XRP whales stock up on 600M tokens – Here’s what you should do!

- Some whales have accumulated more XRPs.

- XRP started the day with a less than 1% increase in value.

Recently, the price of XRP has been fluctuating around the $0.6 mark, not showing a particularly strong performance. Despite this, a group of holders has taken advantage of the lower prices to increase their asset holdings.

Major whales scoop up asset

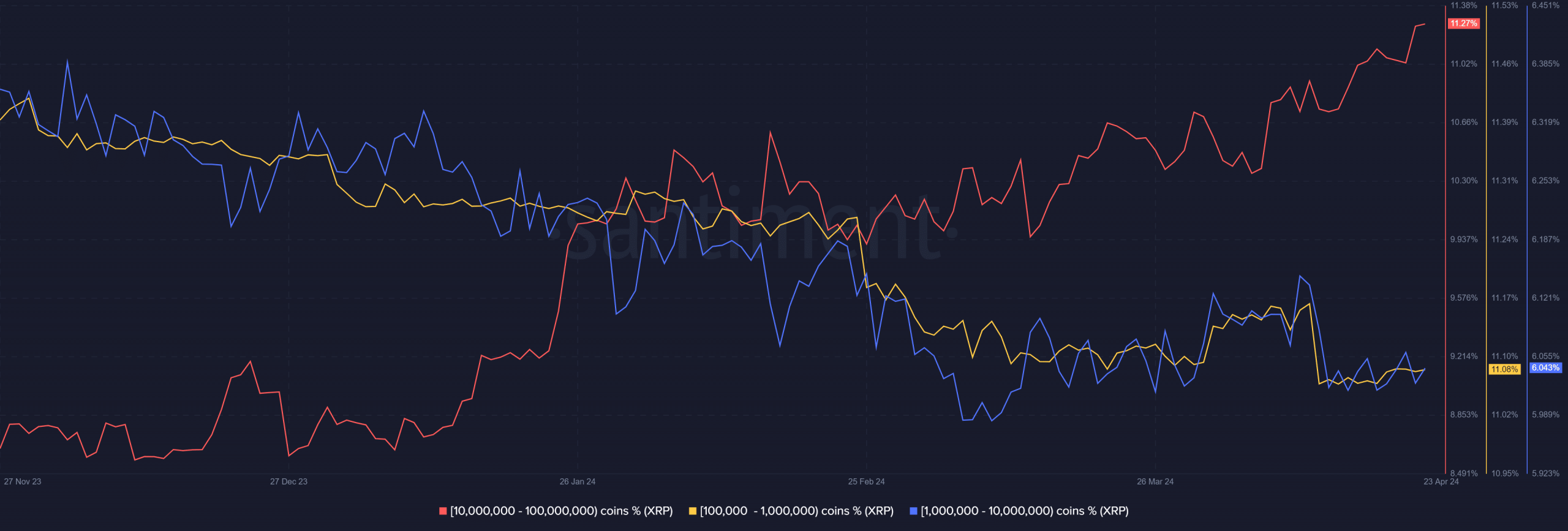

AMBCrypto’s analysis of XRP supply distribution on Santiment revealed significant accumulation by major whales. The study of the chart indicates that accumulation began around January and persisted despite significant price dips.

Over the past week alone, these addresses accumulated over 31 million XRP. As of the current writing, the supply distribution has risen to 11.27%, with 249 addresses involved. Further examination showed that whales stockpiled 600 million tokens in just the last two weeks.

Furthermore, while major whale addresses were actively accumulating, examining others revealed a lack of enthusiasm. Analysis of these addresses revealed periods of significant decline, suggesting a sell-off.

Interestingly, these declines corresponded with drops in the price of XRP.

Are they holding at a profit?

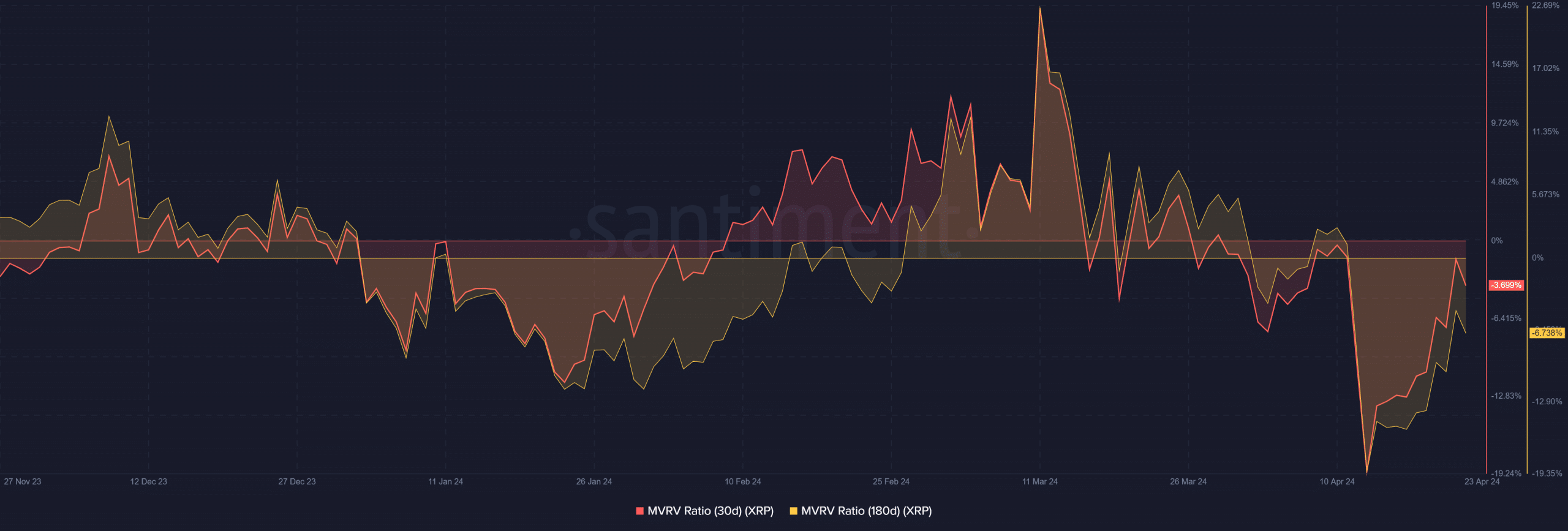

An examination of the 30 and 180-day Market Value to Realized Value ratio (MVRV) suggests that these whales were not holding these assets at a profit.

AMBCrypto’s analysis indicates that the 30-day MVRV stands at approximately -3.7% as of the current writing.

Similarly, the 180-day MVRV hovers around -6.7%. This implies that much of the accumulated XRP is currently valued below its acquisition cost.

Nevertheless, indications are pointing towards further accumulation at this stage. Historically, when the MVRV falls below zero, there tends to be an upward correction. This suggests a high likelihood of these holdings transitioning into profitability.

XRP’s uptrends and declines continue

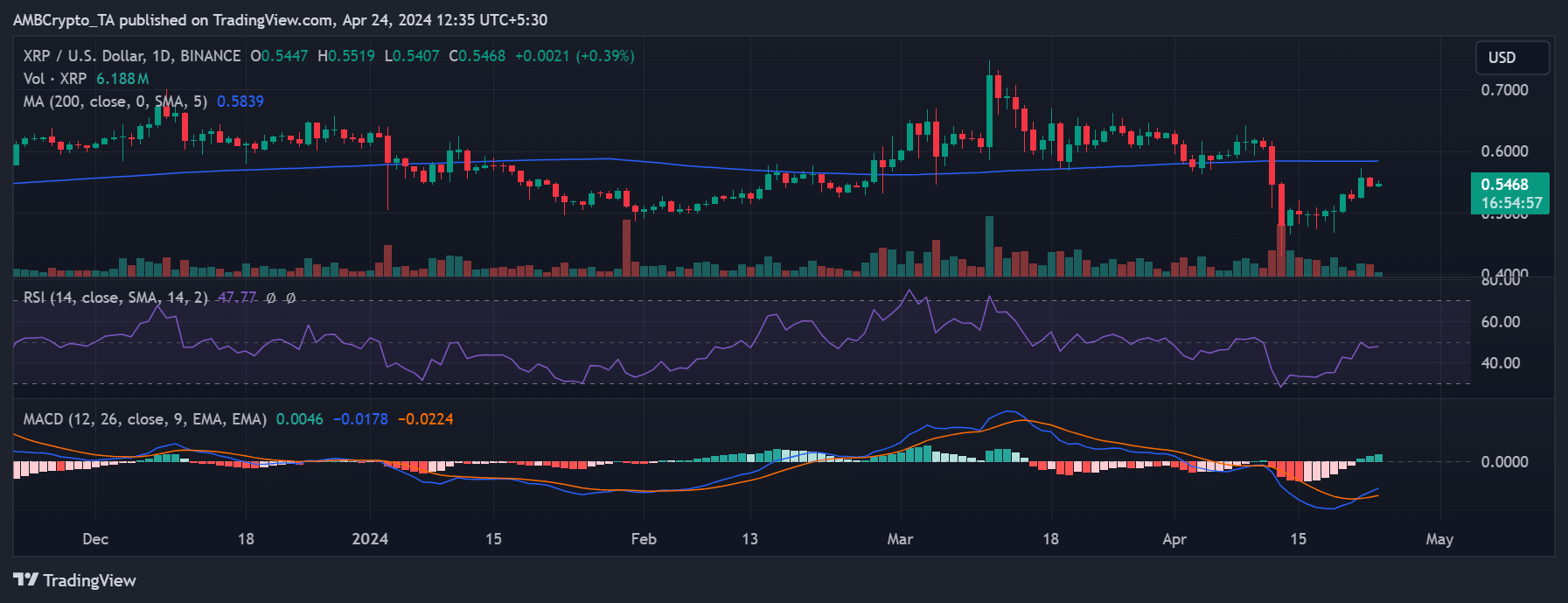

AMBCrypto’s analysis of XRP on the daily timeframe revealed a decline of over 2% by the end of trading on 23rd April. The price chart indicated a trading value of around $0.544 following this 2.09% decline.

This decrease came after a 6% increase, pushing its price to approximately $0.55 during the preceding trading session. As of the current writing, XRP was trading at around $0.547, showing a slight increase of less than 1%.

Realistic or not, here’s XRP market cap in BTC’s terms

Additionally, its long Moving Average (blue line) acted as a resistance at around $0.58.

Furthermore, an analysis of XRP’s supply in profit indicates a continual increase following a significant decline. As of the current writing, the supply in profit stands at approximately 79%, equivalent to around 79 billion XRPs.