Ripple [XRP]: Bulls defend $0.412; can they bypass the $0.45 hurdle

![Ripple [XRP]: Bulls defend $0.412; can they bypass the $0.45 hurdle](https://ambcrypto.com/wp-content/uploads/2023/03/Bulls-e1679729143488.png)

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- XRP bulls defended the 50 EMA.

- The four-hour chart was bullish, but trends on CEXs could complicate bulls’ efforts.

On March 21, Ripple [XRP] appreciated 30% amidst renewed optimism that Ripple Labs could win against the SEC lawsuit. It jumped from $0.3733 to $0.493 but retraced after Bitcoin [BTC] temporarily lost hold of the $28k zone.

Read Ripple’s [XRP] Price Prediction 2023-24

At press time, BTC’s value was $27.50k, and it could block XRP from clearing the key obstacle at $0.4491. As such, XRP’s price action in the next week will be largely determined by new developments on the SEC lawsuit and BTC’s price movements.

Bulls defended the 20 EMA – can they sustain the recovery?

The $0.4118 support level checked XRP’s retracement. But the recovery was blocked at $0.4491, setting it to a correction. However, bulls have defended the 20 EMA (exponential moving average) of $0.4134, prompting another short-term rally. Therefore, bulls must clear the $0.4491 obstacle to continue with the recovery.

A close above $0.4491 could tip bulls to push XRP to the bearish order block of $0.4746. A retest of the $0.5 level could be likely if bulls could clear the bearish order block.

Alternatively, near-term bears could gain market entry if XPR closes below $0.4491. They will likely sink XRP to retest the 20 EMA or the $0.4118 support. Any drop below $0.4118 could attract increased selling pressure, pushing XRP to 200 EMA or $0.3982.

The Relative Strength Index (RSI) bounced sharply from the 50-mark, showing increased buying pressure. Similarly, the Accumulation/Distribution indicator exhibited an uptick, showing the asset was undergoing a short-term accumulation phase. Collectively, these trends show’ bulls’ leverage in the market at press time.

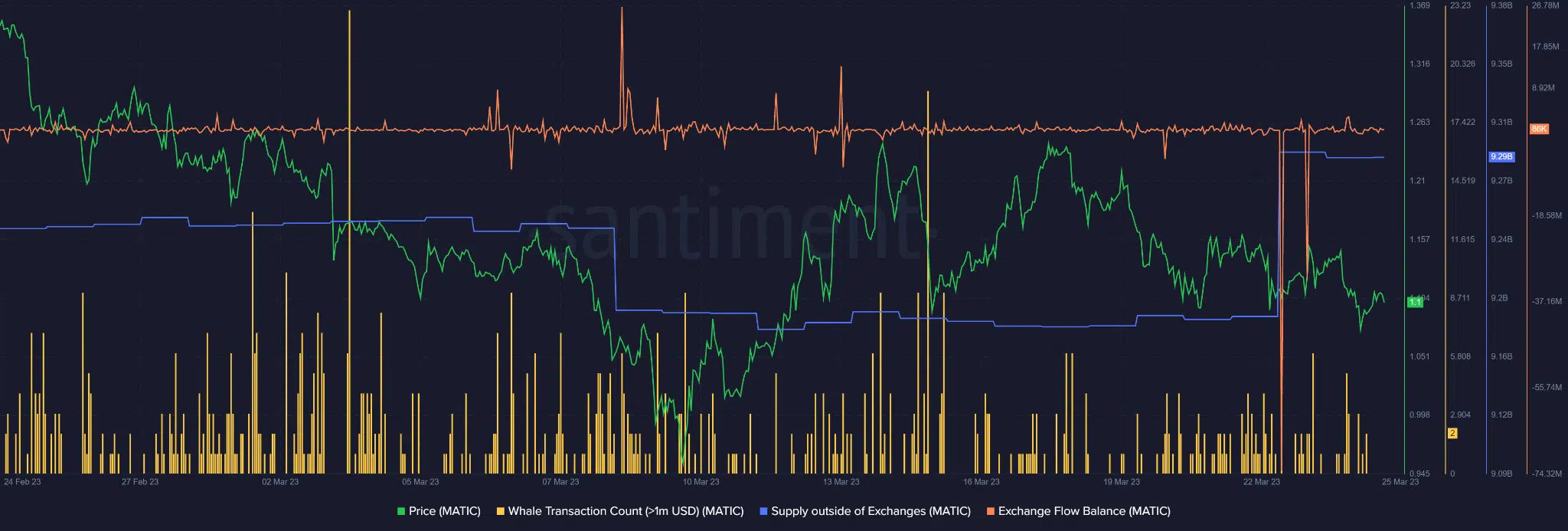

Exchange Flow Balance was positive

According to Santiment, XRP’s exchange flow balance was positive (84k). This was evidence that more XRPs moved in than out of CEXs. It indicated a short-term sell pressure as more XRP could be available for offloading on CEXs.

Is your portfolio green? Check out the XRP Profit Calculator

A drop in supply outside of exchanges further confirms limited accumulation at press time that could tip short-sellers to offload their holdings. As such, bulls could wait for a close above $0.4491 before making moves.

Nevertheless, considerable whale movements have transacted over $1 million in the past few hours, which could give bulls some hope. However, investors should also track BTC’s price action before making moves.