Ripple: 70% of XRP traders go long – Is a rally closer than we think?

- There’s been a surge in the number of XRP long positions opened in the market.

- Several derivative factors have added bullish sentiment, but the rally lacks momentum, which can hinder an upward move.

Ripple [XRP] has managed to maintain a minor drop in value over the past month, declining by 15.61% during this phase of the market.

However, the current sentiment suggests that the market tide could be shifting soon, and the asset may see a rally ahead.

AMBCrypto analysis explores whether the derivative sentiment in the market will be able to counter the lack of momentum driving an XRP buy-in.

The majority of traders go bullish

In the derivatives market, the majority of bullish traders have continued to place long bets.

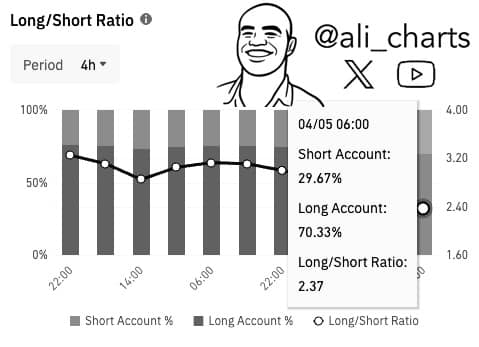

According to available data, 70.33% of derivatives traders on Binance have opened long positions, putting its long-to-short ratio at a high 2.37—signifying the market is very bullish.

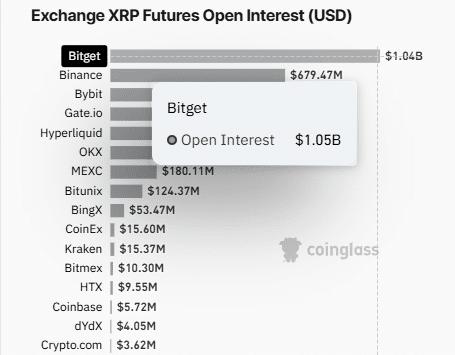

In addition, the open interest on Coinglass has increased to $679.47 million, suggesting that approximately $477.87 million of these positions belong to long traders expecting a rise.

On the other hand, this bullish sentiment is also reflected across other exchanges, including Bitget, which has seen a significant rise in open interest, now reaching $1.04 billion.

This significant long sentiment typically has a way of reflecting on potential price movement, with XRP potentially forming higher highs and lows.

The sentiment continues to rise, and the derivatives market overall continues to grow, increasing the chances of a rally.

Derivative market sentiment stays strong

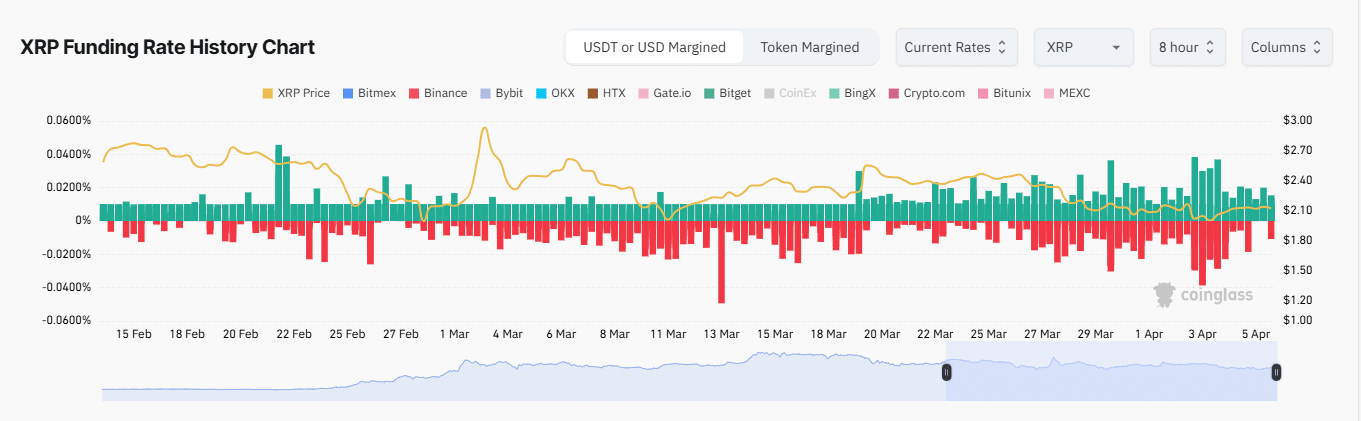

The derivatives market sentiment remains strong, supporting the potential for XRP’s performance. Long traders are now paying a premium fee to short traders, aiming to bridge the gap between the spot and futures markets.

With a funding rate of 0.0059%, long traders dominate the market positions, historically signaling upside potential.

This activity has had a subtle impact on XRP’s price, which has dropped by 0.99%. However, it has resulted in significant short liquidations over the past 24 hours.

During this period, $2.4 million worth of short positions were forcefully closed. These closures occurred as the price moved against traders holding those positions.

Although the overall sentiment in the derivatives market remains positive, it indicates strong interest in a potential rally. However, no significant momentum currently supports a move to the upside.

Will the lack of momentum hold XRP back?

The market lacks momentum to drive an XRP rally. In the past 24 hours, trading volume dropped by 50.69% to $4.98 billion.

This significant decline, coupled with weak performance in parts of the market, indicates negative sentiment. It is not a promising sign for an upward move.

The falling momentum and declining XRP price suggest weakening sentiment. This may eventually favor bears in the market.

In the options market, XRP’s trading volume hit a new low, falling by 62.51%. This indicates reduced interest in XRP.

Continued drops in volume show insufficient support for an upward movement. XRP could face a further price decrease. Such declines put long traders in the derivatives market at significant risk of losses.