Quant [QNT] price prediction: As THIS flips bullish, is $128 coming?

![Quant [QNT] price prediction: As THIS flips bullish, is $128 coming?](https://ambcrypto.com/wp-content/uploads/2025/01/Editors-8-1200x675.webp)

- Smart money has flipped bullish on Quant after the token formed a double-top pattern on its four-hour chart.

- If buyers remain active, QNT could rally to $128.

Quant [QNT], at press time, traded at $117 after an over 10% gain in 24 hours. Trading volumes had also spiked by 53% to $30M per CoinMarketCap, while the token’s market capitalization surged to $1.41 billion.

Amid these gains, smart money has flipped bullish on QNT, per Market Prophit. This is despite the crowd or retail sentiment being bearish.

One of the factors that could be fuelling the positive sentiment by expert investors is a bullish outlook on Quant’s lower timeframe chart.

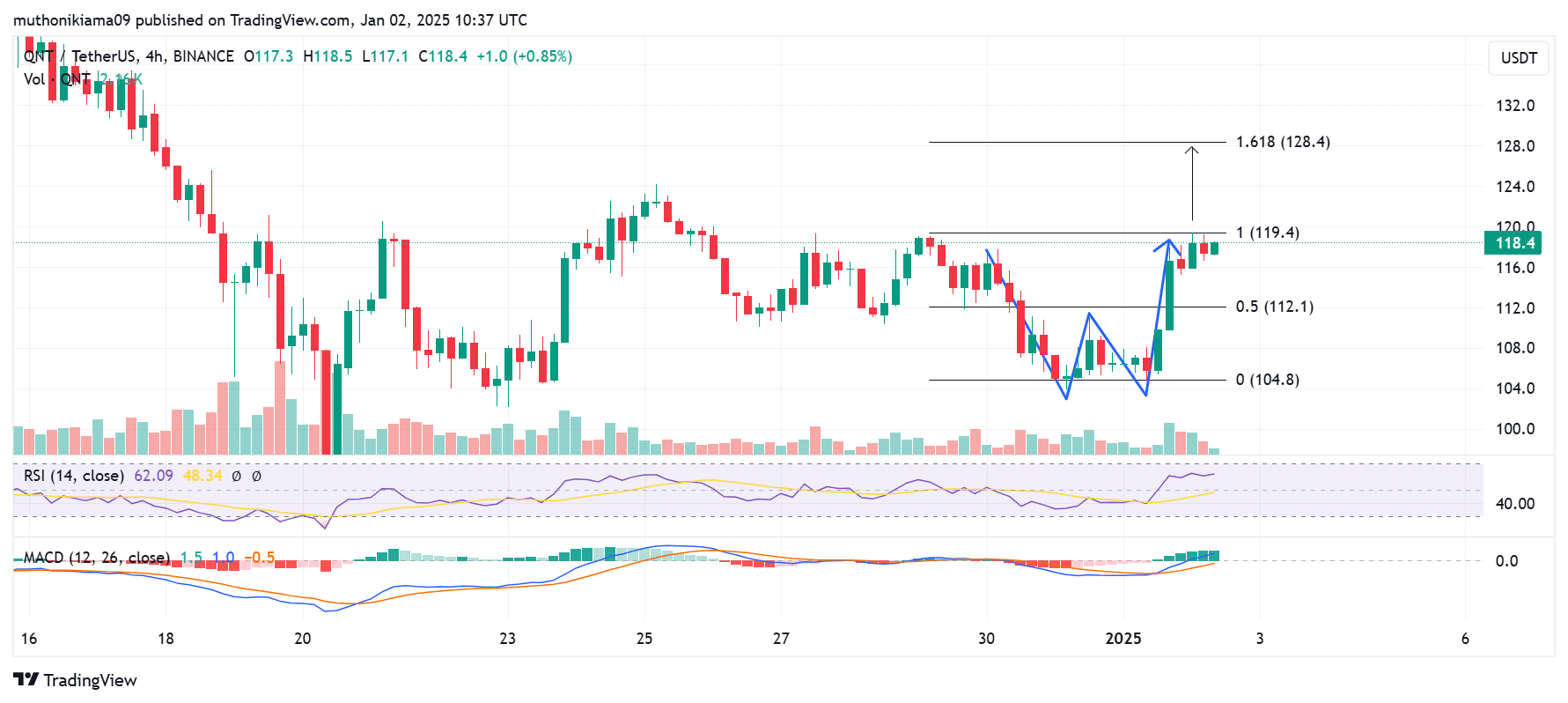

QNT readies for a rally to $128

Quant’s four-hour chart showed that the altcoin had completed a W pattern, which often signals an upcoming uptrend.

Moreover, the token had surged past the neckline of this pattern with strong volumes, showing bullish momentum.

Quant is facing strong resistance at the second peak at $119. If it manages to flip this level, the altcoin could be set for a rally to mid-December levels past $128.

The Relative Strength Index (RSI) confirmed this bullish thesis with the value of 62, indicating that buying pressure was higher than selling pressure at press time.

This indicator was also trending upwards, which pointed towards rising buyer interest.

The Moving Average Convergence Divergence (MACD) line also formed a bullish crossover after flipping positive.

The shortening MACD histogram bars further confirmed that buyers were reentering the market, which could aid a breakout past resistance to $128.

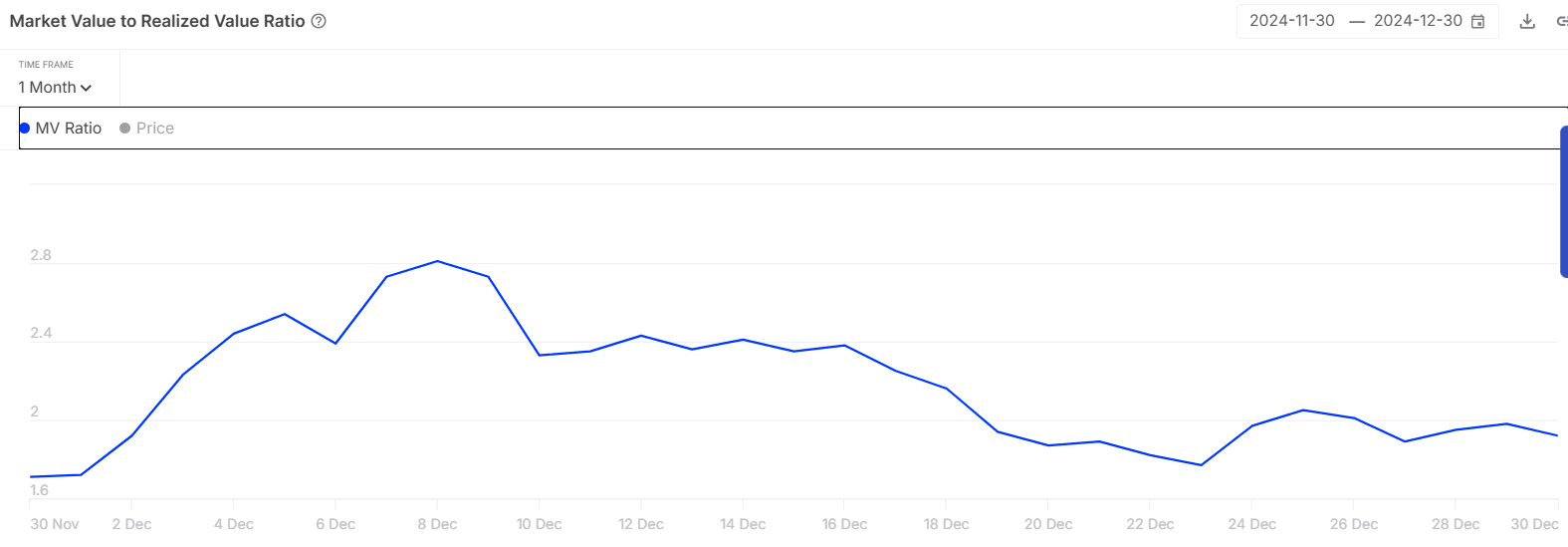

Is a declining MVRV good for price?

Quant’s Market Value to Realized Value (MVRV) ratio has recorded a steep decline in the past month. During this time, the ratio has dropped from 2.81 to 1.92.

A declining MVRV shows that QNT holders have become less profitable. In fact, the wallets that are in profits fell from 85% to 39% within the same period.

While this decline could suggest that QNT is not at risk of being overvalued, it could result in a surge in selling pressure if these wallets choose to sell to minimize losses.

A decline in profitability could result in a bearish sentiment.

Read Quant’s [QNT] Price Prediction 2025–2026

Key level to watch

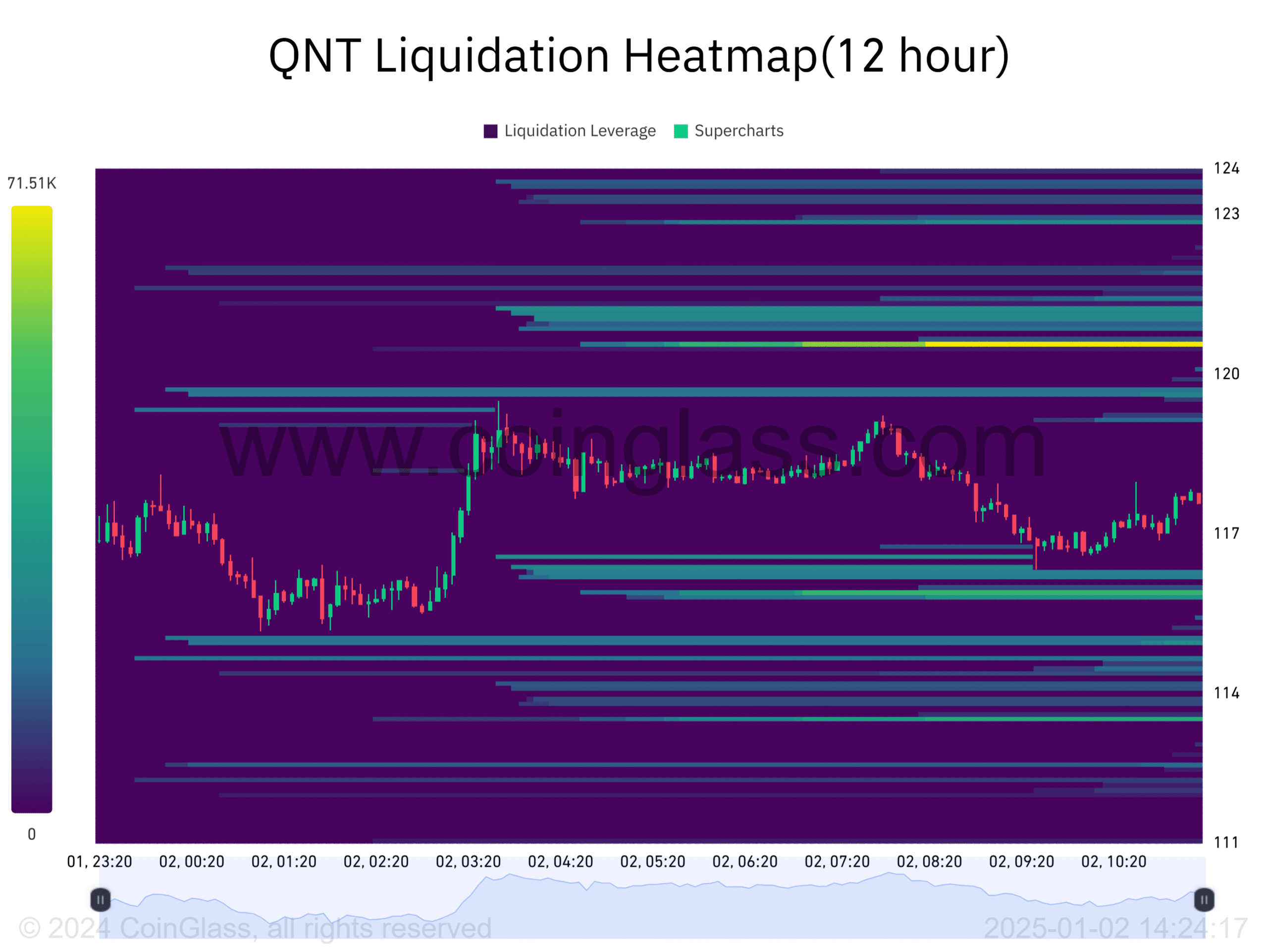

Quant’s liquidation heatmap showed that there was a cluster of liquidations at $120. This level could act as a magnet zone if at-risk traders choose to close their positions as the price rises.

If QNT rises and the open positions at $120 are liquidated, it could lead to a short squeeze where short sellers will turn to buyers. This will result in an uptrend.