Analysis

XRP bounces from mid-range support, but advantage remains with bears

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- The higher timeframe structure was bearish, but on lower timeframes, it had flipped bullish.

- A move upward to the resistance at $0.395 is likely.

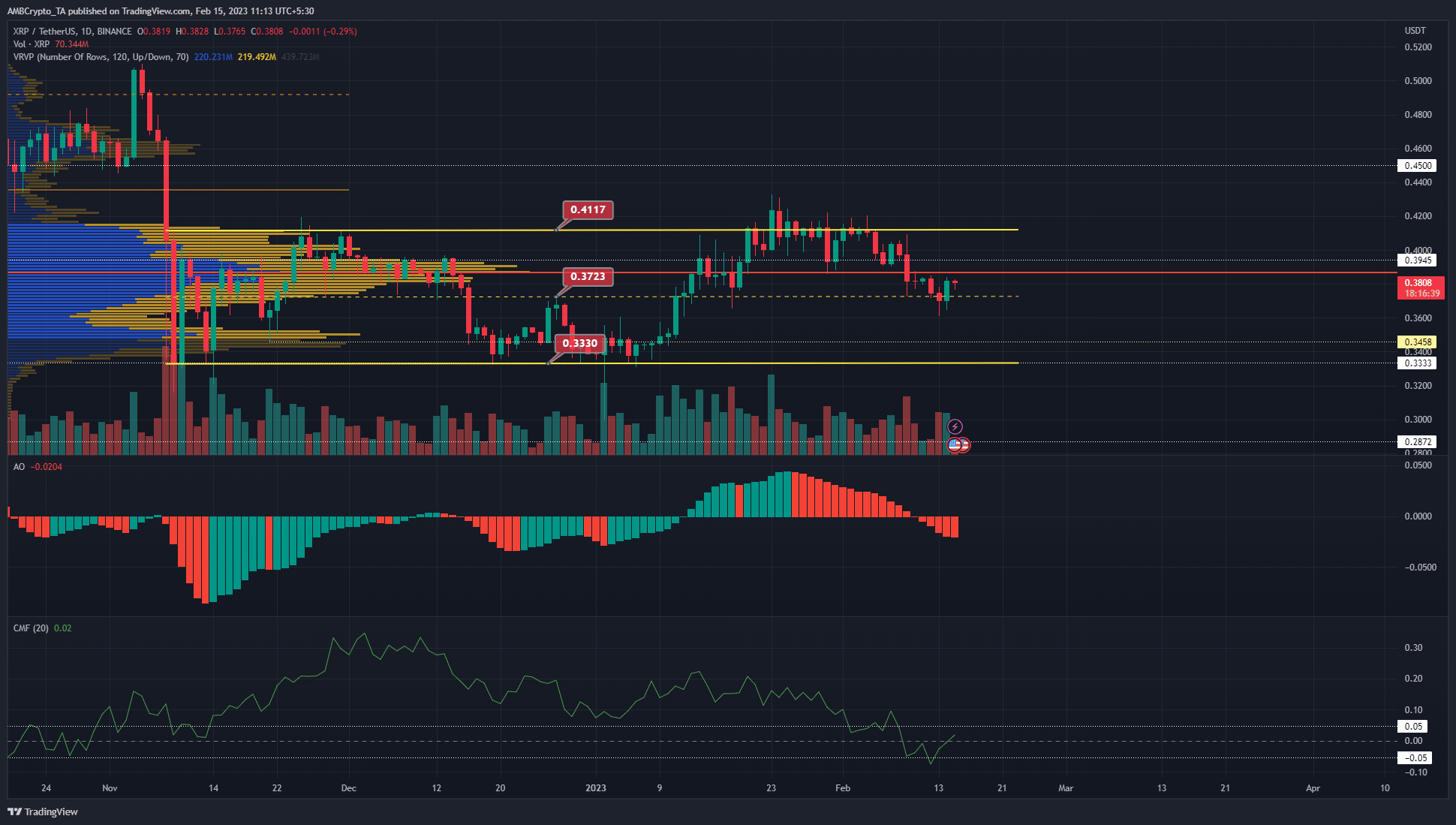

Ripple [XRP] traded within a range and the bulls forced a bounce from the mid-range mark at $0.37. While this bounce inspired lower timeframe bullish momentum, the evidence at hand showed that $0.395 could pose stiff resistance to the price.

How much are 1,10,100 XRPs worth today?

Hence, XRP buyers from the $0.37 area can use a test of the $0.38-$0.39 area to take profits. Thereafter, a breakout upward or a rejection will reveal the direction of the next move.

The Visible Range Volume Profile shows stiff resistance ahead for XRP

The VPVR tool showed the Point of Control (red) to lie at $0.387. Above this level lay a horizontal long-term significance level at $0.395. Hence, it was likely that the bounce from $0.37 would meet stern resistance in this zone. Yet, the defense of $0.37 is significant as well.

Since November, XRP has traded within a range (yellow) between $0.33 and $0.41. The mid-point of this range was $0.37. The selling pressure in February saw XRP unable to break out past the range highs and was forced to drop to the mid-range mark.

Although the Awesome Oscillator was beneath the zero line to denote bearish momentum held sway, buyers can be on the lookout. Lower timeframes such as the one-hour show the market structure was flipped to bullish, and the $0.372-$0.376 region will be defended by buyers.

However, the structure and momentum on the daily timeframe were bearish, so any buys from $0.37 could be sold around the $0.39 area. The CMF was in neutral territory and did not show strong capital inflow yet.

Is your portfolio green? Check the XRP Profit Calculator

Stalled Open Interest suggested sentiment remained bearish

Source: Coinalyze

The four-hour chart showed rising OI from 10 – 12 February. During this time, the price stayed flat at the $0.383 mark. The drop to $0.364 that began on 13 February caught many long positions offside. The liquidation data showed nearly $2.3 million worth of long positions liquidated on 13 February.

After this, XRP’s bounce from $0.37 did not see a rise in the Open Interest. This meant that sentiment was bearish and market participants did not trust the rally of the past couple of days. The spot CVD was also in a sharp downturn to show selling pressure.