post-summer, the fourth quarter tended to be bearish.

Conversely, years that saw a recovery above the BMSB often experienced robust Q4 rallies.

The current market dynamics show Bitcoin’s struggle to climb back above the BMSB. Cowen speculates that the outcome of this struggle could either lead to a repeat of the strong recoveries seen in 2013 and 2016 or mimic the quieter Q4 of 2019.

This uncertainty makes the coming weeks crucial for setting the tone for the remainder of the year.

Current market fundamentals

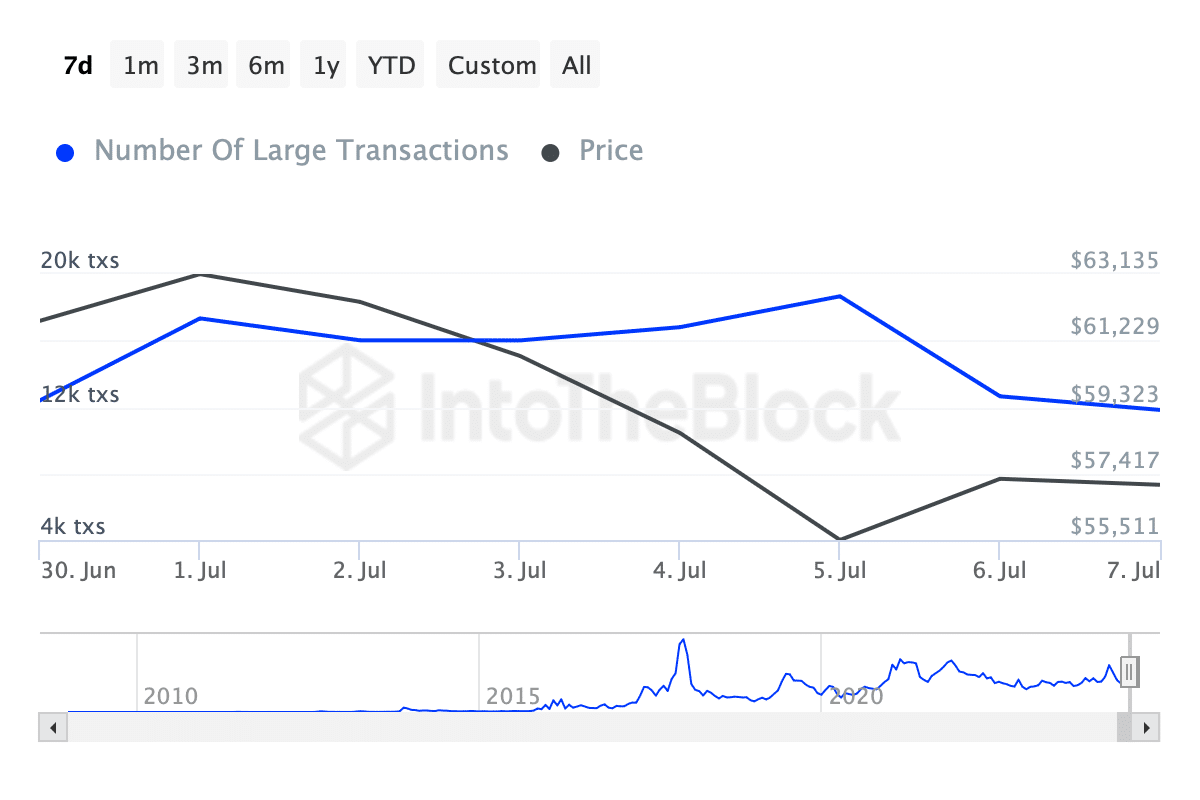

Turning to Bitcoin’s fundamentals, there’s a noticeable decline in whale transactions, with a significant drop from 17,000 to below 12,000 in just one week.

This decrease could indicate a cooling interest from larger investors or a potential consolidation phase.

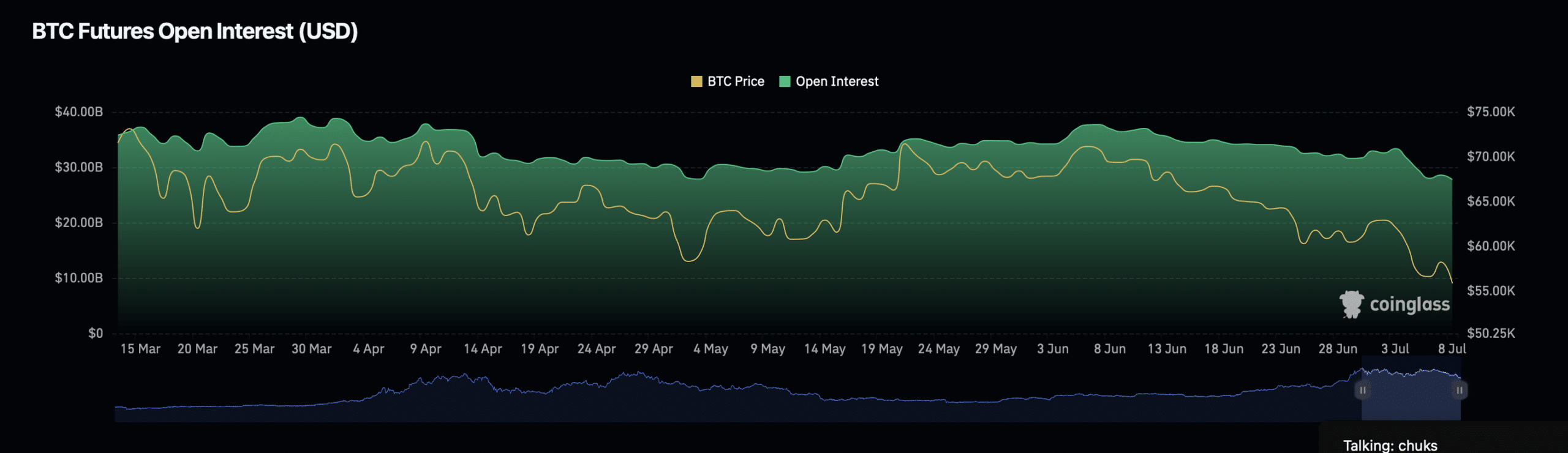

Additionally, Bitcoin’s open interest has slightly decreased by 2%, now standing at $27.62 billion. However, there’s been a stark increase in open interest volume, which surged by 32.91% to $57 billion.

This rise in trading volume amidst decreasing open interest suggests that while fewer positions are open, the transactions that are occurring are more significant.

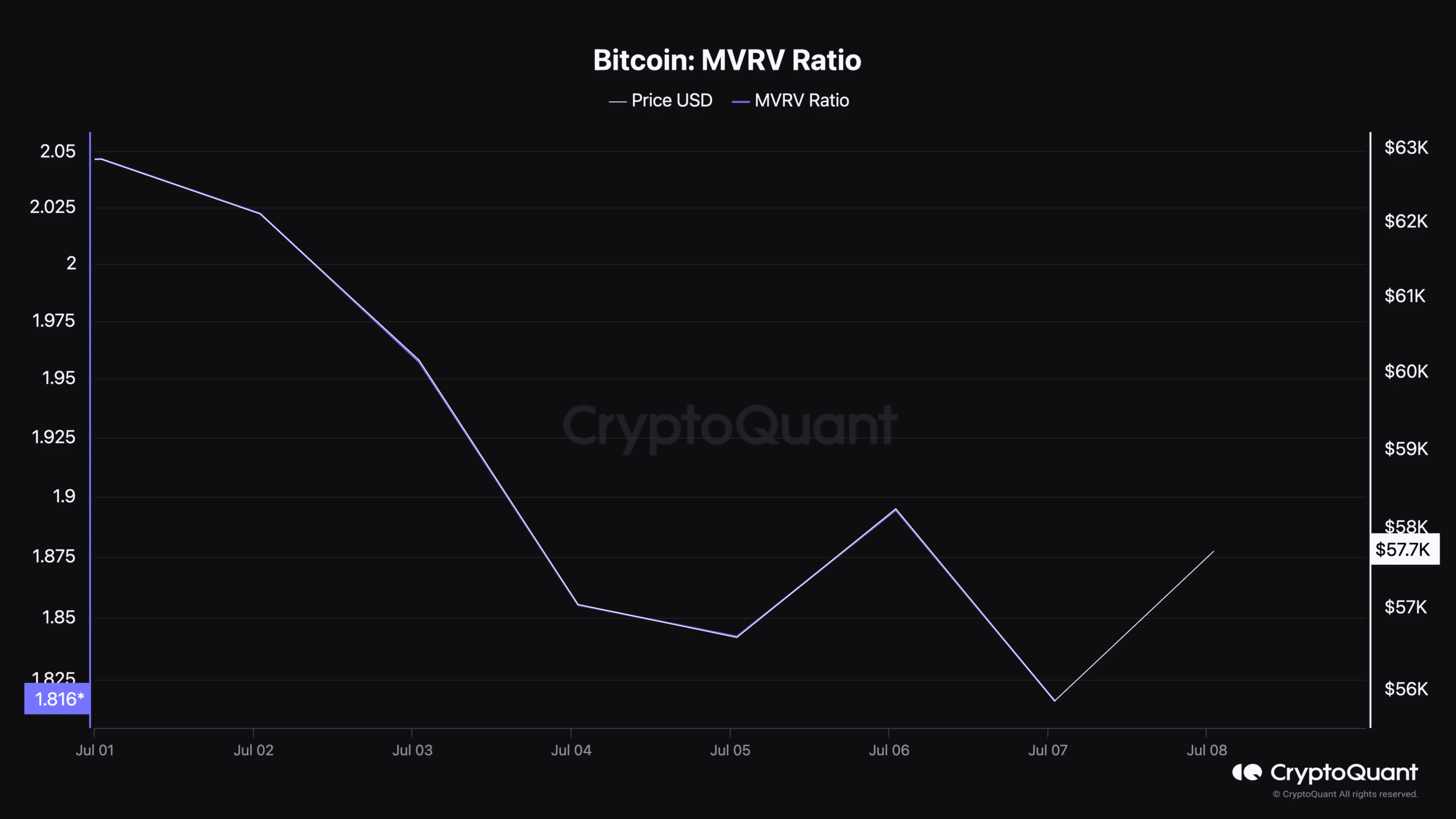

Furthermore, Bitcoin’s Market Value to Realized Value (MVRV) ratio, a measure of the market’s profitability, stands at 1.816.

A ratio above one typically indicates that the average holder is in profit, which could suggest that despite recent price drops, the overall market sentiment remains somewhat positive.

As Q4 approaches, the market remains at a critical juncture.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Whether Bitcoin can rebound above critical technical levels will likely dictate the market’s direction in the coming months, potentially setting the stage for the next major rally or a continued consolidation.

On the other hand, AMBCrypto has recently reported that Bitcoin bottom might be in as the increase in realized losses on-chain indicates that another BTC rally was close.