Ripple vs SEC: Time for XRP traders to play it safe?

The imminent conclusion of the Ripple vs. SEC lawsuit has the entire crypto-industry eagerly anticipating the final ruling. This legal battle carries immense importance as it is poised to bring much-needed regulatory clarity to the USA, which presently lacks a comprehensive framework for governing the sector.

Is your portfolio green? Check out the Ripple Profit Calculator

The Hinman Documents

On 16 May, Judge Torres delivered a significant ruling by rejecting the Securities and Exchange Commission’s (SEC) request to keep the Hinman documents confidential. This implies that the court intends to make these documents accessible to the general public. Subsequently, the countdown began with 6 June anticipated as the date for the public disclosure of these extensively discussed documents.

More recently, both Ripple and the SEC jointly submitted a letter, requesting a one-week extension. Consequently, the deadline for submitting public versions of the summary judgment motions and supporting exhibits, including the Hinman materials, has been rescheduled to 13 June 2023.

XRP enthusiasts get optimistic

According to Sam Lyman, a former policy director, Ripple may have a chance to emerge victorious after the documents become available to the public.

One of the reasons why Ripple may come out on top has been the legal team that the firm has hired. According to John E Deaton, Ripple’s legal team consists of individuals with notable backgrounds, including a former Director of Enforcement, a former Chief of Litigation, and a former Chief of the Criminal Division.

Comments from former SEC commissioner

Joseph Grundfest, who previously served as a commissioner at the SEC, made a few comments about the case in a recent interview. He initially stated that there should be some empathy deployed towards the SEC as it is a regulatory regime that is not designed to deal with problems and challenges around crypto.

However, in the interview, Joseph stated he had questions around the reasons why a lawsuit was filed against Ripple Labs. He also mentioned that he had questions regarding the timing and implications of this event. He further went on to claim that he does not believe this litigation will help provide a significant solution towards compliant crypto in the future.

Traders play it safe

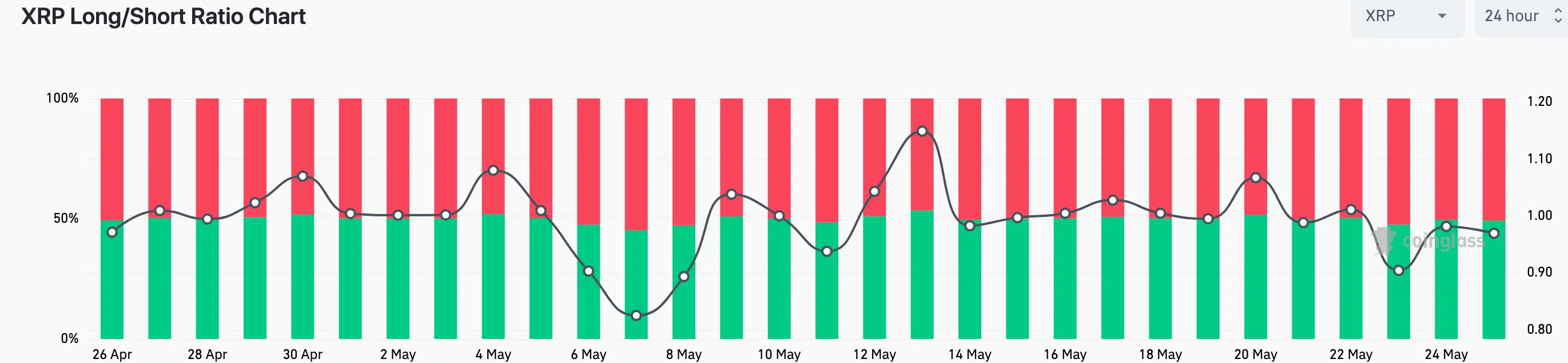

Many in the crypto-space believe that the disclosure of the Hinman documents will provide Ripple enough ammunition to win this case, impacting XRP positively. However, traders don’t quite share the same belief.

According to Coinglass’ data, the sentiment of traders has been rather negative as short positions taken against XRP have risen over the last few days.

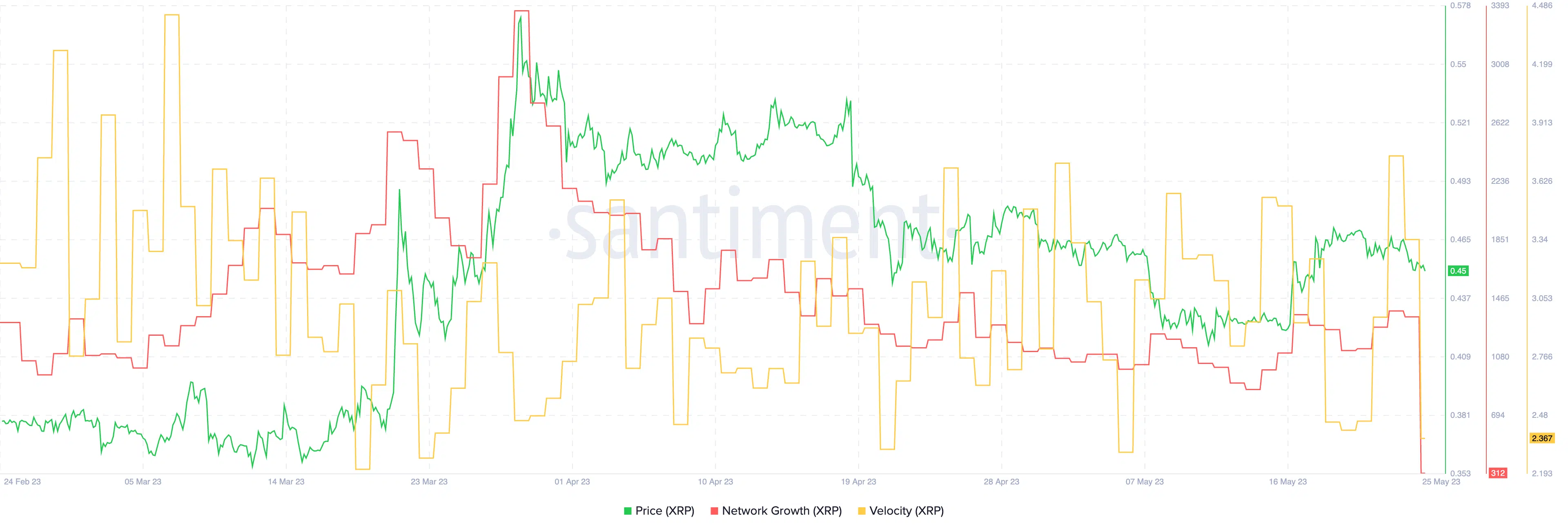

Over this period, XRP’s price also fell. At press time, it was trading at $0.453. The network growth of XRP had decreased as well, indicating that new users aren’t as interested in buying XRP.

Its velocity, however, remained consistent throughout the last few weeks, showcasing that the token was being traded actively despite high fluctuations in its price.

The release of the Hinman documents and the outcome of the lawsuit could provide some positive momentum to XRP’s price. Additionally, Ripple’s other developments may also help in improving the state of XRP.

Ripple enters new markets

Ripple recently revealed its selection to demonstrate a solution for tokenizing real estate assets in Hong Kong’s inaugural e-HKD Pilot Programme.

The projected growth of the real-world asset tokenization industry to a multi-trillion-dollar one by 2030 has resulted in increasing interest in utilizing this approach to tokenize commodities, particularly real estate. Ripple has developed a compelling use case that integrates the e-HKD, tokenized real estate, and lending protocols. This solution will operate on a private and secure ledger, leveraging the same technology employed on the XRP Ledger (XRPL).

Realistic or not, here’s XRP market cap in BTC’s terms

Additionally, Ripple has also been observed to be working on its CBDC platform. Ripple is actively collaborating with over 20 countries to develop plans for Central Bank Digital Currencies (CBDCs). Through this collaboration, Ripple has made significant improvements to its CBDC platform, ensuring it fulfils the specific requirements of many. This enhanced platform enables these entities to tailor their currency plans and create prototypes utilizing the new CBDC platform.