Ripple: How Asia is fueling XRP distribution amid American pushback

- Ripple’s partnerships in Asia seem to be paying off

- Since XRP’s last rally, more addresses have joined the bandwagon

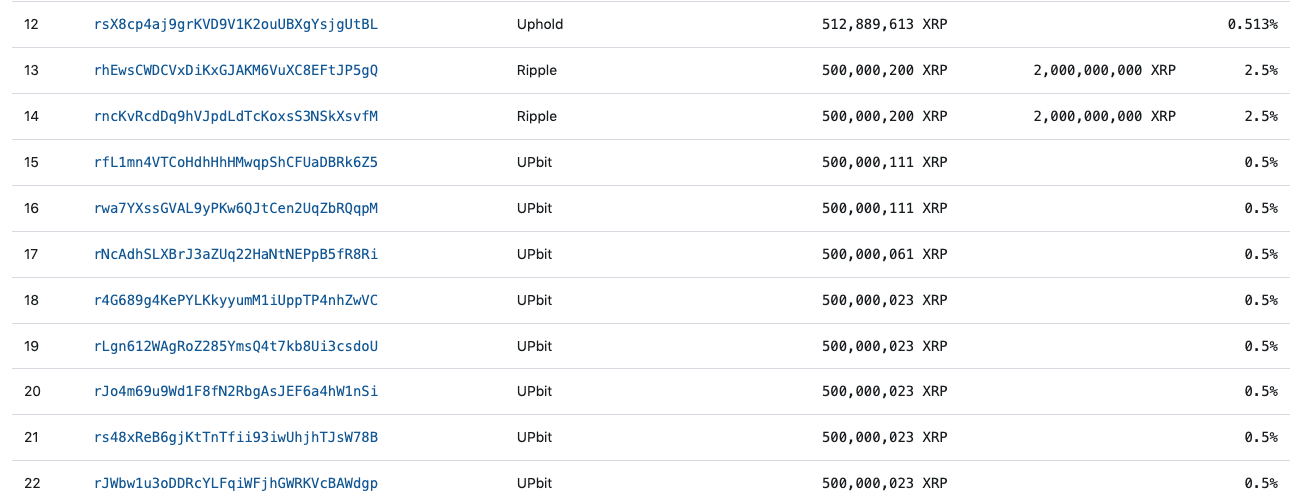

According to data acquired from XRPScan, the number of active XRP accounts has surpassed 4.5 million, with a large percentage of these accounts coming from Asia. As expected, Ripple, the blockchain payments firm, accounted for being the largest holder of the token. Binance held the second position with a couple of billion XRP tokens.

How much are 1,10,100 XRPs worth today?

However, a notable percentage of XRP’s distribution is the amount held by the Asian crypto-community. To drive this point further, consider this –

Upbit, the South Korean exchange, also holds millions of XRP spread across different wallets.

Thanks to the freedom of occupancy

Besides a desire to hold the token, Ripple’s presence in the region could have impacted this trust. The firm has previously partnered with various financial institutions while acting as a remittance provider.

Ripple’s main partner in Asia is Japan’s SBI Holdings, which has a significant stake in the company. This has led to a massive increase in XRP usage in the country.

In 2021, organizations including SentBe and GME Remittance adopted RippleNet to foster cross-border payments. Thus, a hike in real-world use cases across the continent laid the groundwork for further adoption of the token.

Another reason for the Asian input are the regulatory challenges the project has been facing in the U.S. As the matter lingered, Ripple seemed to shift its focus from considering the Joe Biden-led nation as its mainstream base.

So, it was not surprising when trading activity on the Upbit exchange tremendously increased and fueled an XRP rally a few weeks back. Despite struggling to replicate the form in recent times, active addresses have also jumped on the charts.

Ascending the throne from quick attention

At the time of writing, Santiment revealed that the 90-day XRP addresses had a reading of 1.27 million. The metric measures the number of distinct addresses that have participated in an asset transfer.

On-chain data further revealed a rise in transactions since 19 March. Therefore, growing interest in XRP was clearly evident from these metrics.

Read Ripple’s [XRP] Price Prediction 2023-2024

On the other hand, the Spent Coins Age bands decreased to 34.57 million. This metric summarizes the behavior of both short-term and long-term holders, alongside the token’s price action.

In this instance where the metric has fallen, it means that short-term investors are mostly accountable for XRP’s price movement. While this does not negate long-term input, it is a sign of how short-term holders have been overlooked and are now prompting into action.In conclusion, though Ripple’s case with the U.S. SEC is not yet settled, it seems the company has other options. As more financial institutions in Asia continue to adopt XRP, the cryptocurrency’s distribution and usage are likely to continue growing.

![Ripple [XRP] active addresses and spent coins age bands](https://ambcrypto.com/wp-content/uploads/2023/04/Bitcoin-BTC-11.31.49-22-Apr-2023.png)

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)