Project Golem joins ETH staking frenzy, locks up 40K tokens

- Project Golem moved over $124 million worth of ETH for staking.

- Ethereum’s staking frenzy surged ahead of U.S. spot ETH ETFs launch.

Ethereum [ETH]-based distributed computing marketplace Project Golem has joined the ETH staking frenzy.

On the 11th of July, contrary to its recent selling spree, the firm reportedly staked 40K ETH worth over $124.6 million, per Lookonchain’s data.

Golem Network confirmed the Ethereum staking move and stated that it was meant to “create space” to help participants contribute to the network.

‘The Golem Ecosystem Fund is officially launching today! We’ve staked 40,000 ETH from the Golem treasury. This will create space where developers, researchers and entrepreneurs could bring their ideas to life and contribute to the Golem Network and its ecosystem!”

Ethereum staking frenzy

The staking frenzy has gripped Ethereum, with just a few days to potential U.S. spot ETH ETF launch. Recently, an unmarked address locked over 6K ETH as well.

Golem Project’s move to lock 40K ETH on the 11th of July pushed the total locked ETH on the Beacon Chain to the highest level of 47.5 million ETH, worth over $140 billion based on press time market prices.

Beacon Chain is Ethereum’s system that handles the validation of new blocks.

According to a recent AMBCrypto report, the increasing ETH staking ahead of the U.S. spot ETH ETF debut underscored a bullish sentiment.

More ETH has been moved from exchanges, further reinforcing the bullish expectations.

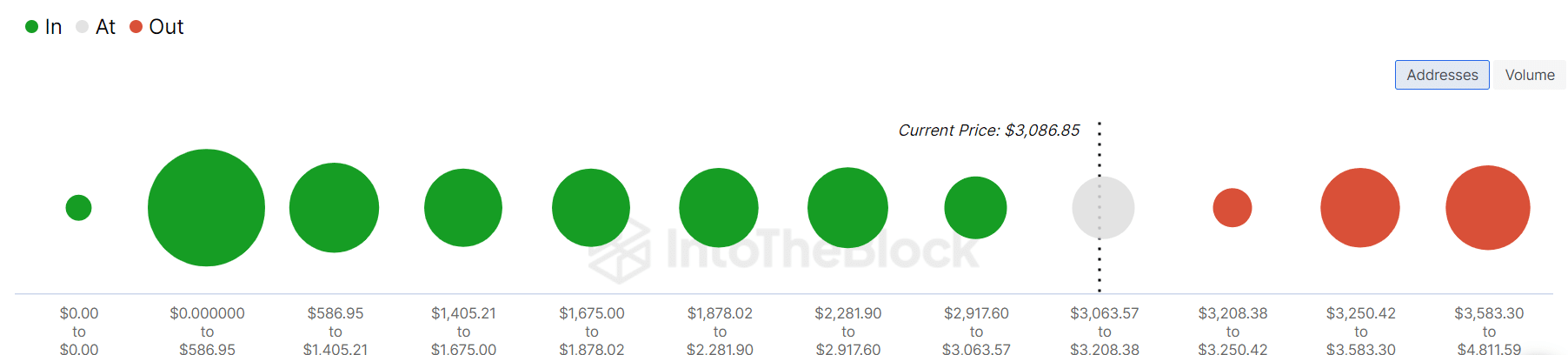

In the meantime, from a short-term perspective, many addresses were in losses at $3.2K and $3.5K levels. Investors could attempt to take a profit if they break even.

These prices are key levels to watch in the short term.