Quant price prediction: Will QNT drop to $74 amid bearish sentiment?

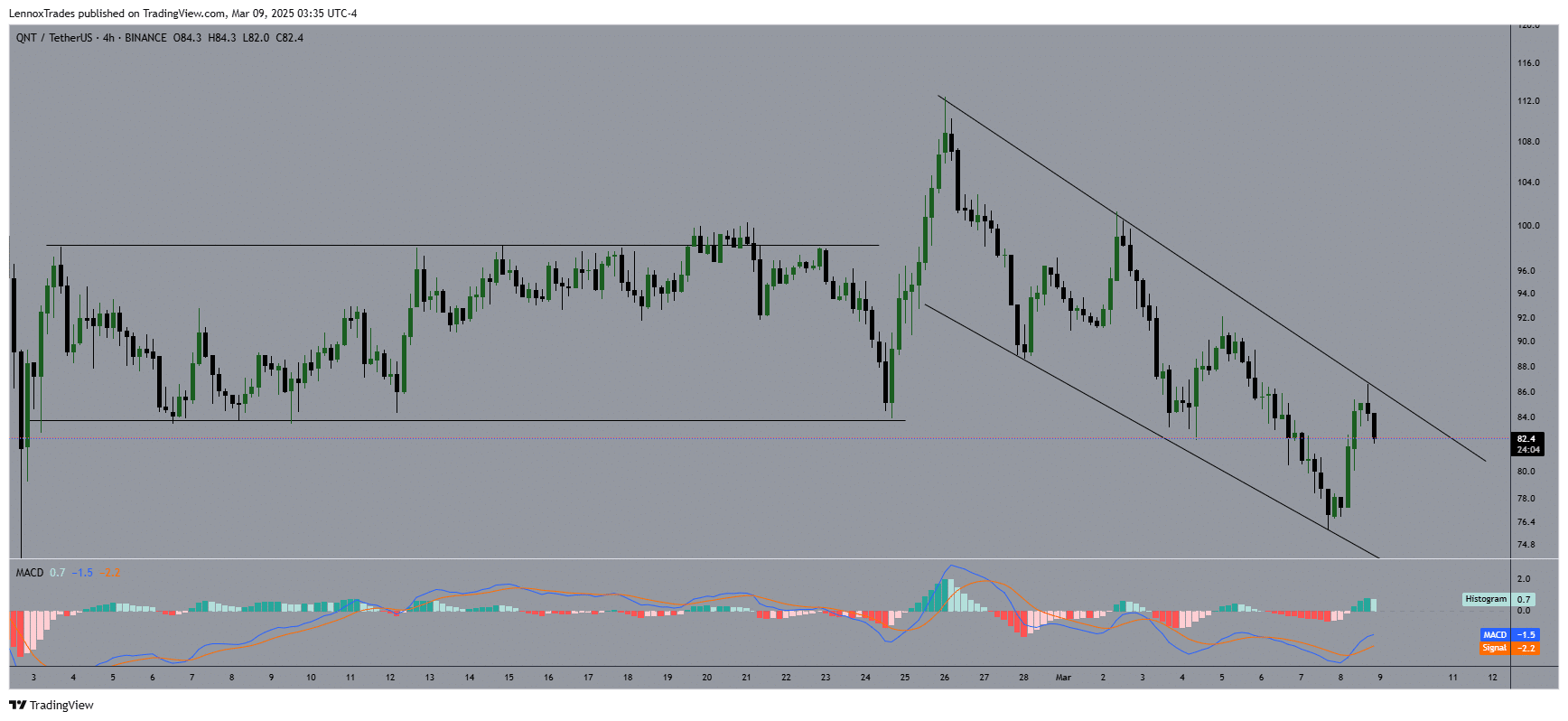

- After Quant broke out of the sideways channel, price hit a high of $112, but QNT is now trading in a descending channel.

- Number of transactions starting to rise despite price generally declining, but Crowd and Smart Money is all bearish.

Quant [QNT] showed an active price action whereby, after a breakout from a range-bound area, the price spiked to $112, a massive breakout.

QNT traded in a downtrend channel at press time, showing a reversal as it gained over 6% in the last 24 hours to $82.4.

The MACD at -1.5 and -2.2 on the histogram predicted bearish momentum, warning traders. If QNT maintains previous uptrends and breaches channel resistance, it could easily test the next resistance around $90.

Failure to achieve this momentum could see a retest of the channel’s bottom at $74, which is recent lows. This trend appears similar to previous consolidations and breakouts.

This indicates that QNT is preparing for a significant price action, either a continuation of recovery or more declines, based on sentiment and volume dynamics.

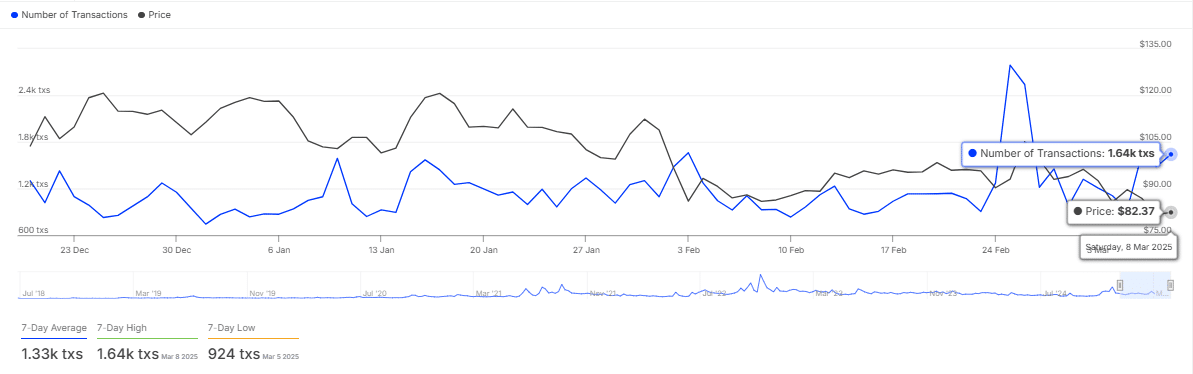

Number of transactions

The number of transactions in the network is increasing, as evident from a peak to 1.64k transactions, while the price of the asset has been decreasing overall to $82.37.

Decoupling can be an indicator of growing investor usage or demand despite falling price, possibly showing hints of underlying strength coming through or excess speculation spilling over.

An increase in transactions during a fall in price can lead to stabilization or reversal of price if it is due to accumulation by investors in expectation of appreciation.

But if sellers are unwinding their positions to increase trading, this will only strengthen the bear’s stranglehold on the price.

Effectively, if increased transactions reflect more buying pressure, we should expect a recovery in price levels.

Nevertheless, when this increase in transactions is also followed by additional selling, then the price can actually move even lower.

What is implied here is examining sources and causes of transactions so that we can predict price action more efficiently.

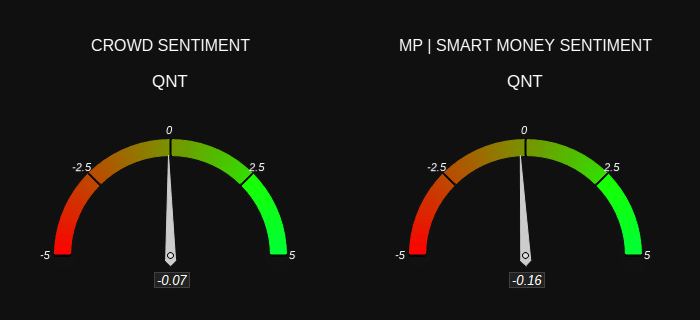

QNT market sentiment

Quant sentiment indicate mildly bearish sentiment both from the crowd at large and smarter money, more informed investors.

Crowd Sentiment was -0.07 at press time, indicating mild bearishness, but the Smart Money Sentiment was even more bearish at -0.16. This indicated bearish or cautious sentiment from more informed investors.

These sentiment pointers can overwhelm QNT’s bullish trend, stabilizing or slightly reducing its price unless sentiments improve.

If optimism returns and reverses these sentiment pointers, it could trigger a QNT price rally as optimism grows, causing both the crowd and smart money to go long and drive the price higher.