Ripple surges to $2.50 – Mapping XRP’s potential $3 move

- XRP has decoupled from the altcoin pack, surging another +14% and breaching the $2.50 resistance.

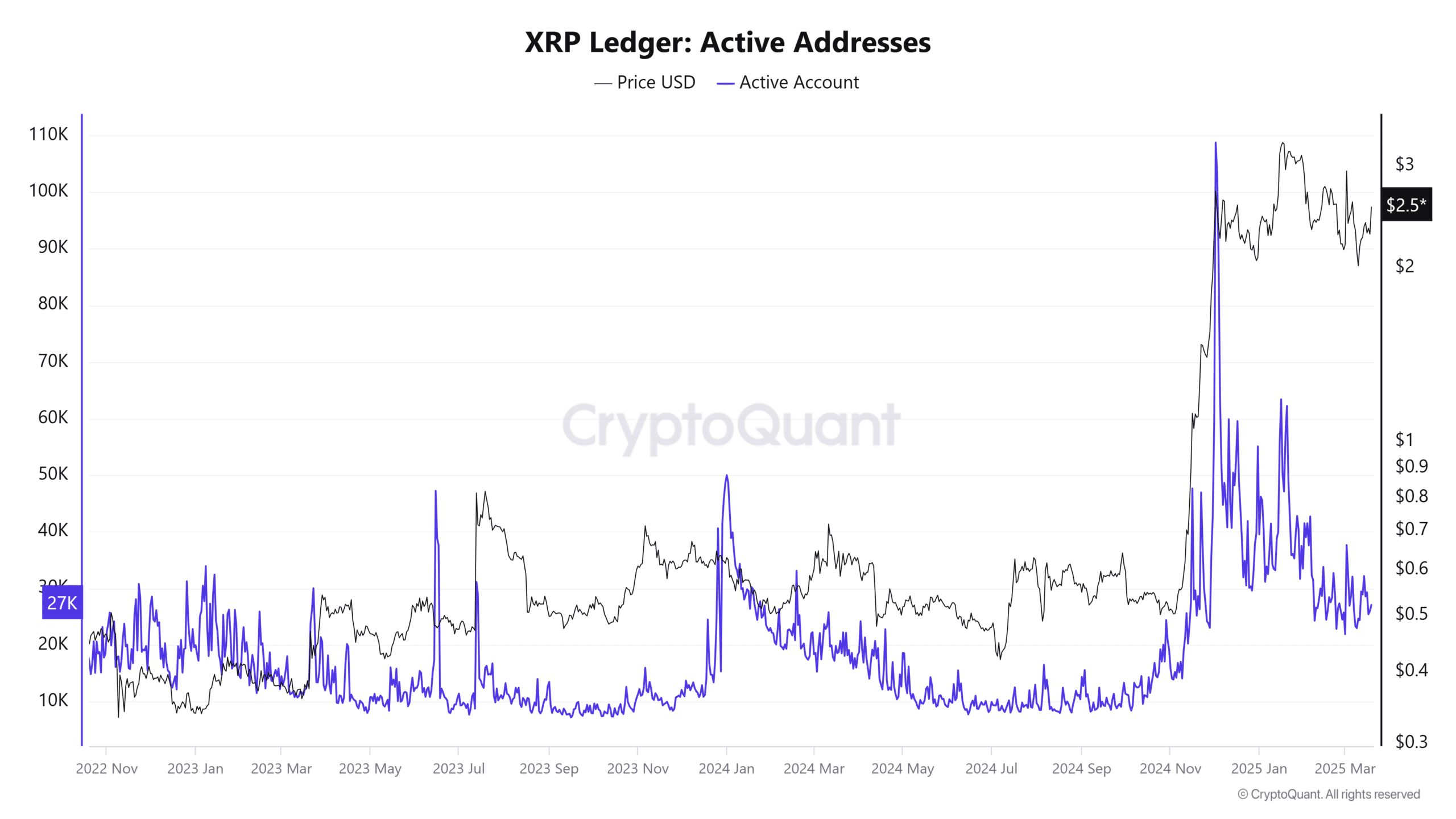

- XRP Ledger matched with substantial growth in active addresses, which demonstrates rising acceptance.

Ripple’s[XRP] recent price increase together with its technical breakout strengthens its positive market outlook.

Data from Santiment highlights that major XRP holders maintained their purchase activity, since big wallet stakeholders increased 1M+ wallet holdings by 6.5% to reach 46.4 billion tokens in two months.

Growing investor confidence continues to drive market demand and rising prices, as indicated by recent trends.

For twelve days, the $2.50 resistance level held firm against breakthrough attempts. Price movements between $2.40 and $2.45 produced red candles, signaling failed attempts. However, a green candle finally emerged at $2.50, successfully closing above this critical resistance.

This breakthrough signals the start of a new cycle of investor purchases, which supports further price gains.

The strong upward trend could push XRP toward the $3.00 resistance level, further distancing it from movements in the broader altcoin market.

The recent price rally of XRP Ledger aligns with significant growth in active addresses, highlighting increased acceptance and utility.

According to CryptoQuant data, March 2025 saw active addresses grow to 70K—six times higher than the first two months of the year. Previously, active addresses ranged between 10K and 12K.

This network growth mirrors XRP’s price surge, rising from $0.60 in early 2024 to $2.50 by March 2025. Spikes in active addresses preceded major price movements, fueling the transition from $1.50 in late 2024 to its current peak.

As network usage expands, investor confidence grows, with XRP showing independence from broader altcoin market trends. This strengthens its long-term value proposition.

SEC drops appeal against Ripple

XRP received a significant regulatory boost when the SEC ended its legal challenge against Ripple. The SEC had initially filed the lawsuit in December 2020, alleging that XRP was an unregistered security.

The dismissal of the SEC’s appeal upheld the July 2023 ruling, which classified XRP as a non-security in secondary trading. This resolution removed a major regulatory hurdle for the asset.

The establishment of clear regulatory guidelines has improved market sentiment, attracting new retail and institutional investors.

Additionally, increased network activity and large traditional investor purchases highlight growing confidence in XRP’s potential.

The resolution of legal challenges now enables XRP to focus on forming key business alliances in cross-border payments and strengthening its position in the industry.