Ripple acquires Swiss startup to expand globally amidst regulatory crackdown

- Ripple acquired Swiss-based Metaco for $250 million.

- The latest incident in its case with the SEC led to a spike in XRP’s value in the past two days.

As its prolonged legal feud with the U.S. Securities and Exchange Commission (SEC) nears its end, crypto payment firm Ripple [XRP] is attempting to expand its international footprint.

Is your portfolio green? Check out the Ripple Profit Calculator

Ripple, on 17 May, announced a $250 million acquisition of Metaco, a Swiss-based provider of digital asset custody and tokenization technology. The deal marks the largest acquisition in the crypto space in recent times.

Today, we are proud to announce Ripple has acquired @metaco_sa, becoming the sole shareholder of the Swiss-based provider of digital asset custody and tokenization technology.

Learn more: https://t.co/GrI3u13iDT

— Ripple (@Ripple) May 17, 2023

Ripple noted that the acquisition will give customers the infrastructure to hold, issue, and settle various tokenized assets. Metaco will also benefit from Ripple’s extensive customer base, financial support, and resources.

On the decision to acquire the Swiss-based custody firm, Brad Garlinghouse, CEO of Ripple, said:

“Metaco is a proven leader in institutional digital asset custody with an exceptional executive bench and a truly unmatched customer track record… Bringing on Metaco is monumental for our growing product suite and expanding global footprint.”

State of XRP on-chain

Following Judge Torres’ denial of SEC’s motion to seal the Hinman documents on 16 November, XRP has since embarked on an uptrend.

Exchanging hands at $0.4482 at press time, the alt’s value surged by 5% in the last two days, data from CoinMarketCap showed.

BREAKING: $XRP price surges after Judge Torres denies SEC's Motion to Seal the Hinman documents, and holds off on #Ripple vs. #SEC verdict, awaits Congress for a regulatory roadmap. pic.twitter.com/JlS0JGBCVR

— WhaleWire (@WhaleWire) May 16, 2023

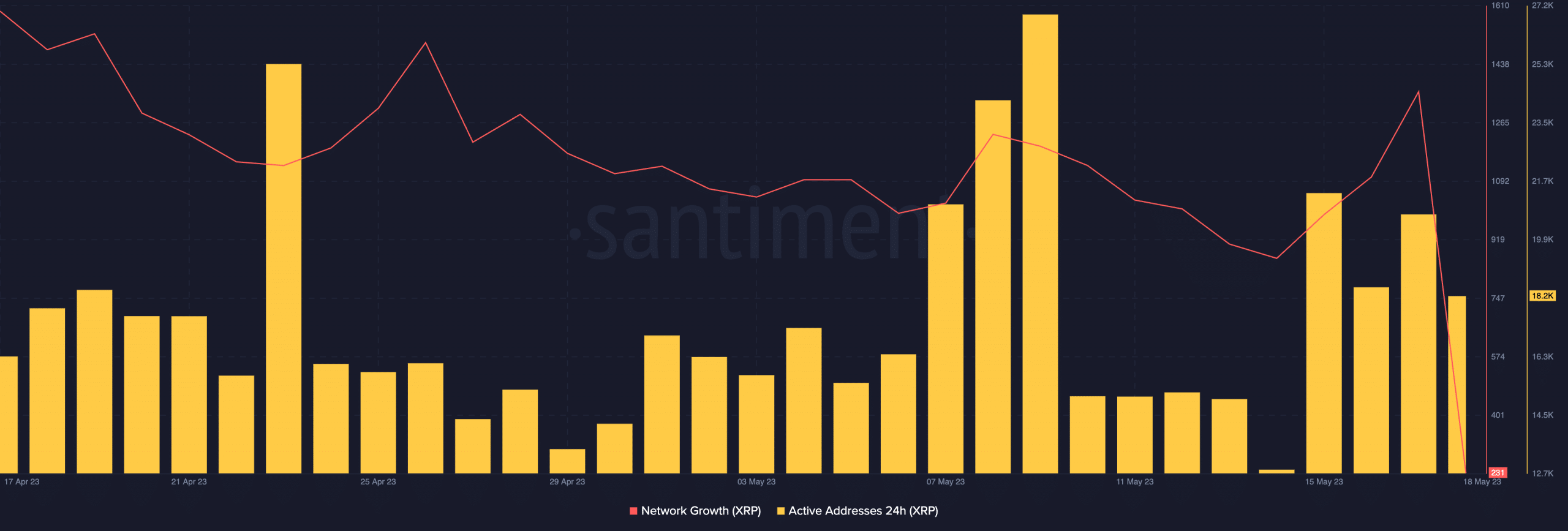

Since the court ruling, XRP has seen a spike in its network activity, data from Santiment revealed.

According to the on-chain data provider, the number of unique addresses involved in daily XRP transactions has rallied by 12%.

Likewise, the count of new addresses created to trade XRP daily has since jumped by 23%.

A close correlation exists between the level of network activity for an asset and its price movement. An increase in network activity typically leads to a rise in the asset’s price.

Conversely, a decrease in network activity is usually followed by a decline in price.

XRP traders see some relief

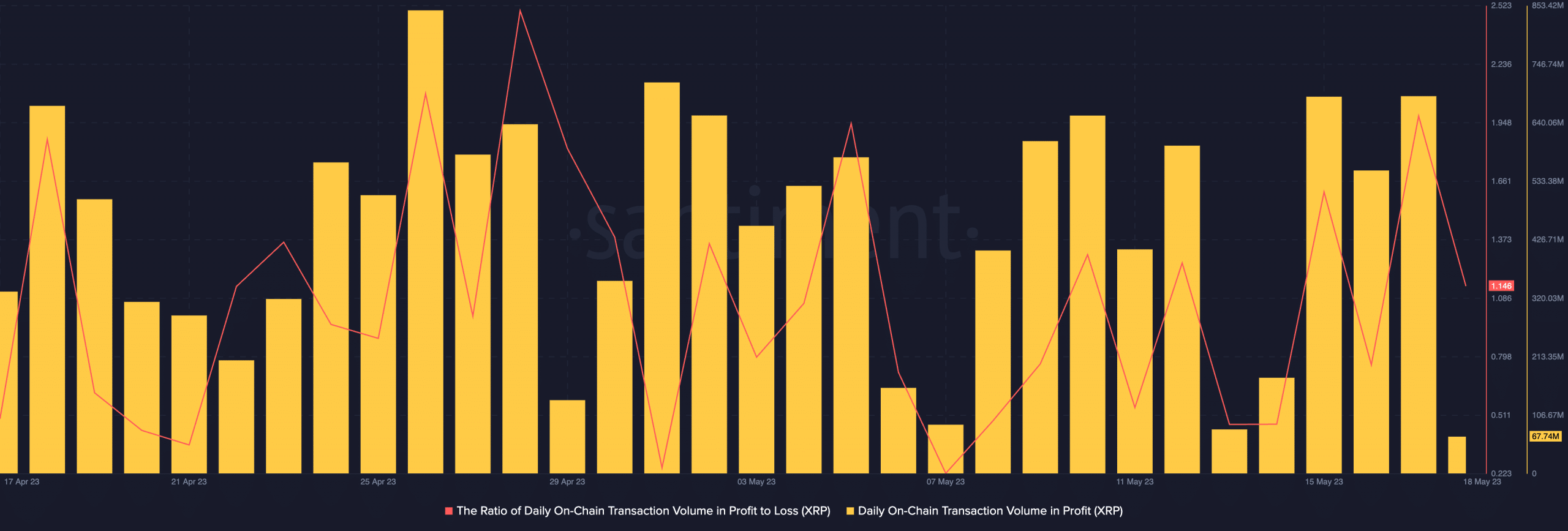

Further, since the price uptrend began two days ago, there has been a surge in XRP’s daily on-chain transaction volume in profit.

This metric tracks the aggregate amount of coins or tokens across all transactions on the network that moved in profit for a given asset in an interval.

According to data from Santiment, the value of XRP’s daily on-chain transaction volume in profit metric increased by 21% between 16 and 17 May.

As for the ratio of daily on-chain transaction volume in profit to loss, this also spiked by 164% within the same period.

Read about XRP’s price prediction for 2023-2024

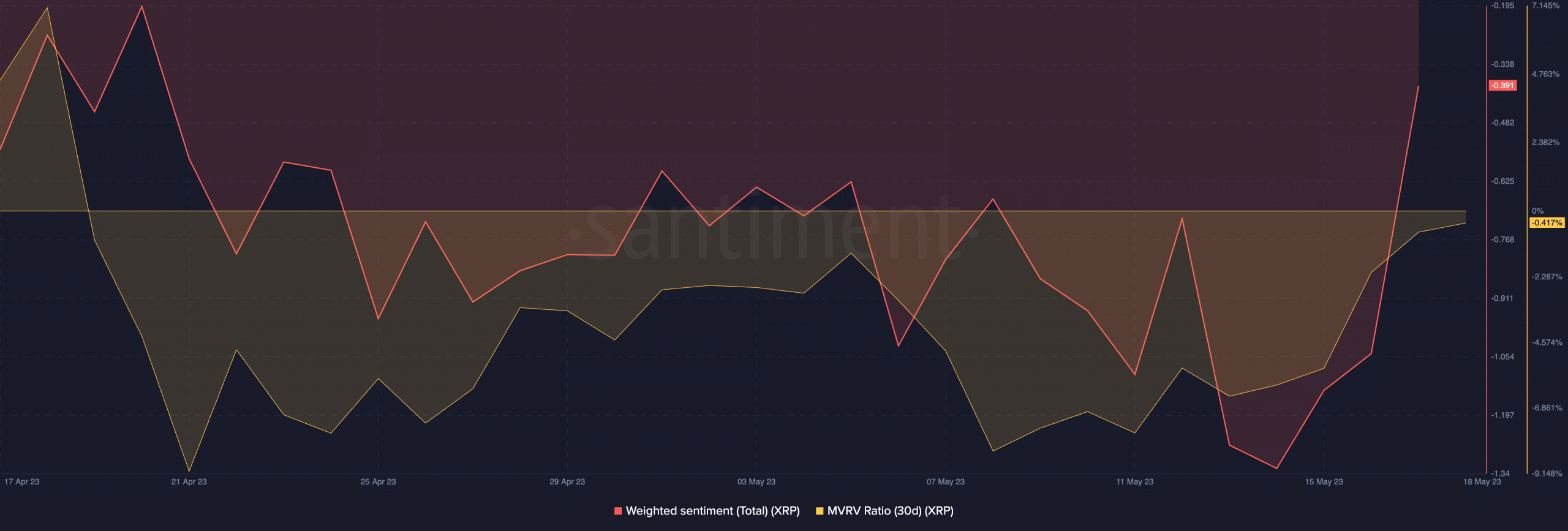

Though the volume of profitable transactions rose, negative sentiment continued to trail the altcoin at press time. Its weighted sentiment was -0.391.

Also, 30-day active XRP traders were in the negative return range since mid-April. This showed that they have continued to log losses on their investments.