Altcoin

Raydium surges 50% in a week: What’s driving the DEX’s rally?

RAY reaps the benefit of impressive demand and utility within the Raydium DEX. TVL and volume soar to noteworthy levels.

- Raydium delivers impressive price action driven by robust ecosystem demand.

- Raydium volume sets new record high and TVL soars close to its ATH.

Raydium [RAY] has been flying under the radar, but a lot has happened under the hood. The Solana DEX has been gaining popularity and that is evident in various performance metrics, including Its native token, RAY.

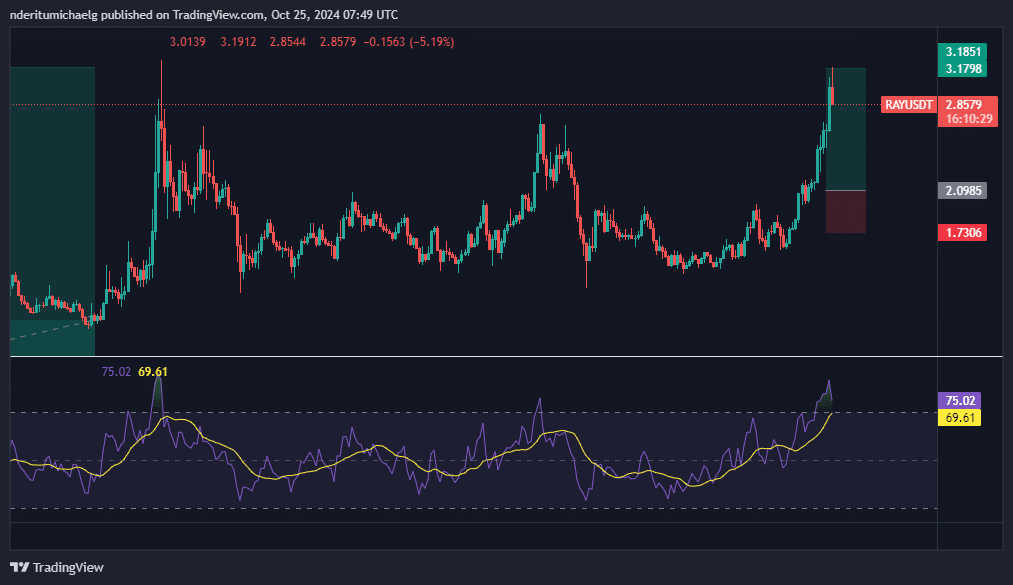

RAY peaked at $3.19 in the last 24 hours after achieving an impressive bullish performance. It rallied by 51% in the last 7 days, earning it a spot in the list of top weekly gainers among the mainstream cryptocurrencies.

This upside also allowed it to achieve a 1,637% gain year over year.

RAY retraced to a $2.85 press time price at press time, indicating some aggressive profit-taking. An unsurprising outcome because the price peaked close to its current 2024 high where it is now experiencing a resistance zone.

It was also deeply overbought, hence was due for a retracement.

Aggressive Raydium utility behind RAY’s demand?

RAY’s bullish performance confirms robust demand, and most of it was driven by the Raydium ecosystem growth. It has been holding down the title for the top DEX since April. It currently controls over 50% of the total DEX volume in the Solana ecosystem.

The surge in Raydium volume and ATH emphasize the aggressive resurgence of activity within the DEX.

Raydium’s growing market share in the Solana ecosystem reflects in it the volumes that it has been handling this year. The market has been heating up and this brought forth a revival in Solana’s DeFi ecosystem, just as was the case in the first half of 2024.

The latest excitement in the market yielded heavy volumes within Raydium. Its daily volume recently achieved a new record high at $1.81 billion on 23 October. For perspective, this was a 1,083.66% gain in daily volume compared to its 2-month low in mid-September.

The recent daily volume peak was not the only new high that Raydium celebrated this week. Its TVL also soared to a new 2024 high of $1.93 billion on 25 October.

However, this was not its historic high, but it’s latest ascend did come close to it. Raydium’s TVL achieved an ATH of $2.21 billion on 15 November.

Realistic or not, here’s RAY market cap in BTC’s terms

But what does this all mean for Raydium its native token moving forward? A dominant position means it may secure more demand and utility in the coming months as the bull run builds up momentum.

RAY could thus be due for more recovery since its press time price was still trading at a discount from its historic high.