Ripple: How XRP is moving beyond legal woes to benefit investors

- Despite ongoing legal battles, Ripple’s XRPL ecosystem continues to develop new features to increase the utility of XRP.

- Key metrics such as volume and active addresses have also been increasing.

Ripple (XRP) has been the subject of litigation for years, and only recently has it looked like an end might be in sight. Despite the ongoing legal battle, activities on the Ripple XRPL have not stopped. Various features are also being developed to give XRP more utility.

How many are 1,10,100 XRPs worth today

Expanding on Ripple (XRP) use cases

A recent post by Messari provided an in-depth analysis of the Ripple XRPL ecosystem while defining the value of XRP. Ripple’s XRPL currency exchange feature is one of its most popular uses since it has become the backbone of the platform’s commerce.

As a result of this feature, XRP may be traded for other cryptocurrencies and even fiat currency with minimal effort and time spent by the user.

Moreover, NFT capability has been added to the XRPL, and DEXs are currently being built on it. XRP’s utility and potential applications have been expanded through these moves.

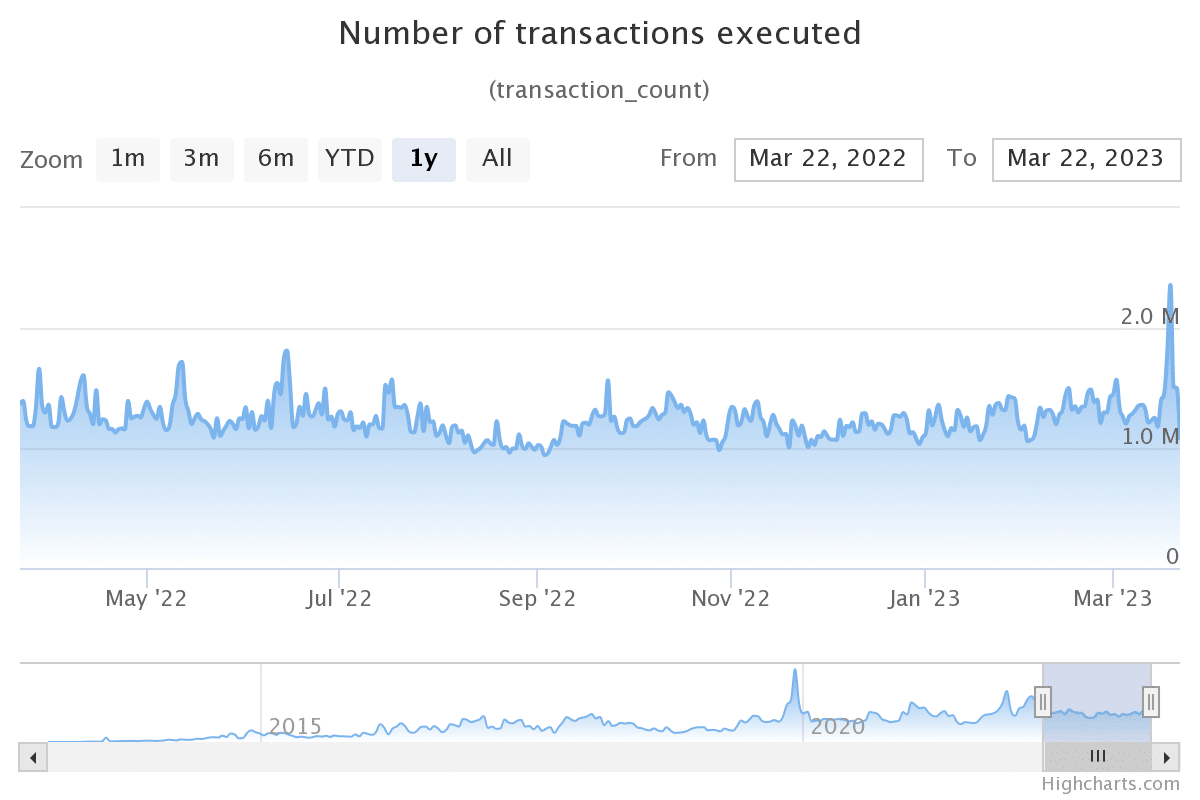

There has been a recent uptick in XRPL transactions, as reported by XRPscan. According to the XRP Ledger measurements, the number of transactions processed on the ledger has surpassed 2 million for the first time in over a year.

With the approval of its EVM testnet, which enables the creation of smart contracts and decentralized apps on the XRPL, Ripple recently garnered news. The EVM testnet was validated by RippleX, the company’s developer-focused project, expanding the potential for XRP.

Key Ripple metrics spike

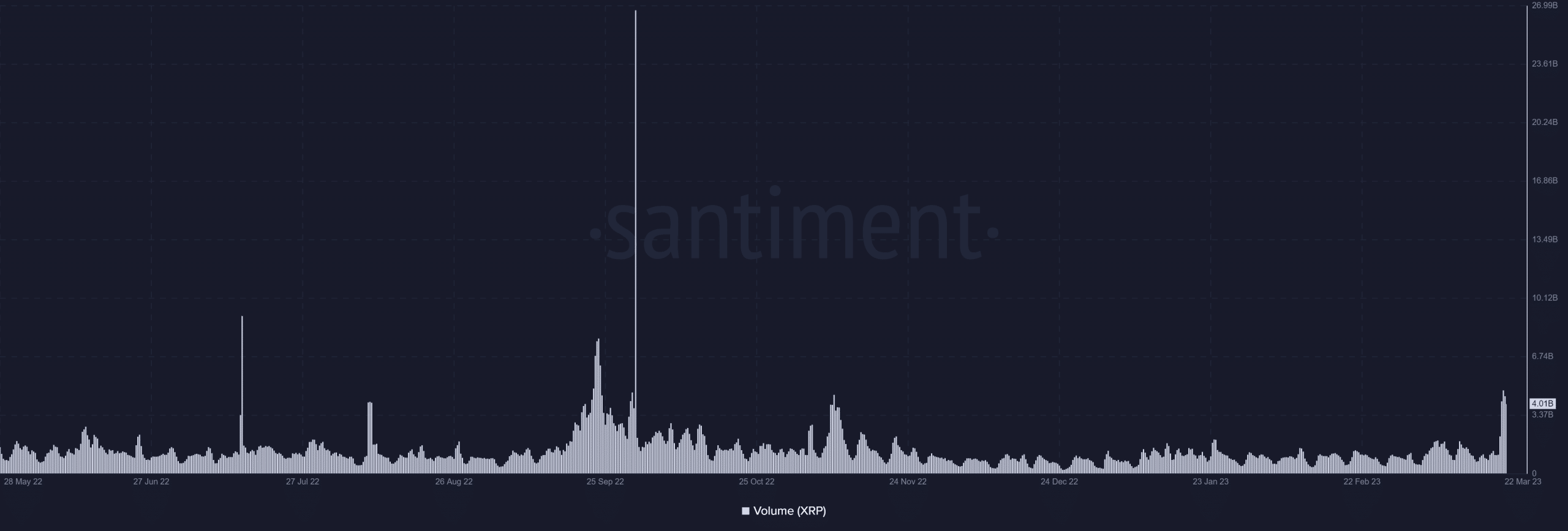

According to its volume and active addresses analytics on Santiment, XRP has seen extremely high activity. The volume was over 4 billion as of the time of this writing. The volume has also increased significantly, reaching its greatest level in over four months.

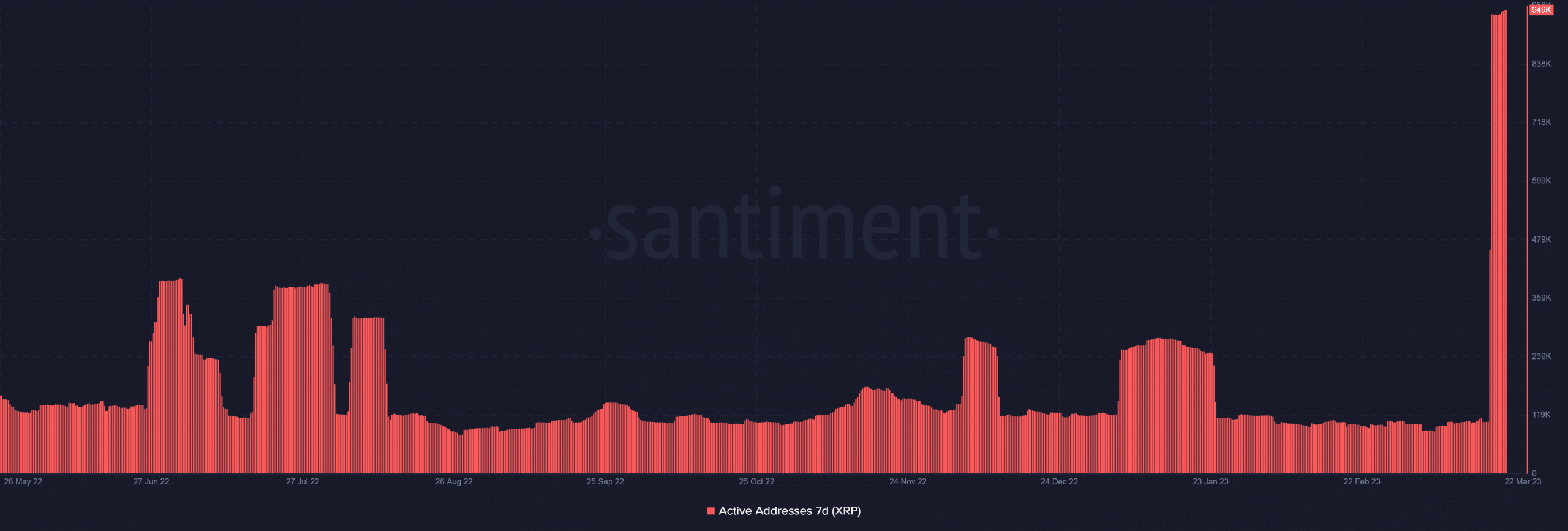

Recently, there have also been considerable rises in the seven-day active address statistic. Almost 948,000 active addresses were present as of this writing, which was a record high compared to the previous nine months.

Ripple’s price movement and MVRV

Meanwhile, the price of XRP rose by 25.73% on a daily timeframe, reaching $0.47 at the end of trading on 21 March.

Also, the price increase caused it to move into the overbought area of the Relative Strength Index (RSI). However, as of this writing, it had dropped more than 7% and was selling at about $0.43. Despite falling below the oversold region, it was still in a solid bull trend.

Realistic or not, here’s XRP market cap in BTC’s terms

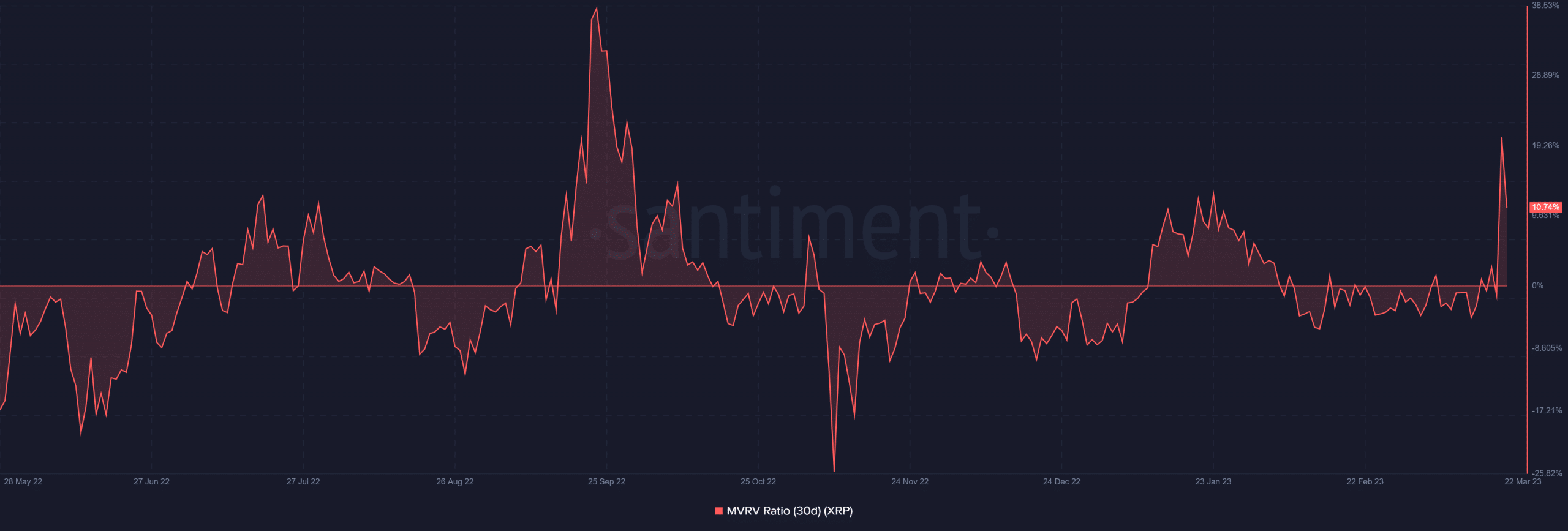

Furthermore, due to the price increase, the 30-day Market Value to Realized Value ratio (MVRV) also indicated that the asset was overvalued.

The MVRV had risen over 0% and was at 12.51% as of the time of writing. The position of the MVRV indicated that it was both in profit and overvalued.