QNT crypto faces resistance at $72 – Is a breakout imminent?

- QNT crypto has soared to its highest price in nearly two weeks.

- The gains come amid a surge in open interest and network activity.

Quant [QNT] has outperformed most cryptocurrencies in the last 24 hours, after recording a 7.5% gain. The rally comes amid surging interest in the token with trading volumes increasing by more than 200% at press time per CoinMarketCap data.

QNT was trading at $70.95 at the time of writing, its highest price in nearly two weeks. So, what is fueling QNT crypto’s gains despite broader bearish sentiment?

Bulls take charge

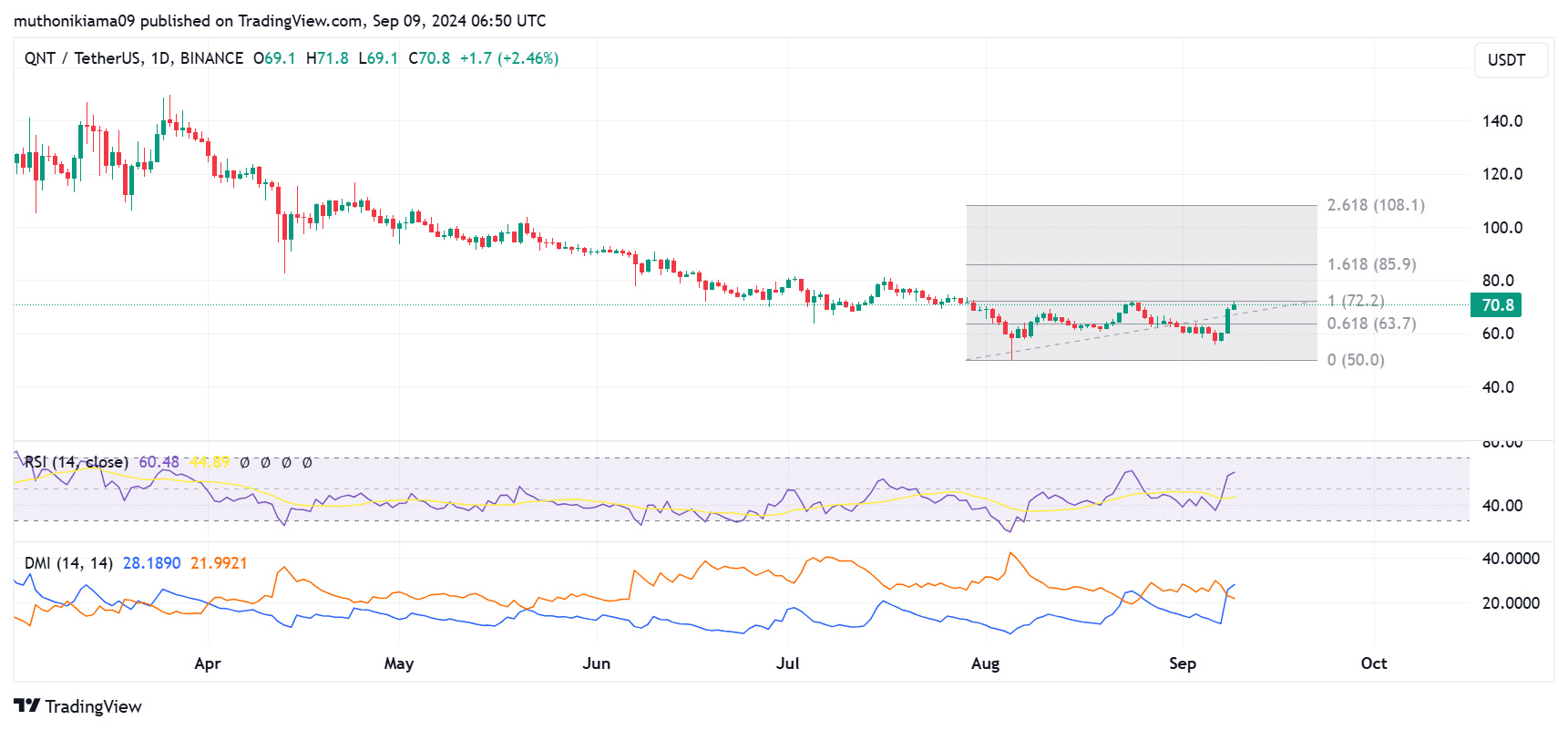

A surge in buying activity is behind QNT’s rally. The Relative Strength Index (RSI) was at 61, showing bullish momentum. Moreover, despite an influx of buyers, QNT is not yet overbought, an indication that there is room for further growth.

The RSI line has also made a sharp move north and crossed above the signal line, also showing that buying pressure has outpaced selling pressure.

The strength of the uptrend is further seen in the Directional Movement Index (DMI) as the +DI has crossed above the -DI. Traders might view this crossover as a buy signal, anticipating that the price will continue to rise.

QNT was nearing a critical resistance at $72, also the 100% Fibonacci level. This price has acted as a strong resistance point, with past rallies being cut short whenever QNT approaches it.

However, with buyers flocking to the market, a breakout is currently possible. If QNT breaks this resistance, the next target is $85, or the 1.618 Fib level.

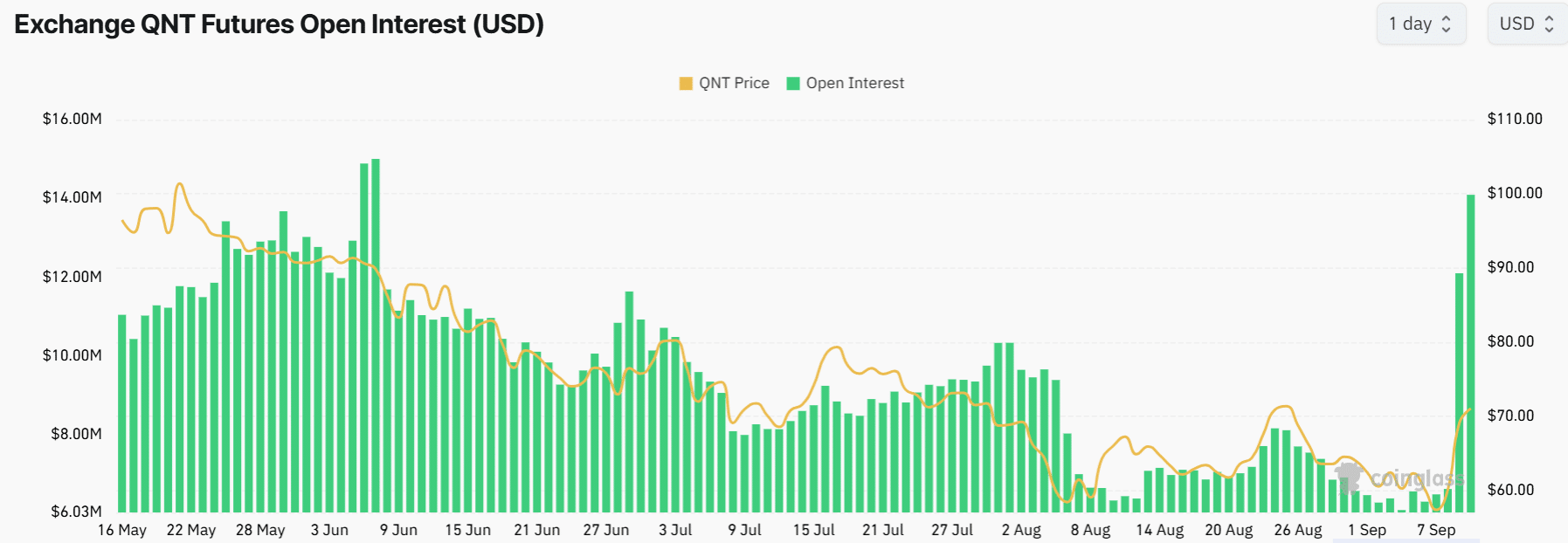

The derivatives market is also showing increased interest in QNT crypto as evidenced by the jump in Open Interest to a multi-month high.

QNT’s Open Interest was $14 million at press time, an over two-fold increase within 24 hours as seen on Coinglass.

On-chain metrics support QNT crypto rally

On-chain data is also supporting the bullish case for QNT. Per CryptoQuant, exchange reserves have dropped significantly, to the lowest level since mid-July.

This drop usually suggests that there are fewer QNT tokens available on exchanges for sale. Falling exchange reserves amid a surge in demand strengthens the bullish thesis.

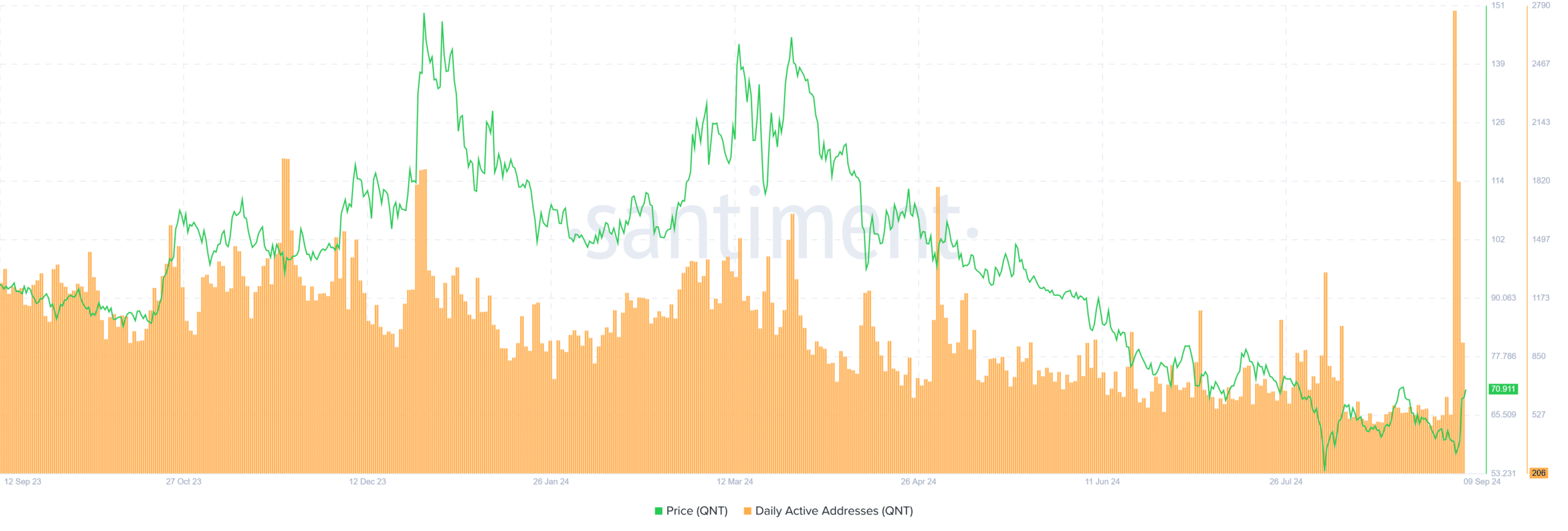

Moreover, activity on the Quant network has been on the rise. Data from Santiment shows that the daily active addresses shot to the highest level in over a year, which is a positive sign of the network’s growth and adoption.

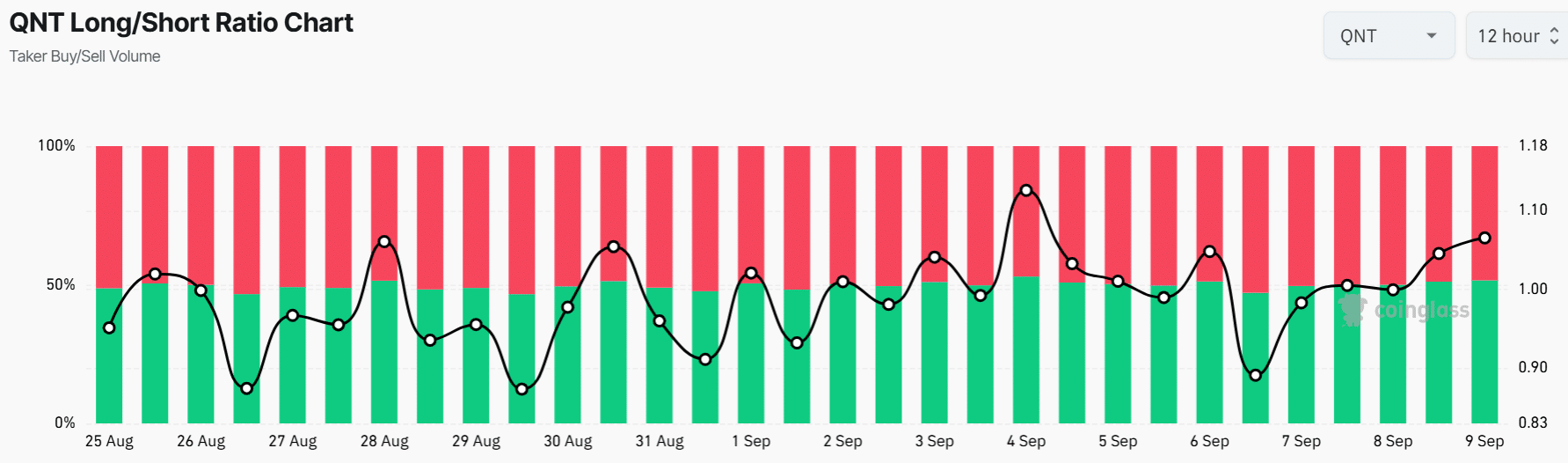

As more bullish signals emerge, the QNT long/short ratio has increased gradually from below 1 to 1.06 at press time indicating a slight increase in long positions. However, the ratio still shows a balanced market.

![Bittensor [TAO] tops the AI charts once again, but 3 hurdles loom](https://ambcrypto.com/wp-content/uploads/2025/04/420567A0-9D98-4B5B-9FFF-2B4D7BD2D98D-400x240.webp)