Ripple: This is where you can look to short XRP amid increased sell pressure

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- XRP formed a bearish pennant on the 3-hour timeframe.

- The alt could continue to face short-term selling pressure.

Ripple’s [XRP] drop continued into the early part of the weekend despite the bulls showing little interest. In the past seven days, the asset has lost 7% of its value. At press time, it was trading at $0.3812, and underlying fundamentals suggested a further drop was likely.

Read Ripple [XRP] Price Prediction 2023-24

Sideways or drop – which way for XRP?

Is your portfolio green? Check out the XRP Profit Calculator

XRP entered an extended short-term price correction after facing a price rejection at $0.4092. Its price action in the past two days formed a bearish pennant pattern. Similarly, the OBV (On Balance Volume) fluctuated as it dropped gently, indicating trading volumes were limited in the same period.

Therefore, XRP’s short-term drop could continue, and a retest of $0.3728 could be likely. Short traders could take short-selling opportunities at $0.3781 and $0.3766.

But bears must be cautious of bullish RSI divergence, which shows that bulls were within the vicinity. As such, countering buying pressure could set XRP to trade sideways within the 38.2% – 23.6% Fib pocket level. Such a move would invalidate the above bearish bias.

Ripple’s demand fluctuated, and the sentiment was negative

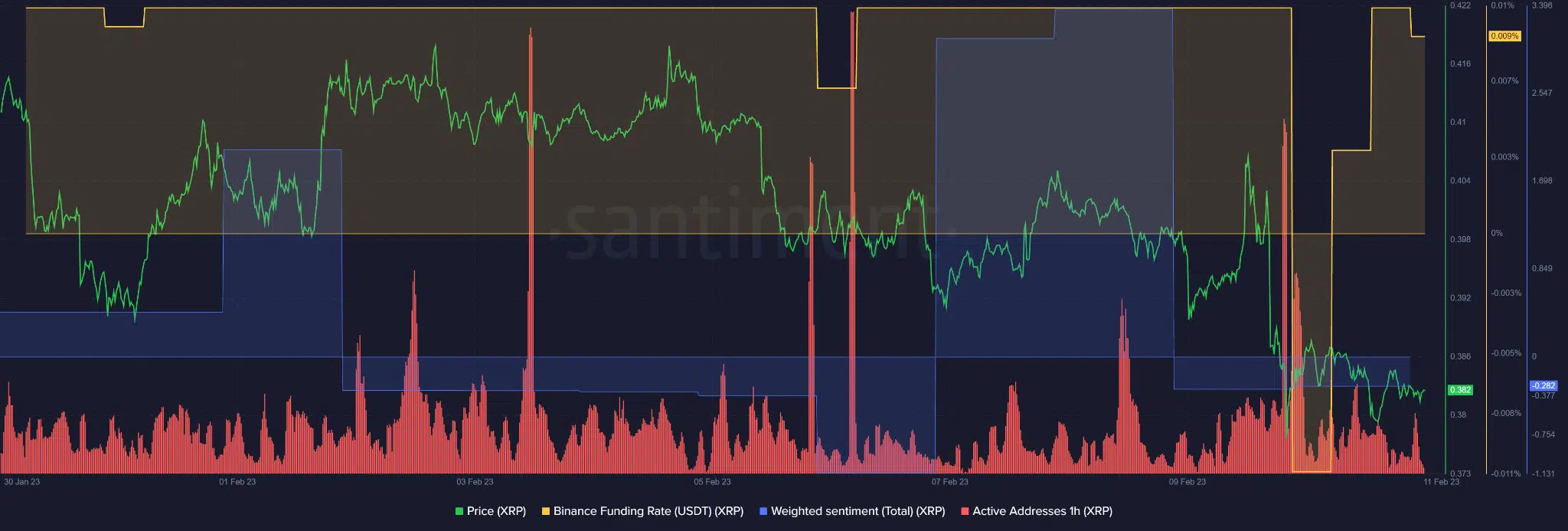

According to Santiment, Ripple’s [XRP] demand fluctuated after it dipped but recovered later, as shown by the Funding Rate. Notably, the buoyant demand in the past few hours slightly dropped at press time.

In addition, XRP’s weighted sentiment has remained negative for the past three days, underlying the market’s bearish outlook. Collectively, the drop in demand and the underlying bearish sentiment could weaken the market further in the next few hours.

However, there was a slight uptick in active hourly addresses, showing more accounts were transacting the token. If the trend continues, XRP’s trading volumes could be boosted, tipping bulls to aim at the 38.2% Fib level. Therefore, caution should be exercised.