Why XRP whales need to exercise caution as Bitcoin drops

- XRP’s price tumbled, whales sold as a major decision in the SEC lawsuit drew near.

- Most holders decided not to let go but XRP might slip below $0.59.

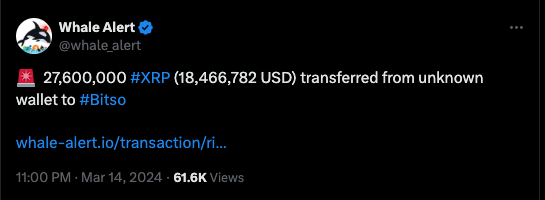

The actions of some Ripple [XRP] whales in the last 24 hours suggested a lack of confidence in the token. According to Whale Alert, one whale transferred 27.6 million XRP to digital exchange platform Bitso.

Around the same period, another whale sent 22.8 million tokens to the Bitstamp exchange.

The next verdict may determine what’s next

Wallet-to-exchange transactions are not uncommon in the crypto market. But most times, the intention is not to hold the tokens. Instead, participants involved sell which forces the price of the asset to drop.

For these whales, the decision to sell now could be connected to the lawsuit between the U.S. SEC and Ripple. While there has not been any major updates about the case, the 22nd of March comes to mind.

By that time, the SEC is expected to submit remedy-related briefs to Judge Analisa Torres. For the unfamiliar, a remedy-related brief is a file that seeks compensation for causing damages or losses.

On the said date, the SEC might outline penalties for Judge Torres to hammer on Ripple. From AMBCrypto’s investigation, it remains uncertain if the judge would succumb to the demand.

However, it is likely for the embattled blockchain-payment firm to argue against.

As the outcome surrounding the issue remains speculative, the recent sell-off indicated that whales do not want to be at the receiving end of a possible XRP plunge.

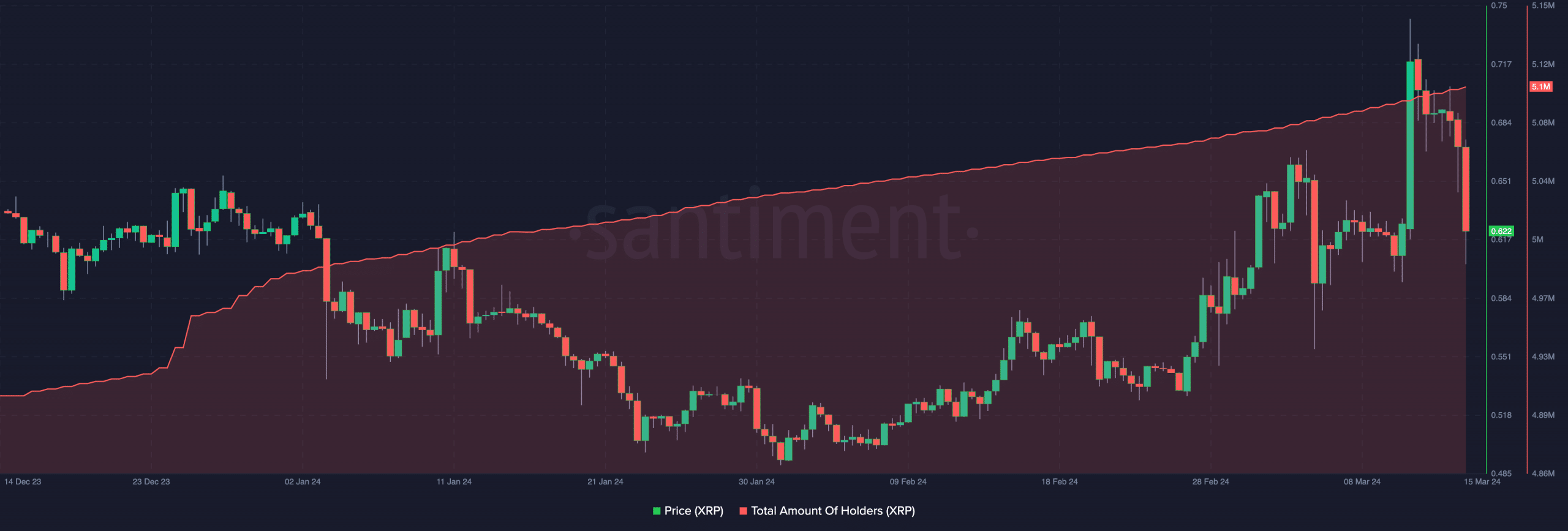

At press time, XRP’s price was $0.61— a 9.13% correction in the last 24 hours. Despite the drawdown, the total number of XRP holders remained above 5 million.

XRP might keep digging deep

This data implied that many holders of the token are convinced that XRP would perform well in the long term. If the number of holders increase, then XRP’s price might rebound.

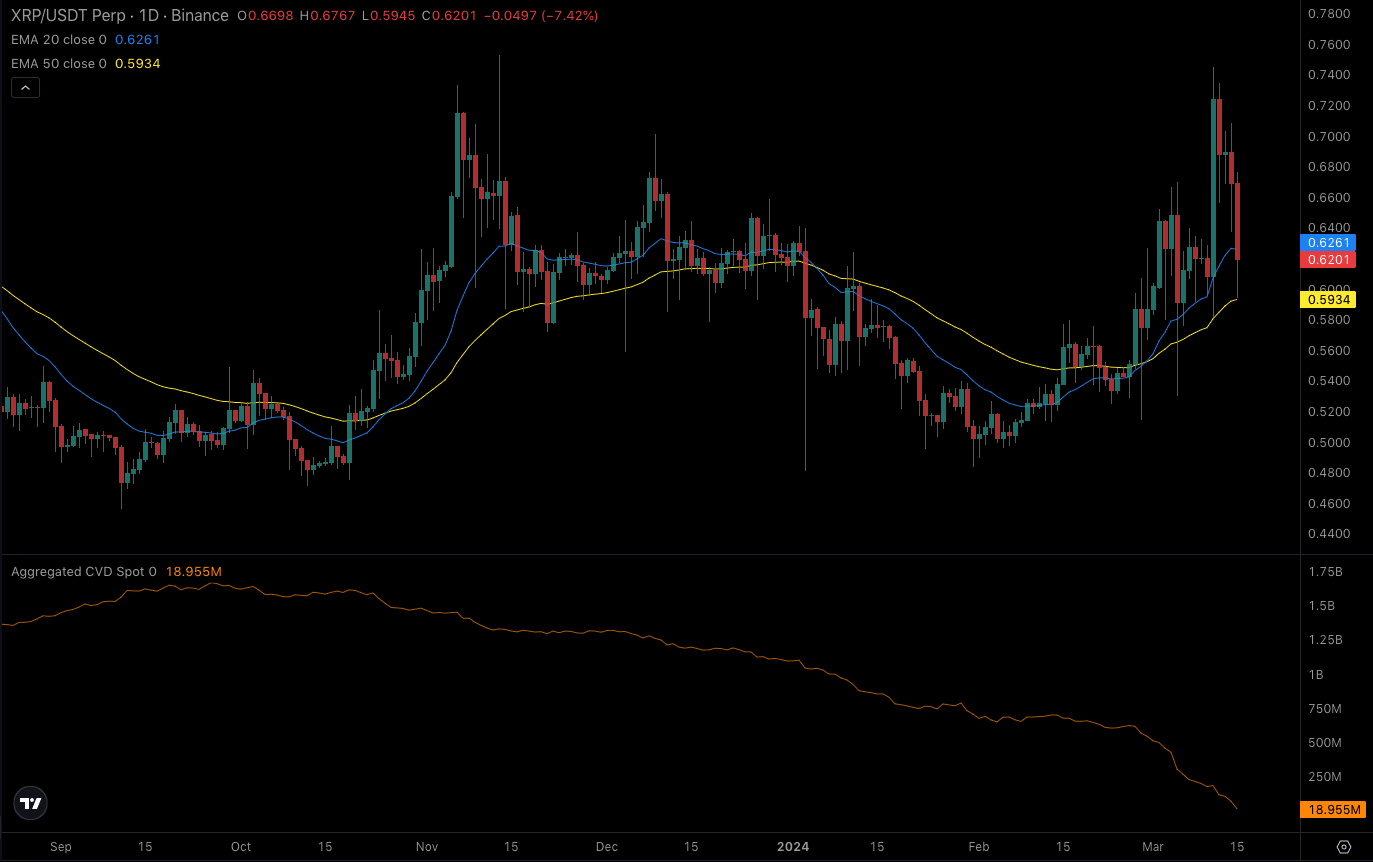

Should this be the case, the bullish price predictions AMBCrypto reported at some point might come to pass. However, the technical outlook on the XRP/USD daily chart suggested that the price might continue to decline.

One reason for this forecast was the Exponential Moving Average (EMA). At press time, the 20 EMA (blue) crossed over the 50 EMA (yellow) which was suppose to indicate a bullish trend.

But XRP had dropped below the 20 EMA, indicating that the bullish thesis had been invalidated. The chart below also showed how it was on the verge of dropping below the 50 EMA. If the price drops below the 50 EMA ($0.59), then it could plummet to $0.55.

Is your portfolio green? Check the Ripple Profit Calculator

Furthermore, the Cumulative Volume Delta (CVD) tumbed, suggesting that sellers are eager to meet the bid while buyers might be willing to accept the offer.

If this continues, the price of XRP might tank further. In a highly bearish scenario, a fall to $0.53 might be an option unless buyers begin to trade in their offers.