QNT’s 2025 price targets – Why altcoin must hold above THIS level this year

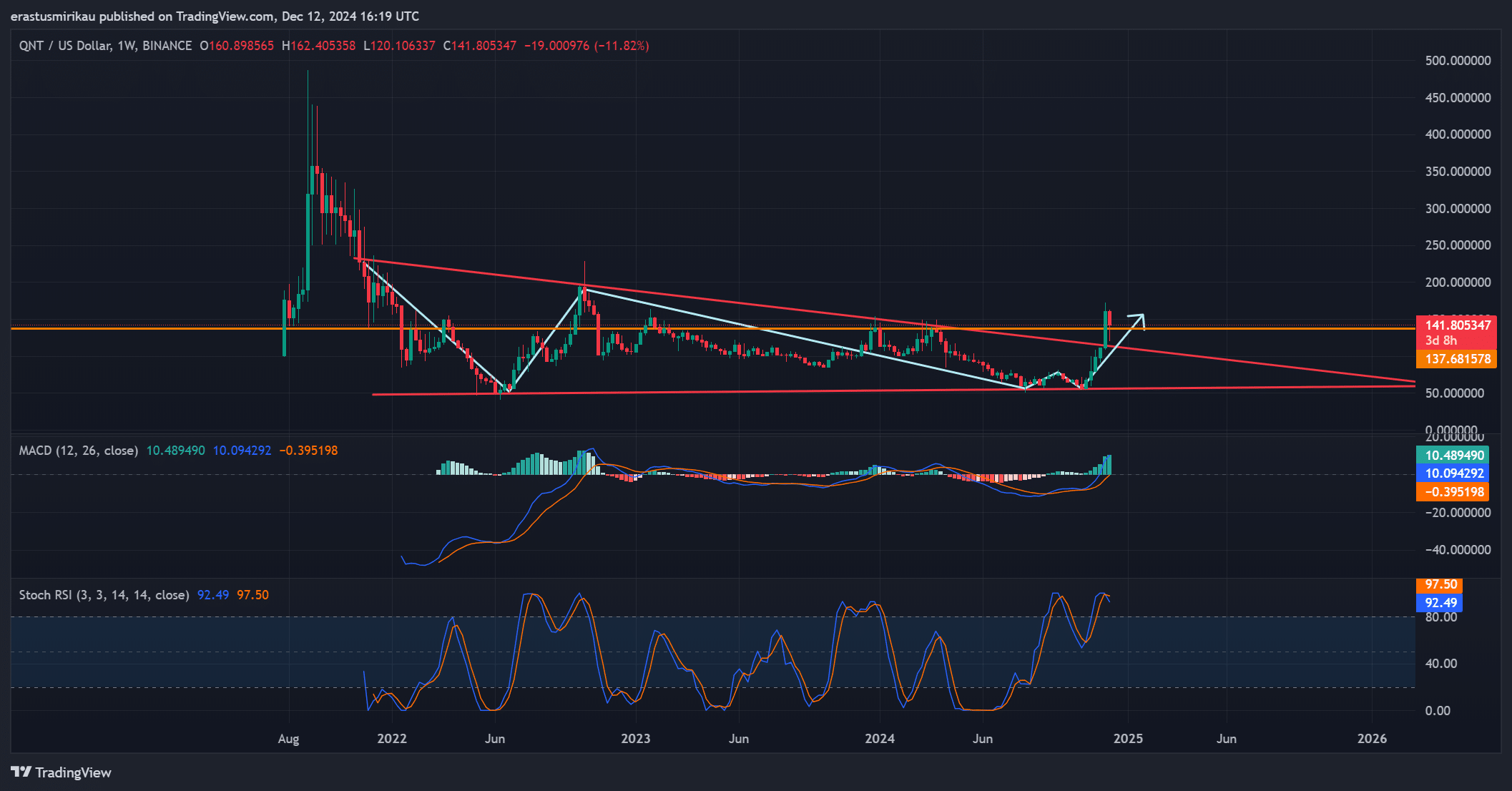

- QNT broke out of a descending wedge, retesting the $139 resistance with strong technical indicators

- Market sentiment and on-chain metrics, including a 3.59% surge in large transactions, remained bullish too

Quant [QNT] a prominent player in the crypto market, has grabbed significant attention due to its bullish breakout and strong technical indicators. Trading at $141.98 after falling by 6.08% at press time, QNT seemed to be retesting the crucial resistance level around $139.

This pivotal moment could determine the token’s next trajectory as it fights to maintain its upward momentum.

QNT chart analysis – The breakout and key resistance retest

QNT recently broke out of a long-term descending wedge, a classic technical pattern that often signals bullish reversals. However, the ongoing retest of the $139 resistance level is critical. If this level holds, it could confirm the breakout and lead to higher price targets.

Furthermore, technical indicators provided a mixed, but overall positive outlook. The MACD had a reading of -0.39, showing slight bearish pressure that has been steadily decreasing. Additionally, the Stochastic RSI was at 97.50, reflecting overbought levels and indicating strong buying pressure.

While these figures, together, signaled upward momentum, the $139 support must hold for the bullish scenario to remain valid.

On-chain signals reveal growing strength

On-chain metrics strengthened QNT’s bullish case. Net network growth rose by 0.84%, signaling healthy expansion of the network and growing user adoption. Additionally, large transactions surged by 3.59% – A sign of greater interest from whales and institutional investors.

However, “in the money” addresses fell slightly by 0.22%, hinting at a small decline in profitability for holders. Despite this, exchange reserves dropped by 0.07%, with only 1.542 million QNT held on exchanges, as per CryptoQuant analytics. This fall indicated lowered selling pressure, often a precursor to upward price movement.

Market sentiment is turning optimistic

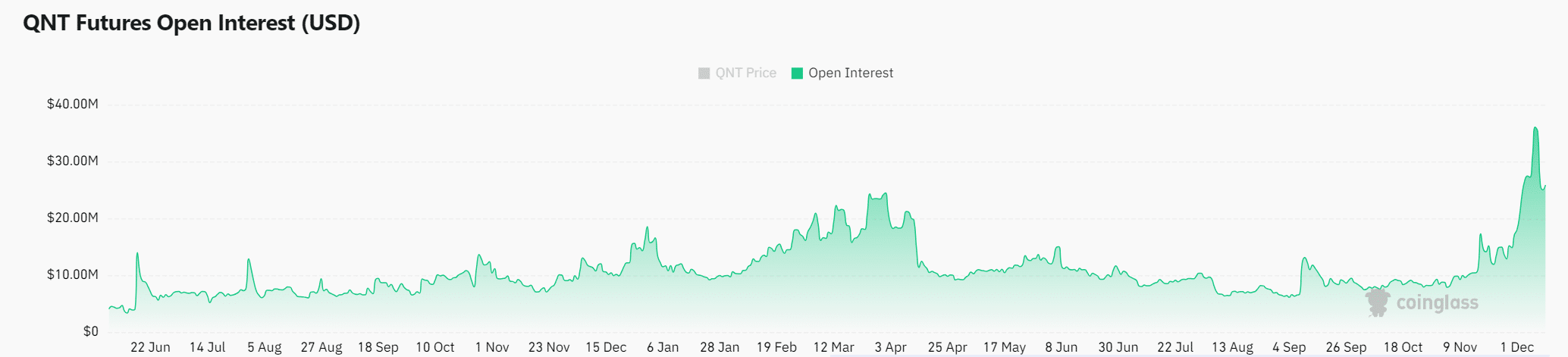

Market sentiment around QNT has remained bullish, supported by a 3.72% uptick in Open interest, with the same having figures of $28.27 million. This surge highlighted growing trading activity and confidence among investors.

Additionally, crowd sentiment and smart money indicators seemed to align too, further bolstering optimism for QNT’s price trajectory.

Read Quant’s [QNT] Price Prediction 2024–2025

Can QNT rally into 2025?

QNT has a strong chance to sustain its bullish breakout and rally higher. With a robust combination of technical strength, positive on-chain metrics, and growing market sentiment, the token might be poised for upward movement.

However, holding above $139 will be crucial for confirming this breakout and achieving significant gains into 2025.