Ripple

Ripple on ‘the right side of history,’ says CEO amid appeal against SEC

Ripple’s filing comes days after the SEC filed its own Form C.

- Ripple files a Form C as a cross-appeal in its case against SEC.

- CEO and CLO remain optimistic about the verdict.

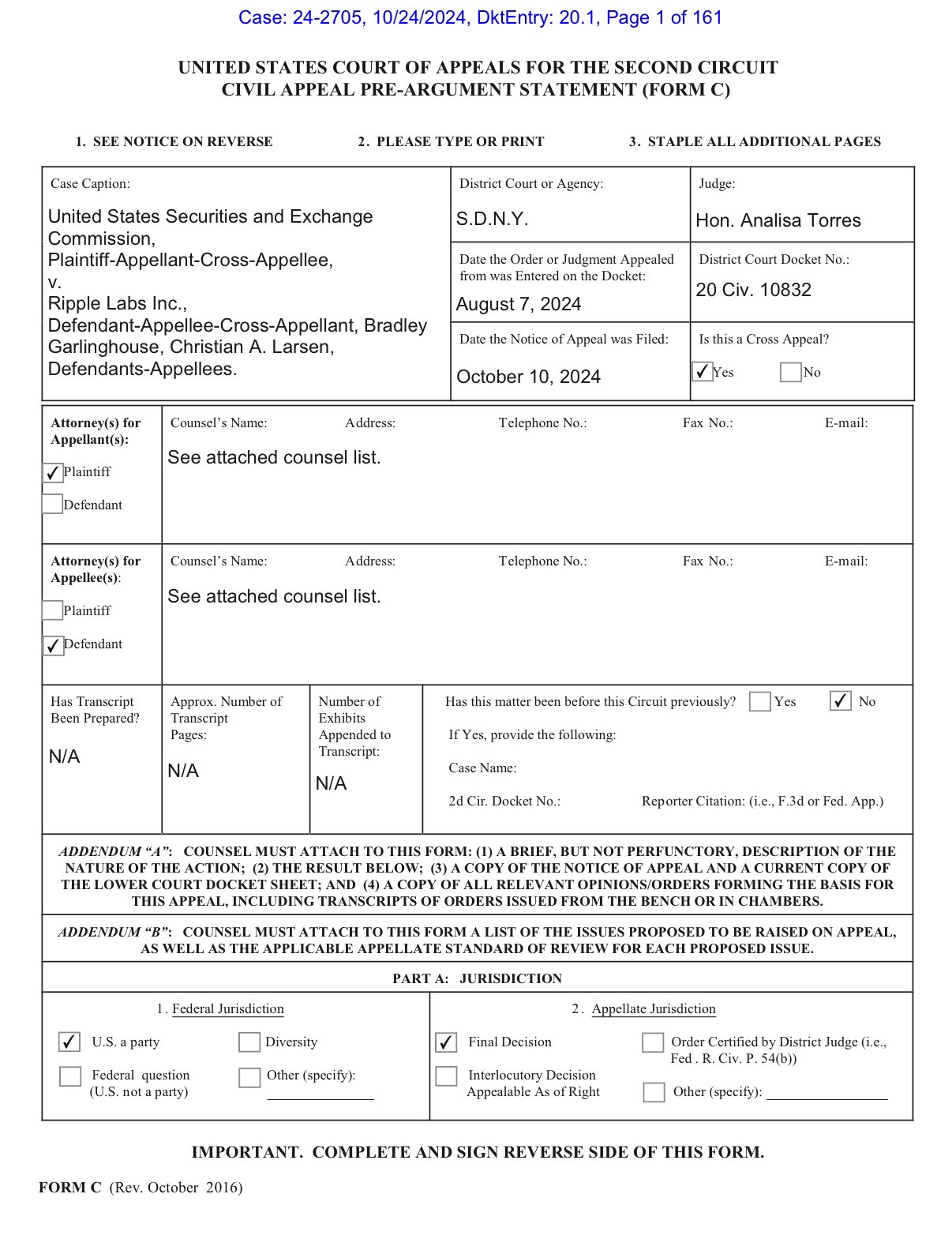

In a fresh turn of events, Ripple [XRP] submitted its Civil Appeal Pre-Argument Statement [Form C]. The appeal was submitted on 24th October in the ongoing Ripple vs. U.S. Securities and Exchange Commission [SEC] case.

James K. Filan, defense attorney, and former federal prosecutor shared the filing on X.

Notably, on the same day, Filan also revealed that the SEC had filed a request with the U.S. Court of Appeals for the Second Circuit. The SEC was seeking an extension to submit its principal brief by the 15th of January, 2025.

CLO affirms legal clarity

After the filing, Stuart Alderoty, Ripple’s Chief Legal Officer, took to X to emphasize the key issue in the case, stating,

“The case is not about whether XRP, in and of itself, is a security. XRP is uniquely situated as having clarity (alongside BTC) in not being classified as a security.”

Alderoty further clarified that the appeals process is much less dramatic than the initial litigation, as no new evidence can be submitted.

He highlighted the SEC’s broader strategy to create “distraction and confusion.” However, the CLO downplayed it as mere “background noise.”

Ripple’s business, he noted, continues to grow despite the ongoing legal battle.

Garlinghouse’s confidence in Ripple’s appeal victory

This optimism was corroborated by Ripple’s CEO, Brad Garlinghouse. In an interview with Fox News reporter Eleanor Terrett, he reiterated his confidence in the company’s success in the Second Circuit.

Garlinghouse remarked,

“I am so confident that we’re going to win the appeal and that would really put a dagger in Gary Gensler’s whole agenda around crypto regulation.”

The CEO asserted that Ripple is on,

“The right side of the law…the right side of history.”

Ripple’s Form C addresses four critical issues, including whether an investment contract under the Securities Act must have explicit post-sale obligations and rights to profits, the classification of the institutional sales of XRP, the company’s fair notice defense, and the injunction’s clarity.

SEC vs. Ripple

For the uninitiated, the SEC filed a lawsuit against Ripple Labs in December 2020. The former accused the company of raising $1.3 billion through the sale of unregistered securities in the form of XRP.

After nearly two years of litigation, Ripple secured a partial victory in July 2023. U.S. District Judge Analisa Torres ruled that its public sales of XRP did not violate federal securities laws.

However, the court also ruled that Ripple’s institutional sales of XRP did constitute the sale of unregistered securities.

In response, the SEC filed a notice of appeal in October 2024, seeking to overturn the ruling. Furthermore, on the 17th October, the SEC filed a Form C, as reported by AMBCrypto.

Realistic or not, here’s XRP’s market cap in BTC’s terms

As the case moves forward, the court will issue a scheduling order consolidating all briefings, including those from the district court, under lead case 24-2648.

The outcome of this appeal could have significant implications for Ripple and the wider cryptocurrency industry.