Ripple confident ahead of SEC lawsuit, but XRP may fall to bears

- Ripple’s Q4 report revealed a drop in important KPIs.

- XRP contracted by 5% at press time after making decent gains in January.

Ahead of a possible resolution in the SEC lawsuit, Ripple Labs [XRP] appeared confident about its chances in the two-year-long case over the status of XRP in its fourth-quarter earnings report. The report stated:

“After two years of fighting this lawsuit on behalf of the entire crypto industry and American innovation, the case is fully briefed and Ripple is proud of its defense and feels more confident than ever as it awaits the Judge’s decision.”

Read Ripple’s [XRP] Price Prediction 2023-24

Ripple also attacked the U.S. Securities and Exchange Commission (SEC), accusing it of ‘regulation by enforcement.’

Q4 report is uninspiring

The on-chain activity on the XRP ledger [XRPL] plummeted on a year-over-year basis. While the number of wallets fell by almost 63%, the total transaction count was reduced to 106 million, from about 130 million in Q4 2021, recording a contraction of 18%.

However, the same set of metrics saw an increase from the previous quarter.

Additionally, Ripple highlighted the expansion of its on-demand liquidity (ODL) customer base as it entered more partnerships in the European and African markets. Despite this, the sale of the platform’s cryptocurrency, XRP, fell by 27% from the previous quarter.

XRP’s trading volume also dwindled to a little over $64 billion from $72.65 in Q3, registering a drop of 11%, the report highlighted.

XRP could enter danger zone

The quarterly report could potentially harm the interests of XRP holders. At press time, the coin slipped by almost 5% with a similar contraction observed in its market cap, per data from CoinMarketCap.

This came after a rather good start for XRP in 2023, during which it locked in gains of 18% and reclaimed its pre-FTX level market cap of $20 billion.

The market indicators gave warning signals. The Relative Strength Index (RSI) dipped sharply to its neutral level from the highs experienced of late. Moreover, the Awesome Oscillator (AO) was in red while the Moving Average Convergence Divergence (MACD) showed a bearish crossover, which could lead to significant retracement for XRP.

Is your portfolio green? Check out the XRP Profit Calculator

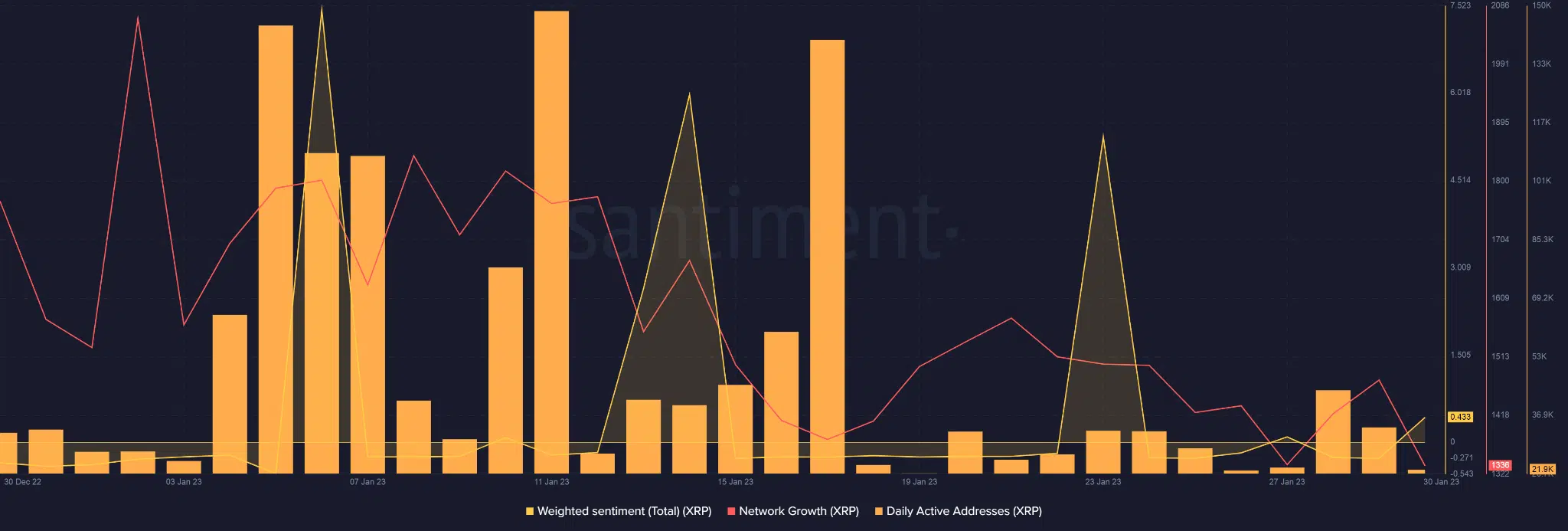

The weighted sentiment for XRP was low at press time, having entered the positive territory after a week of negativity gripped the investors. The Network growth and daily active addresses have tapered down as well, indicating low activity on the network.

The verdict of the SEC’s case against Ripple over the status of XRP could have significant implications for the wider cryptocurrency market. The laws governing the status of cryptocurrencies as commodities or securities are still not very clear.