Reserve Rights crypto surges by 70% in 24 hours, hits a 2-year high

- RSR has surged over the past 24 hours by 70% to hit a two year high.

- Reserve Rights trading volume surges by 1658.79% and volume by 223% to ATH.

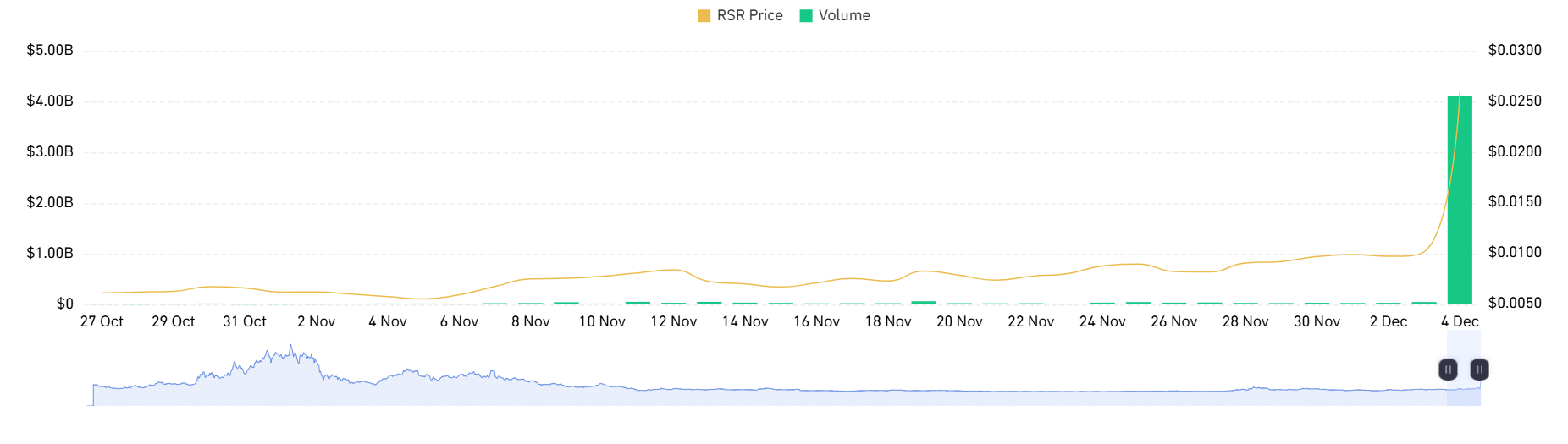

Over the past 24 hours, Reserve Rights [RSR] has made massive gains on its price charts, making a breakout to reach a 2-year high of $0.0269. The altcoin experienced a sustained uptrend over the past month as well.

At the same time, its trading volume surged by 1658.79% to hit $1.83 billion. In total, its volume has reached a new all-time high of $4.11 billion.

With the recent gains, two questions that arise are the sustainability of the uptrend and what’s driving it?.

One factor that is driving this uptrend is the persisting rumors that Paul Atkins will become the next SEC chair during the Trump administration.

Since the U.S. election, this has become a topic of discussion with Polymarket showing 74% odds of Atkins as the potential pick.

Can RSR sustain the rally?

According to AMBCrypto’s analysis, RSR is currently experiencing a sustained upward movement amidst strong bullish sentiment.

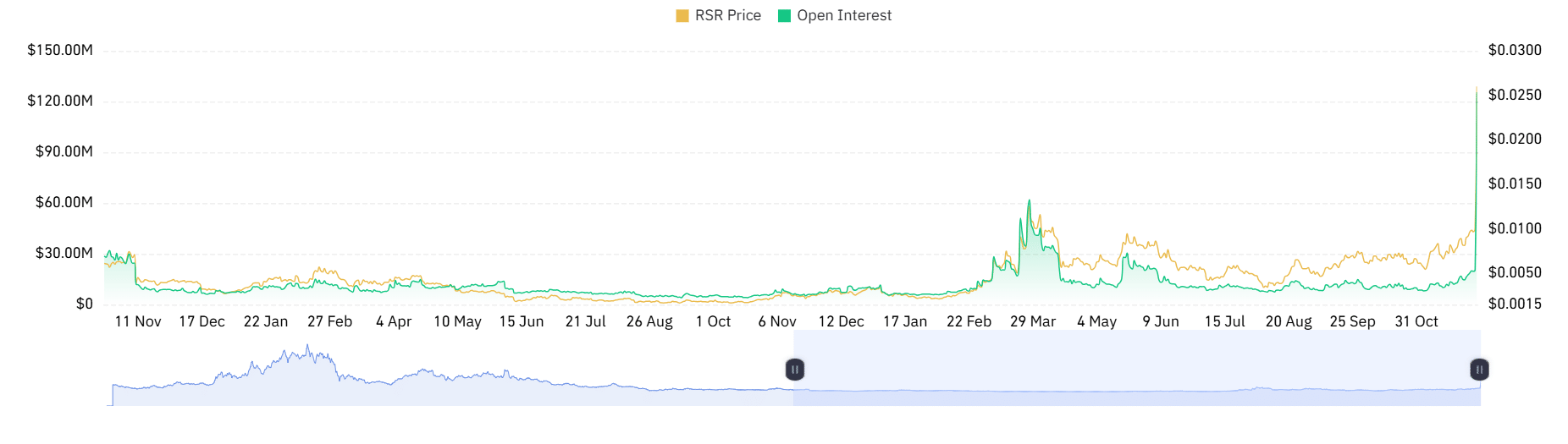

This bullishness was witnessed among investors as they continue to open new positions. According to Coinglass data, Reserve Rights’ open interest has surged by 223% to reach a new all-time high of $125.4 million aligning with the rising volume.

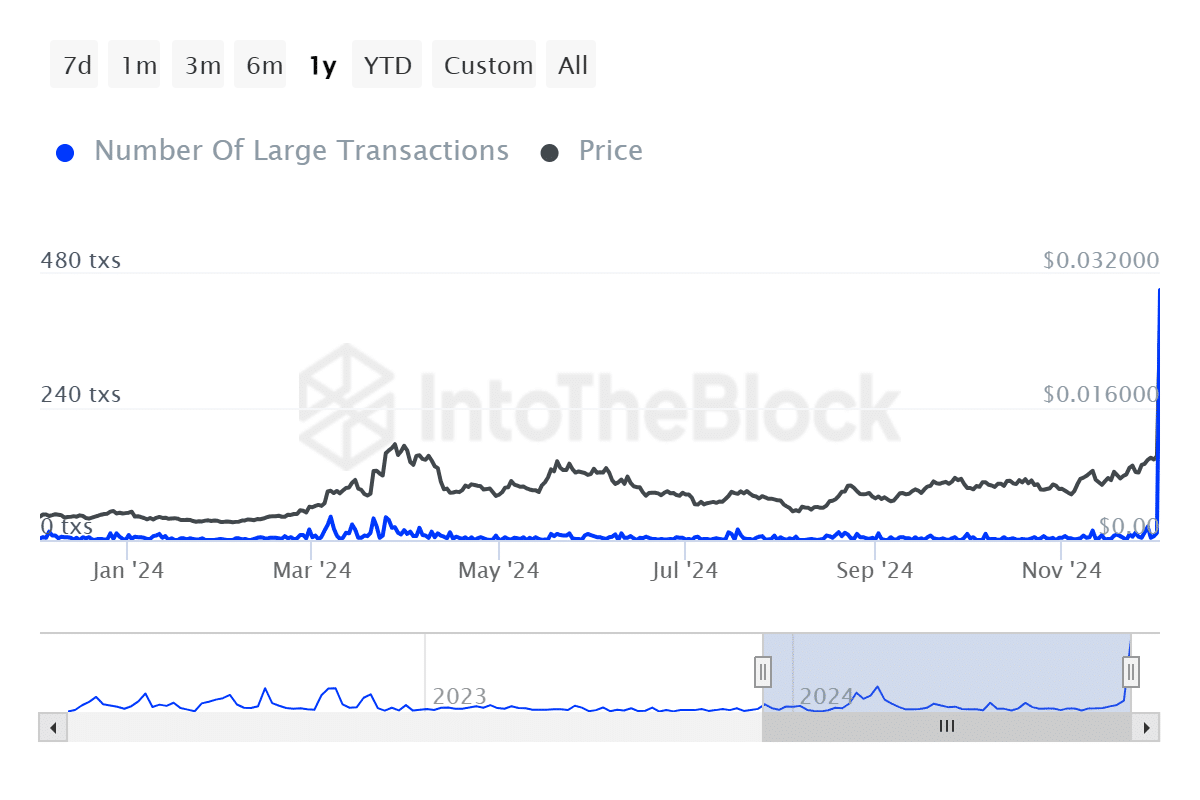

Additionally, the altcoin’s large transactions have spiked by 3369.23% to reach a yearly high of 451 transactions. It means whales have entered the market as they view the altcoin to have potential.

This shows that the earlier observed surge in open interest is large holders taking long positions.

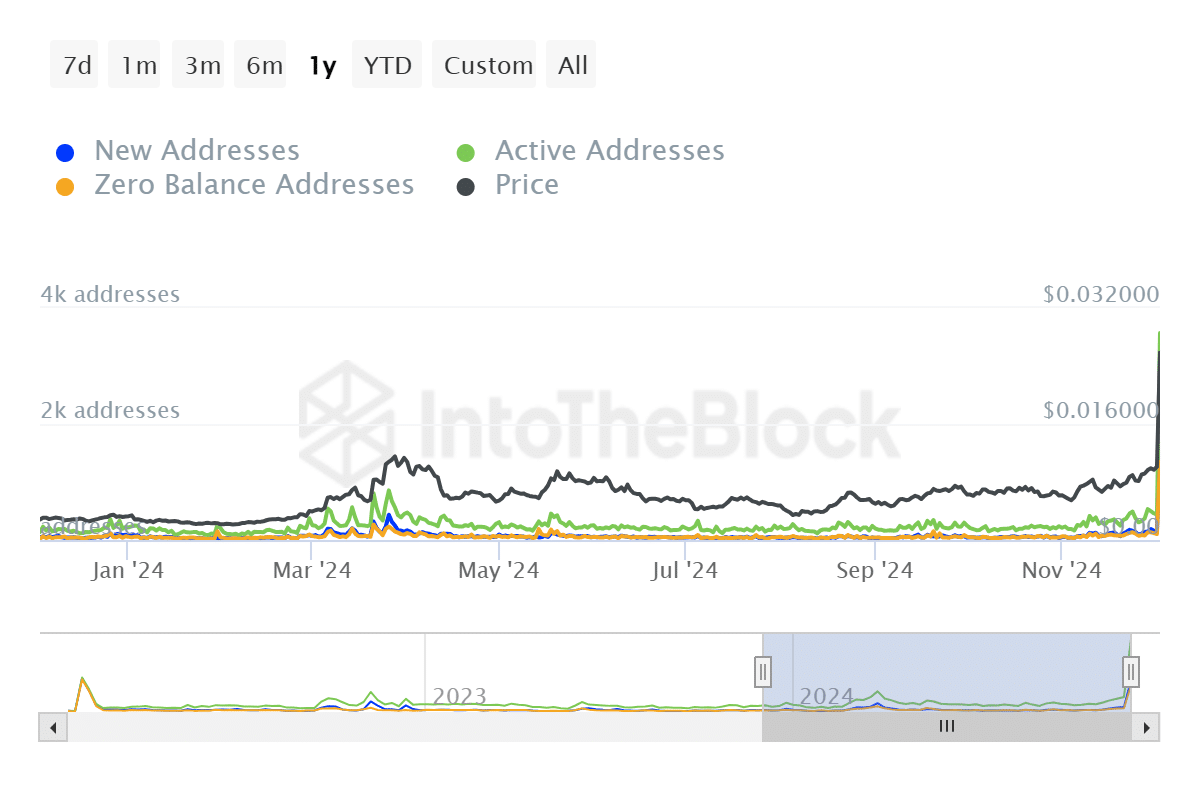

Finally, Reserve Rights’ Daily active addresses have surged by 861.73% over the past 24 hours to reach a yearly high of 6.54k. When active addresses rise, it implies demand, interest, and increased adoption.

Thus, a rising number of participants shows that the price rally is supported by strong market fundamentals and not market speculation which is central for a sustained rally.

As such, the market has geared up with increased participation and funds inflow. This bullishness positions RSR for more gains on price charts. If the current conditions hold, RSR will move to its next target of $0.03.

However, if buyers lose momentum, RSR will decline to $0.0190.

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-400x240.webp)

![Shiba Inu [SHIB] price prediction - A 70% rally next after 300%+ burn rate hike?](https://ambcrypto.com/wp-content/uploads/2025/04/Erastus-2025-04-12T132907.604-min-400x240.png)