Quant surges 28%: Is this the start of QNT’s bullish breakout?

- Quant’s breakout from a descending wedge and 28% surge signaled bullish momentum, targeting $103.20.

- Market sentiment improved as exchange reserves dropped.

Quant [QNT] has stolen the spotlight with a stunning 28% price increase in the last 24 hours, reaching $83.76 at press time.

This surge came with a massive 523% spike in trading volume, boosting its market cap to over $1.01 billion. As crypto markets showed mixed trends, QNT’s price action was gaining momentum.

The question now is whether this breakout marks the beginning of a sustained bull run.

Quant: What’s driving the rally?

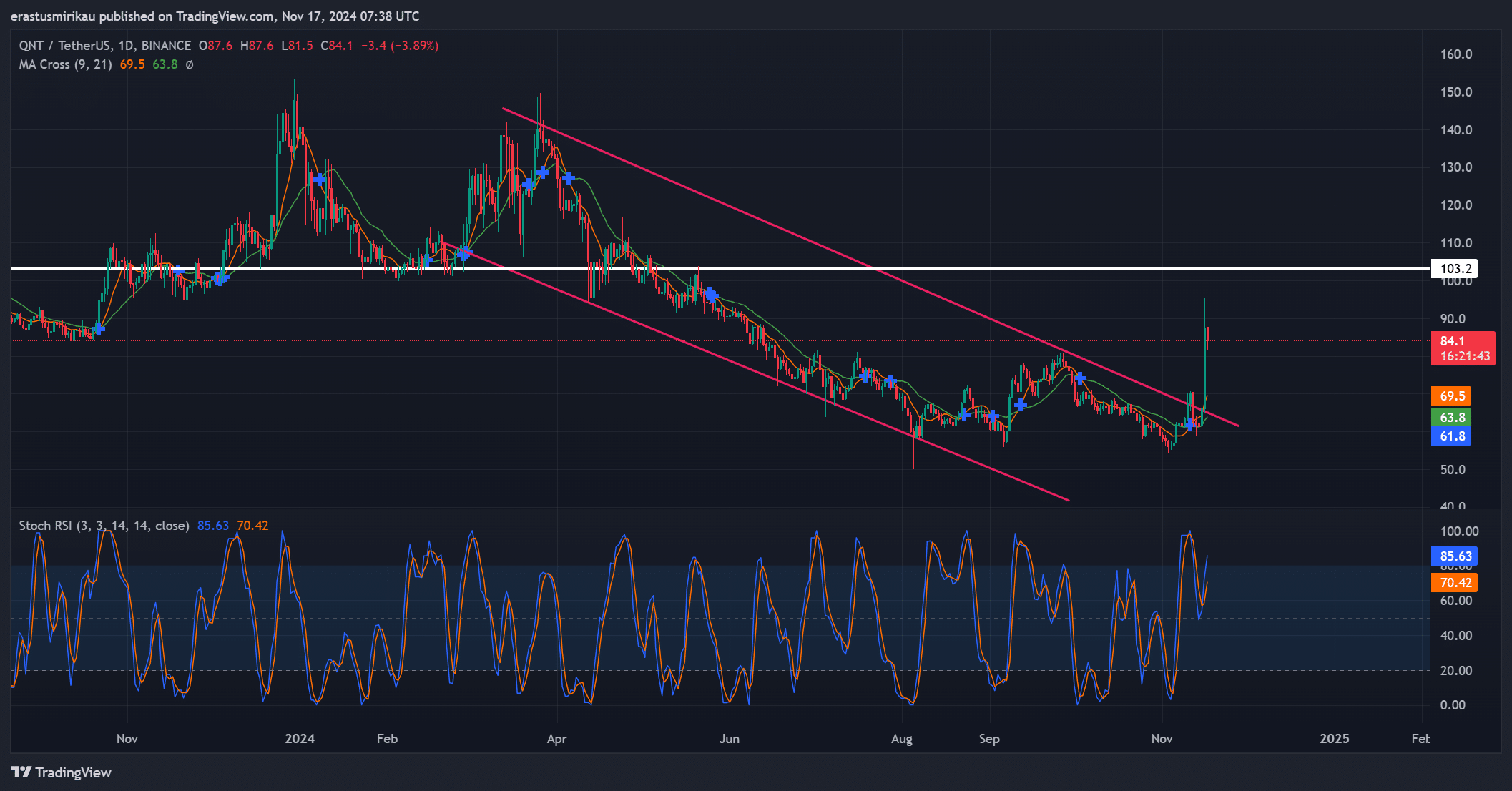

QNT’s breakout from a prolonged descending wedge pattern signaled a potential shift in market sentiment.

Such breakouts have historically indicated the start of bullish trends, and QNT appeared to be following that trajectory. However, the critical resistance at $103.20 loomed ahead.

Breaking past this level could ignite stronger buying momentum, while rejection may lead to a retest of lower support levels near $70.

Technical indicators reflect this positive sentiment. The stochastic RSI was 85.63 at press time, firmly in overbought territory, which indicated strong buying activity but also raises the possibility of short-term corrections.

Furthermore, the moving average (MA) cross at $69.50 and $63.80 confirmed bullish momentum, as the shorter-term MA (9-day) has crossed above the longer-term MA (21-day).

These metrics underscores strengthening momentum, but caution remains necessary after such rapid gains.

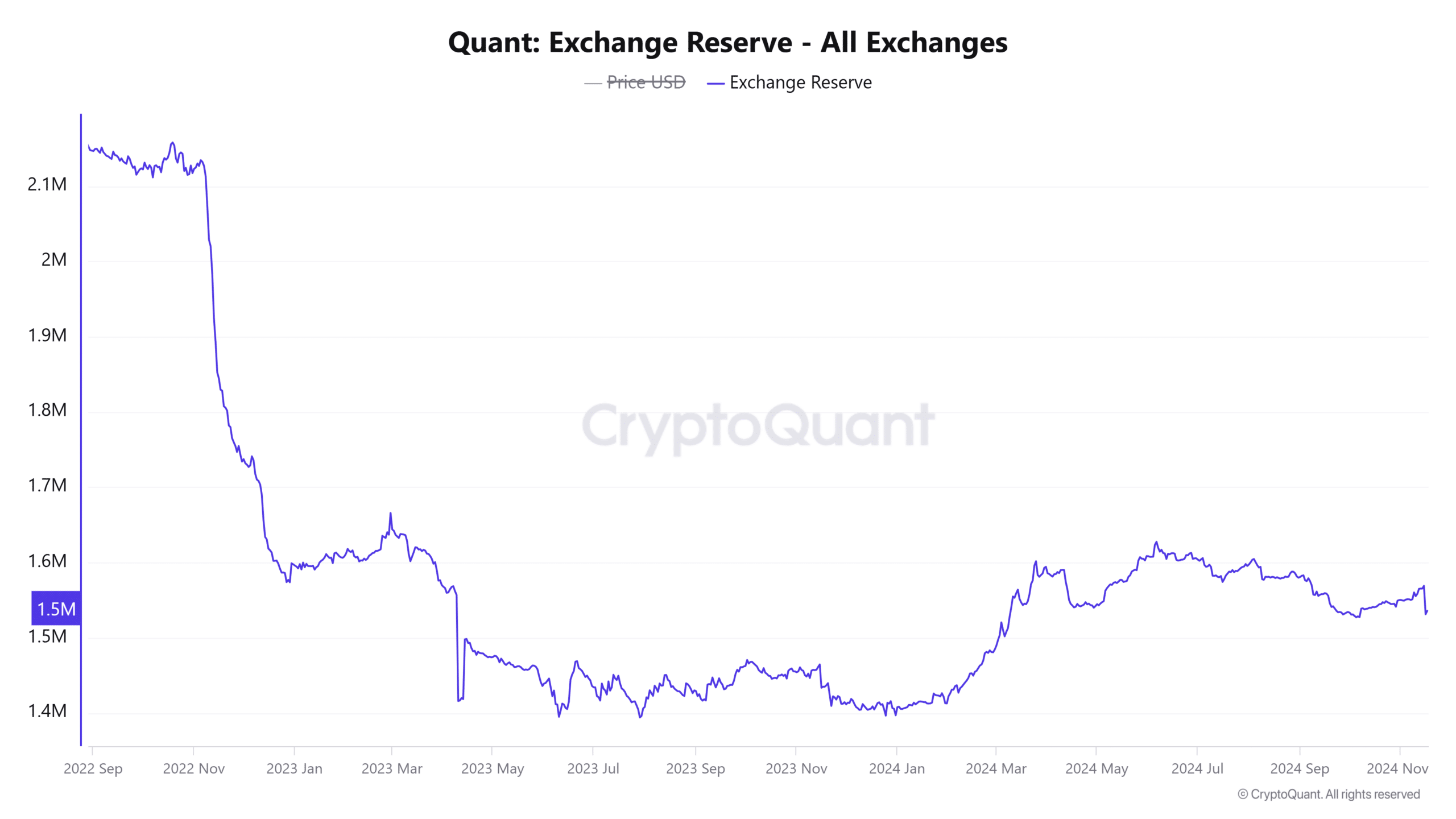

QNT exchange reserves: A key bullish signal

Exchange reserves have decreased by 2.27% over the last 24 hours, standing at 1.5357 million tokens at press time. Reduced availability on exchanges often indicate lower selling pressure and rising investor confidence.

Therefore, with less QNT available for immediate sale, the potential for upward price movement increases, provided demand remains robust.

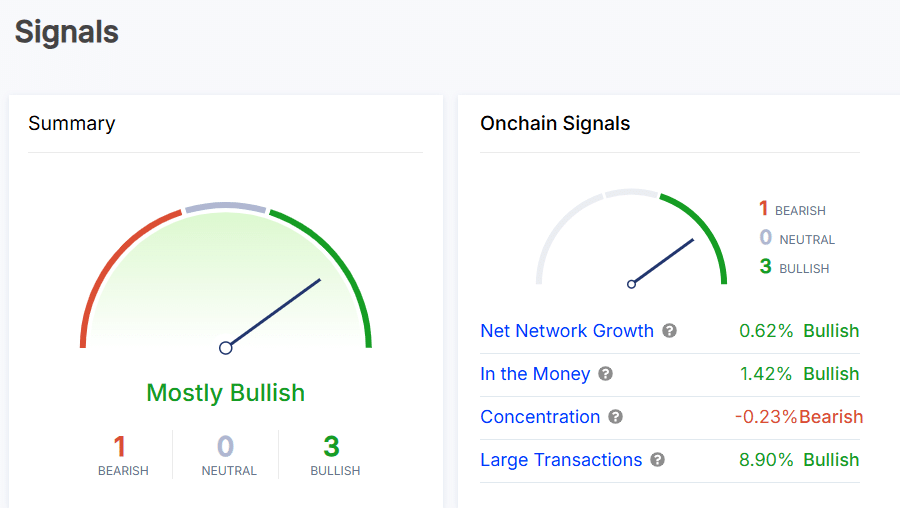

On-chain signals indicate growing confidence

On-chain metrics further highlighted QNT’s strong position. Notably, large transactions surged by 8.90%, and net network growth climbed by 0.62%, signaling increased adoption and activity among major holders.

Additionally, 1.42% of QNT wallets were now “in the money,” reflecting heightened profitability. While concentration among top holders has declined slightly (-0.23%), the broader sentiment remained mostly bullish.

Read Quant’s [QNT] Price Prediction 2024–2025

Will QNT sustain its bullish momentum?

Quant’s breakout above its descending wedge, accompanied by a 28% price surge and a 523% increase in trading volume, signaled strong bullish momentum.

However, the resistance at $103.20 remained a decisive hurdle. If QNT can break above this level in the coming days, it is likely to confirm a broader bullish reversal and potentially spark further gains.