Ripple boosts global payments with new RLUSD integration

- RLUSD integration and growth reflect Ripple’s push for global enterprise payment dominance.

- Stablecoin competition intensifies as Ripple targets top-five status with $3 billion RLUSD market cap.

Ripple[XRP] Labs continues to make waves in digital finance by integrating its RLUSD stablecoin directly into Ripple Payments. Jack McDonald, CEO of Standard Custody, confirmed the rollout, stating,

“RLUSD is now integrated into Ripple Payments—our cross-border payments solution with near-global coverage through 90+ payout markets… Enterprise utility right out of the box.”

The integration of RLUSD establishes connections with a robust network of banks, financial institutions, and payment providers worldwide.

This stablecoin provides direct access to deep liquidity, enabling businesses to efficiently settle cross-border transactions.

Ripple’s launch of RLUSD goes beyond introducing a stablecoin—it sets the stage for scalable enterprise adoption. The company also announced plans to use RLUSD as collateral for tokenized assets and expand its application within DeFi protocols.

How fast has RLUSD been growing since launch?

Since its official launch in December 2024, RLUSD has delivered explosive growth. Ripple recently minted 50 million new RLUSD tokens on the XRP Ledger, demonstrating ongoing demand.

Consequently, its total market capitalization surged to an impressive $293.79 million, far exceeding initial projections.

Furthermore, listings on major exchanges such as Kraken and Margex have amplified the token’s exposure. These strategic moves not only drive accessibility but also reflect rising confidence among institutions.

While RLUSD still trails industry titans like USDT and USDC, its current trajectory indicates it could soon close the gap.

Therefore, Ripple’s execution around RLUSD proves that utility, compliance, and adoption can scale together—quickly.

Is RLUSD a real contender in the stablecoin arena?

The stablecoin market has become a fierce battleground. Circle recently filed for an IPO, and Tether acquired 8,888 BTC, signaling aggressive expansion strategies from Ripple’s main competitors. These moves indicate that established players are gearing up for long-term market dominance.

Ripple, however, is taking a different approach. By tying RLUSD to regulatory compliance and enterprise-grade infrastructure, Ripple aims to position the stablecoin among the top five globally by late 2025.

The firm also seeks to achieve a $3 billion market cap, firmly establishing RLUSD in the upper echelon of digital assets.

Unlike its competitors, RLUSD doesn’t just aim to compete—it seeks to disrupt. Its integration with regulated finance gives it an edge that many rivals lack.

How is XRP responding to Ripple’s expansion strategy?

XRP remains essential in this narrative. A recent CNF report confirmed that Ripple re-locked 700 million XRP in escrow following large-scale wallet activity.

This action reinforces long-term confidence and reduces the immediate market supply.

At the time of writing, XRP [XRP] traded at $2.05, reflecting a 2.49% drop in price over the last 24 hours. However, trading volume soared by 63.28%, reaching $6.82 billion—a strong indicator of active market engagement.

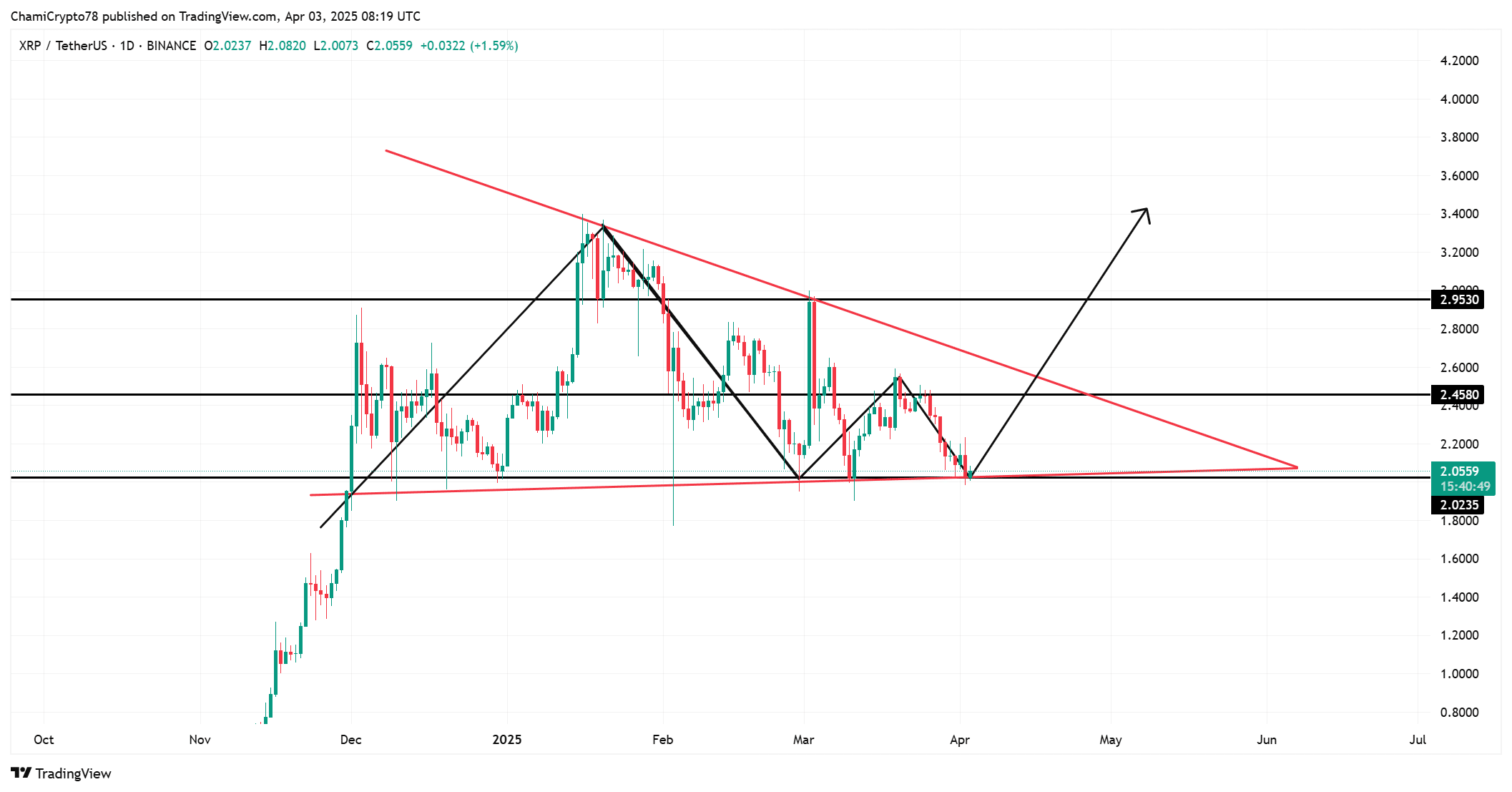

From a technical standpoint, XRP was trading within a bullish pennant flag, as shown in the latest chart. The token bounced off the $2.0235 key support, signaling potential upward momentum.

If this breakout materializes, XRP could push toward the next major resistance levels at $2.4580 and $2.9530.

Therefore, XRP’s current setup presents a high-probability opportunity for bulls. Additionally, the RLUSD integration strengthens fundamentals, aligning both assets for sustained growth.