Report: With European Bitcoin ETPs going strong, here’s what’s in store for BTC

A new study by Arcane Research has stated that the global Bitcoin ETP holdings have reached an all-time high. The month of May was already a productive month for ETPs but June has already witnessed the momentum soar higher. However, the ETP holdings are not consistent across the world with Europe still indicating the rule of the bears.

ETPs on-track

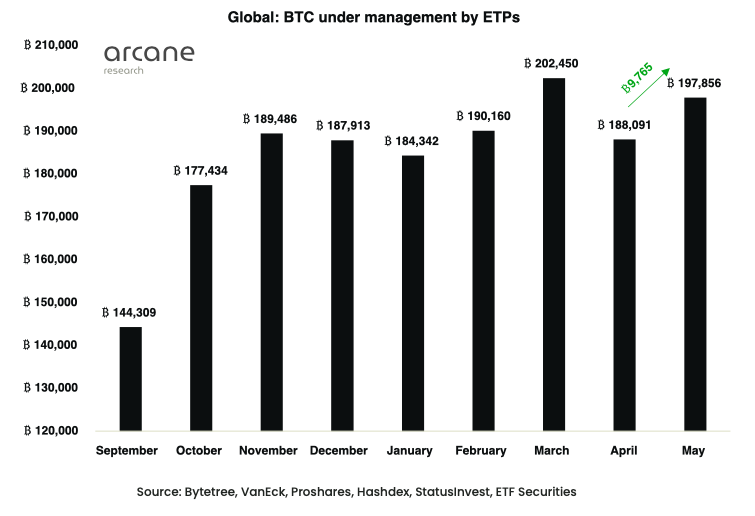

The latest Arcane study titled “In Tune with the Flow” has shed light on the stunning BTC ETP recovery in May. While the larger crypto markets fluctuated, Bitcoin ETP holdings mounted a recovery after a dip in April. The global net inflows amounted to 9,765 BTC, which eventually skyrocketed to an all-time high of 205,008 BTC on 3 June.

What’s up with Canada?

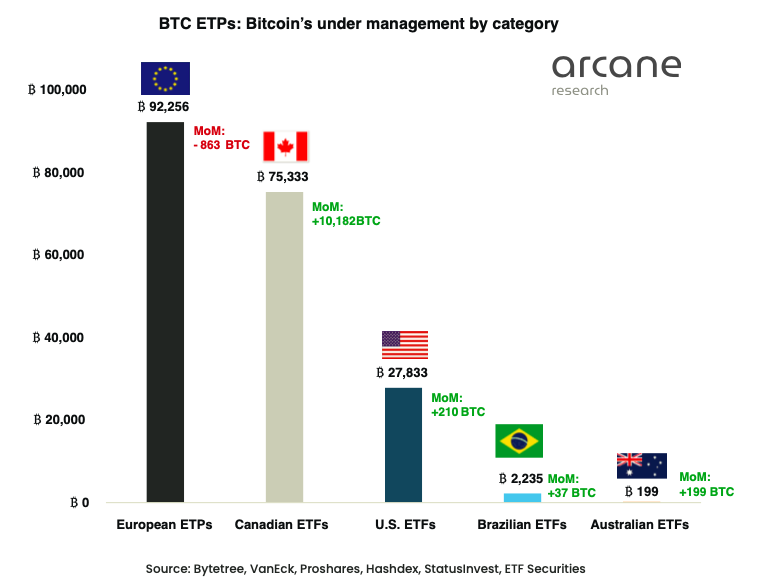

Canada should be credited for “pulling the strings” as Canadian ETFs displayed their strongest inflows since May 2021. By the end of May 2022, Canadian ETFs reached an all-time high BUM of 75,333 BTC.

“As of the end of May, European ETPs still dominate the ETP market, but the strong growth in Canadian ETPs suggests that the European hegemony as the leading ETP region will end.”

U.S and Brazil share the stalemate

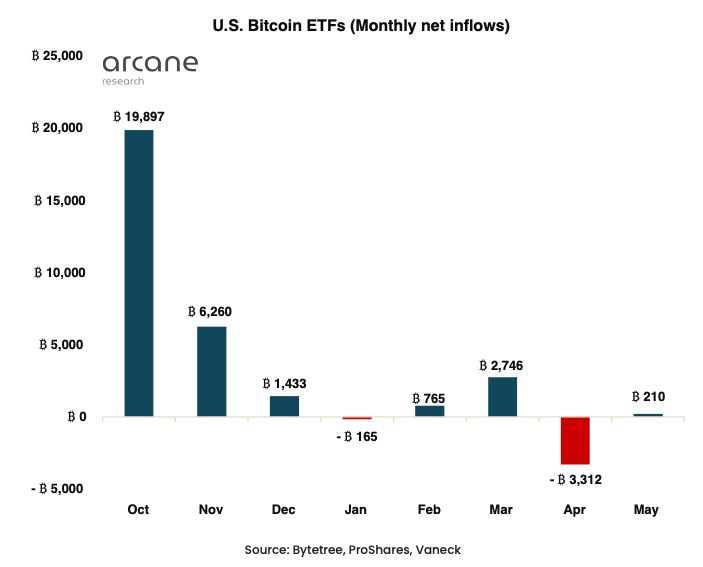

The overall BTC ETFs in the United States saw a “slow month” in May after seeing net inflows of 210 BTC. While inflows remained slow, they did see promising growth towards the end of May and early June. This led the BITO’s Bitcoin ETFs to reach their highest level since April.

Furthermore, Brazil is another country that saw a stagnant month after seeing net inflows of 37 BTC. While flows have remained on the lower end since the launch, the country is yet to see outflows in its BTC ETF market.

Here’s the European Caveat

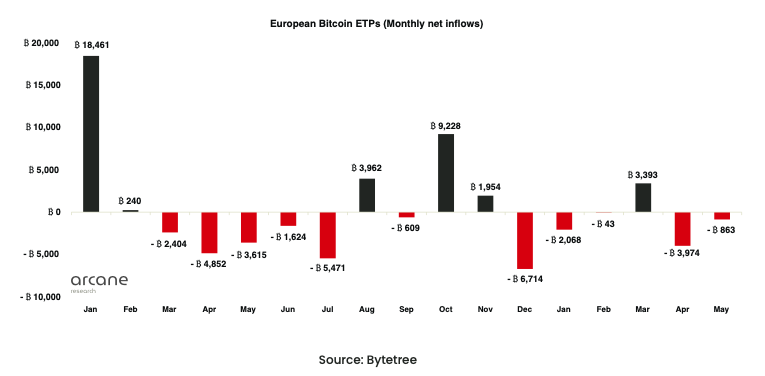

European ETPs are losing further ground on Canada after witnessing another month of net outflows. The tendencies within the European ETP market remain similar as the older ETN structures see outflows, while the newer ETPs with active redemptions see inflows.

“These tendencies lead to stickiness in Europe’s net outflows, but the trend seems to be an overall restructuring of European BTC exposure in investment vehicles over time.”

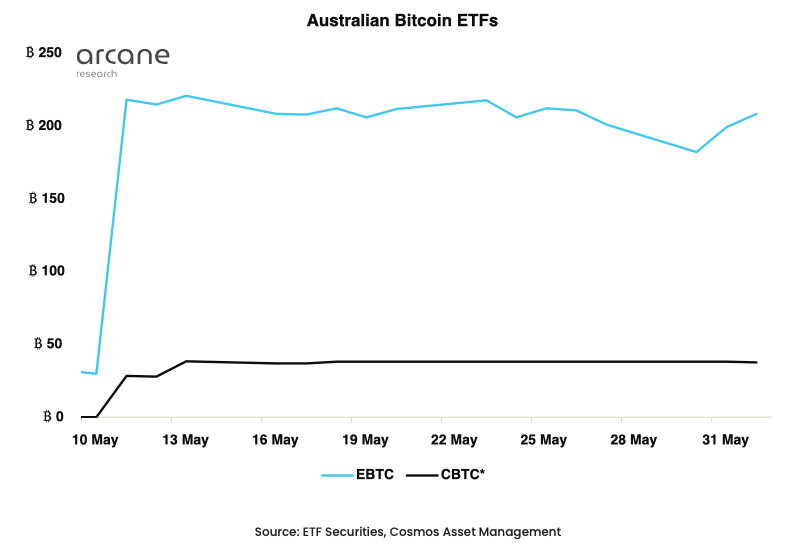

A late bloomer in the far-East

Australia has had a slow start in the Bitcoin ETF market since its launch in May. It amassed an AUM of 240 BTC two weeks into the launch. The report pushes the blame on the Luna collapse that saw the ETFs have a “burdensome” launch.