Ripple: Analyst says XRP will face a potential 43% drop if…

- Peter Brandt made a bearish XRP call, warning of a likely dip to $1.

- XRP was relatively overvalued, but bullish market structure was still intact as of this writing.

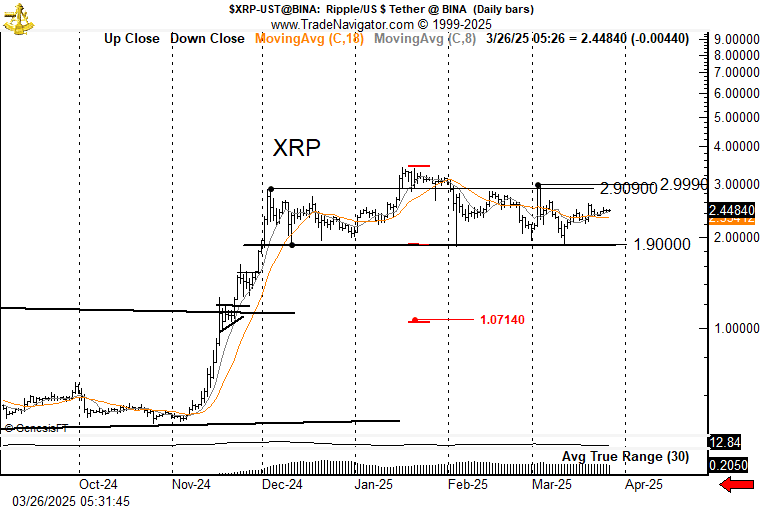

Ripple [XRP] failed to decisively surge above $2.5 despite recent bullish updates on the SEC lawsuit front. It was still stuck on its Q1 downtrend and had shed 30% from record highs of $3.4.

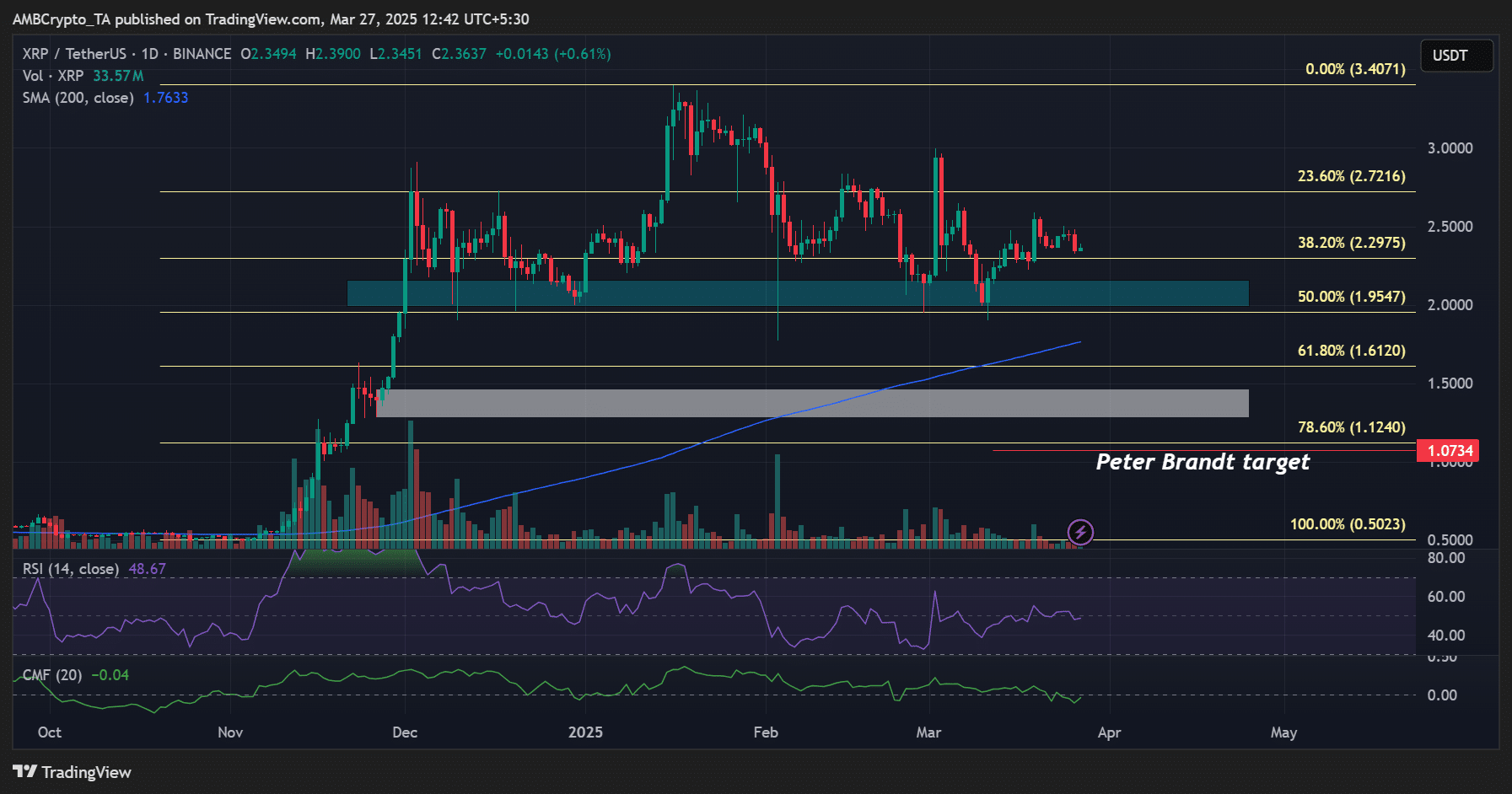

In fact, renowned price chart analyst Peter Brandt projected that the altcoin could crash 43% if it slipped below $1.9. He cited the bearish formation of an H&S (head and shoulder) pattern, which, if validated, would target $1.07.

“$XRP is forming a textbook H&S pattern. So, we are now range-bound. Above 3.000, I would not want to be short. Below 1.9, I would not want to own it. H&S projects to 1.07”

Do XRP on-chain signals agree?

Some on-chain signals also painted a similar weak outlook. On a weekly average, XRP Ledger active addresses declined by 62% from 74K users at the December peak to 28K in March.

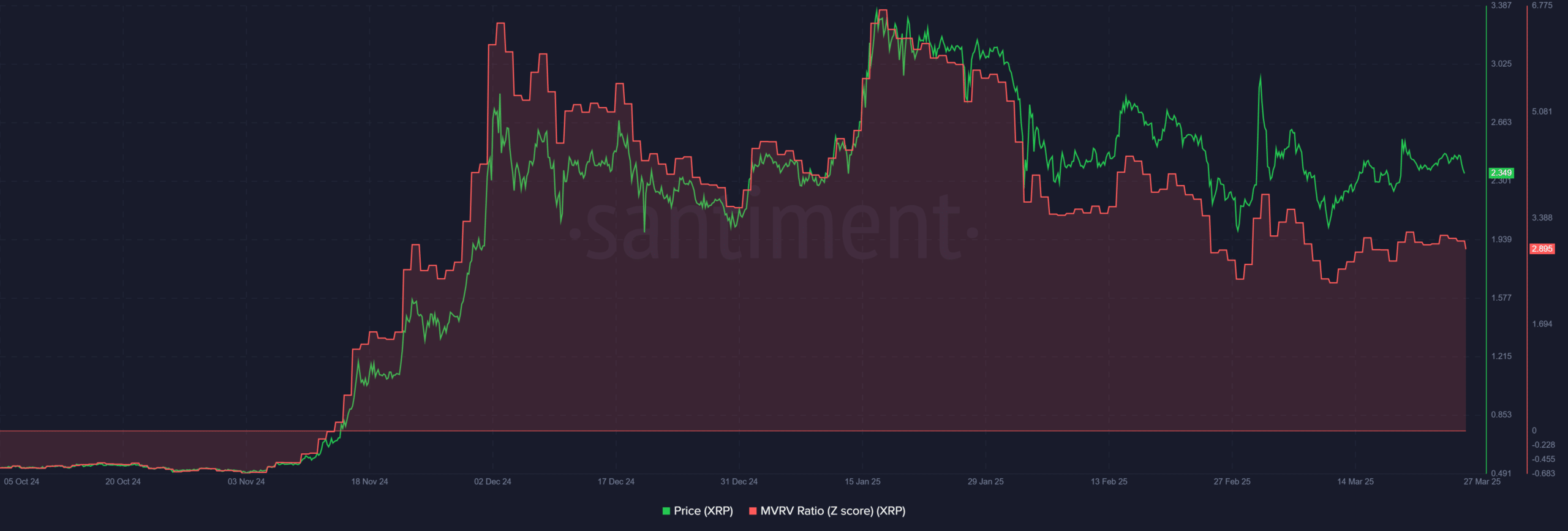

According to Santiment’s MVRV Z score, XRP was still relatively overvalued at current levels. The indicator tracks whether an asset is overvalued or undervalued relative to its price.

A reading above one could be deemed ‘overpriced’ as more holders are in profit and could sell. On the contrary, MVRV Z score values below one are perceived as ‘undervalued.’

For Ripple, the metric climbed above 6 in December and was 2.8 at press time. Simply put, long-term holders had 2.8X-6X unrealized gain and could potentially book profit and tank XRP.

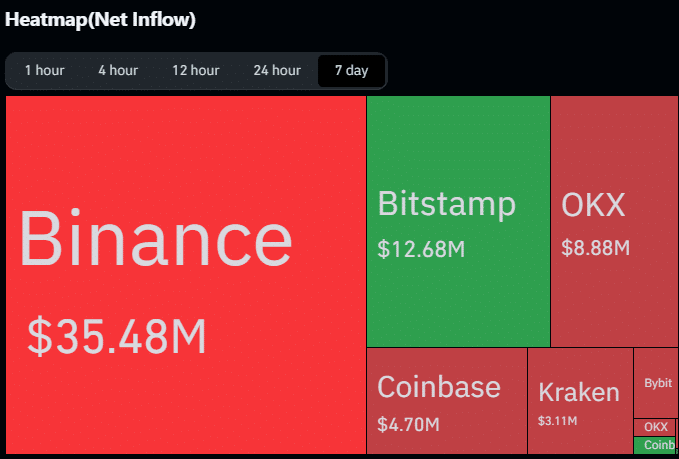

But the level of accumulation seen in the past seven trading days didn’t support the bearish inclination.

Per Coinglass data, $43 million worth of XRP was withdrawn from exchanges this week. Overall, $290 million worth of XRP left exchanges in March, suggesting that some players expected an extra rally. Will their long bet materialize?

From a price chart perspective, the $2 (cyan) and $1.4 (white) levels were key supports to watch before Brandt’s target.

In addition, the price action was still above the 200 Daily Moving Average (DMA) in blue, which meant that XRP’s bullish market structure was still intact, at least as of this writing.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)