‘Recipe for Ethereum to reach $10K’ – How ETFs can help ETH soar

- Cumulative inflows into Ethereum ETFs turned positive for the first time since July.

- Blackrock’s ETHA ranked as one of the top ETF launches this year.

On the 12th of November, Ethereum [ETH] ETFs broke new ground, finally tipping total net flows into positive territory—for the first time since their launch.

Data from SoSo Value revealed a daily net inflow of $135.92 million, pushing cumulative inflows to $94.62 million.

Trading activity also ramped up, with a total value of $582.18 million traded and total net assets climbing to $9.67 billion.

Of the nine ETFs, five saw inflows. Meanwhile, only Grayscale Ethereum Trust [ETHE] recorded outflows, with the remaining funds showing no new inflows.

Execs weigh in

The latest development caught the attention of industry leaders on X (formerly twitter).

Nate Geraci, President of the ETF Store, highlighted the net positive flows mark a significant milestone for ETH ETFs given they have,

“Overcome $3.2bil in outflows from ETHE.”

Additionally, Geraci pointed out that 19 of the top 50 ETF launches this year are linked to Bitcoin [BTC], ETH, or MicroStrategy, with 12 among the top 18—an impressive figure out of 610 total launches.

Furthermore, iShares’ Ethereum Trust [ETHA] ranked as the 6th top ETF launch of 2024

Bankless co-founder Ryan Sean Adams also commented on the development. He noted that ETHE’s dominant outflows essentially offset any upward pressure from ETFs.

However, as inflows turn positive for the first time, this might signal a shift.

Adams even forecasted that this shift is a

“Recipe for an ETH rocket to $10k.”

Ethereum ETFs hit record inflows

This latest milestone comes a day after the ETFs experienced a record-breaking day on 11th November, registering $295 million in inflows.

This influx, led by industry giants like Fidelity and BlackRock, marked nearly triple the previous peak of $106.6 million recorded on launch day.

Eric Balchunas, Bloomberg’s senior ETF analyst, noted on X that ETFs were,

“Trending in right direction.”

The analyst further anticipated a positive trend for the ETFs, stating,

“Sunny days ahead, although still several country miles behind BTC ETFs.”

How are BTC ETFs doing?

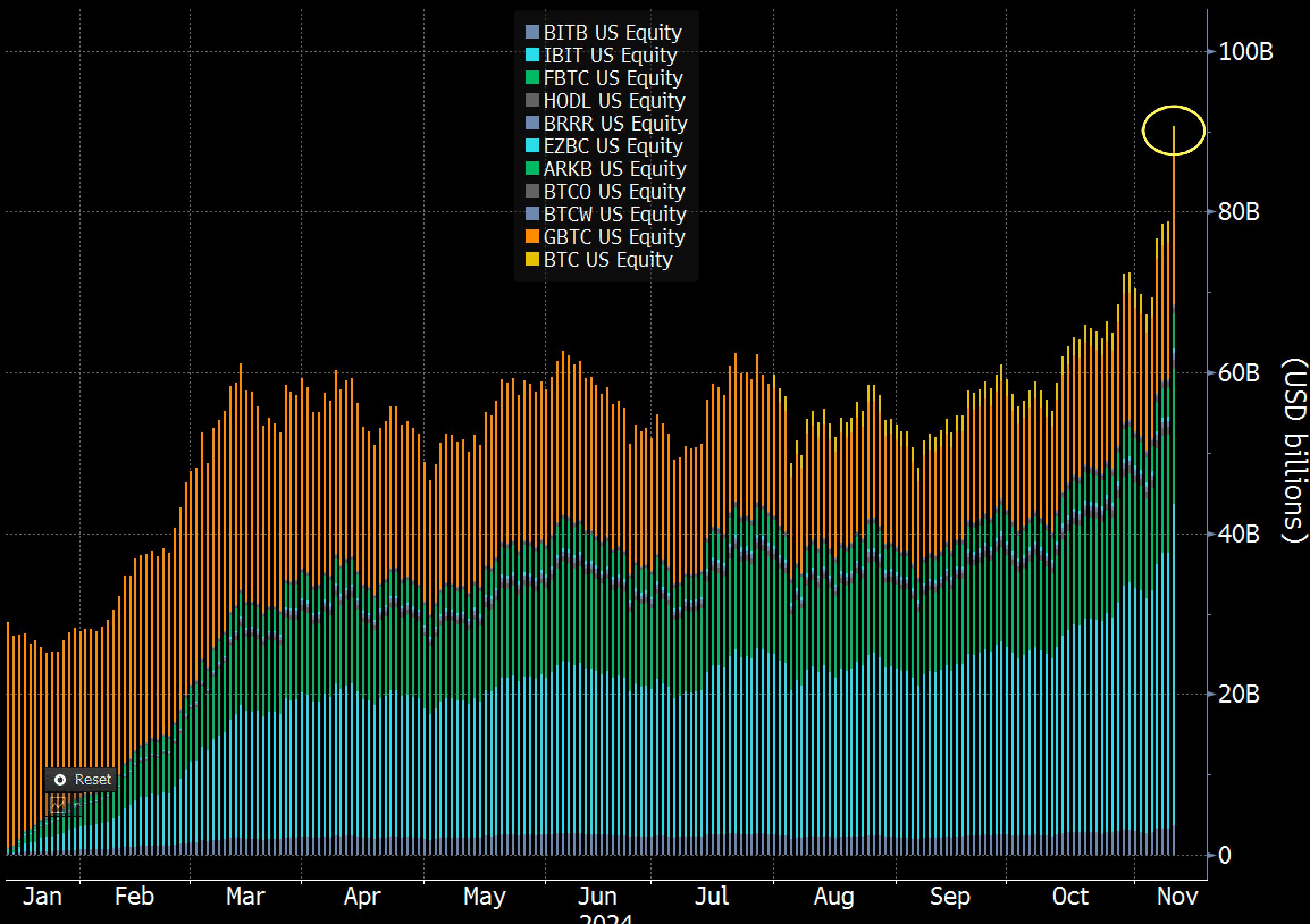

Meanwhile, BTC ETFs also hit a record of their own. Balchunas revealed on X that Bitcoin ETFs crossed the $90 billion mark in assets under management, following a substantial $6 billion increase.

This comprised $1 billion in new inflows and $5 billion in market appreciation. This surge means that Bitcoin ETFs were now 72% of the way toward surpassing gold ETFs in total assets.

In a further sign of demand, IBIT reached $1 billion in trading volume within just 25 minutes—faster than the previous day, when it went on to break an all-time record.

Balchunas described the sustained interest in BTC ETFs as a “feeding frenzy” that shows no signs of slowing down.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)