Ripple’s latest move may do little for XRP’s price action because…

- Ripple is working on its future and it involves more integration into business and retail.

- XRP gives up gains and returns to levels previously seen before its July rally.

Do you ever wonder what’s in store for the XRP token especially once Ripple finally overcomes its legal troubles? Well, Ripple is wasting no time in letting its next potential moves known.

Is your portfolio green? Check out the XRP Profit Calculator

Based on recent announcements, Ripple might expand its presence into everyday life by improving on traditional settlements. The company is reportedly planning to eliminate inefficiencies and friction that exist for e-commerce companies. The XRP token could become a critical component in this process.

.@Ripple wants to turn every eCommerce company into a crypto company. Click here to get all the inside details from our conversation Brad Chase: https://t.co/fEE93inCpH #Ripple #XRP pic.twitter.com/aLjgXZhKuZ

— PYMNTS (@pymnts) September 12, 2023

This announcement came only a day after Ripple revealed that SMEs will be part of its business strategy. Particularly when it comes to cross-border payments. In other words, Ripple is attempting to bring efficiencies that banks have failed to achieve.

XRP reverts to pre-SEC-Ripple win levels

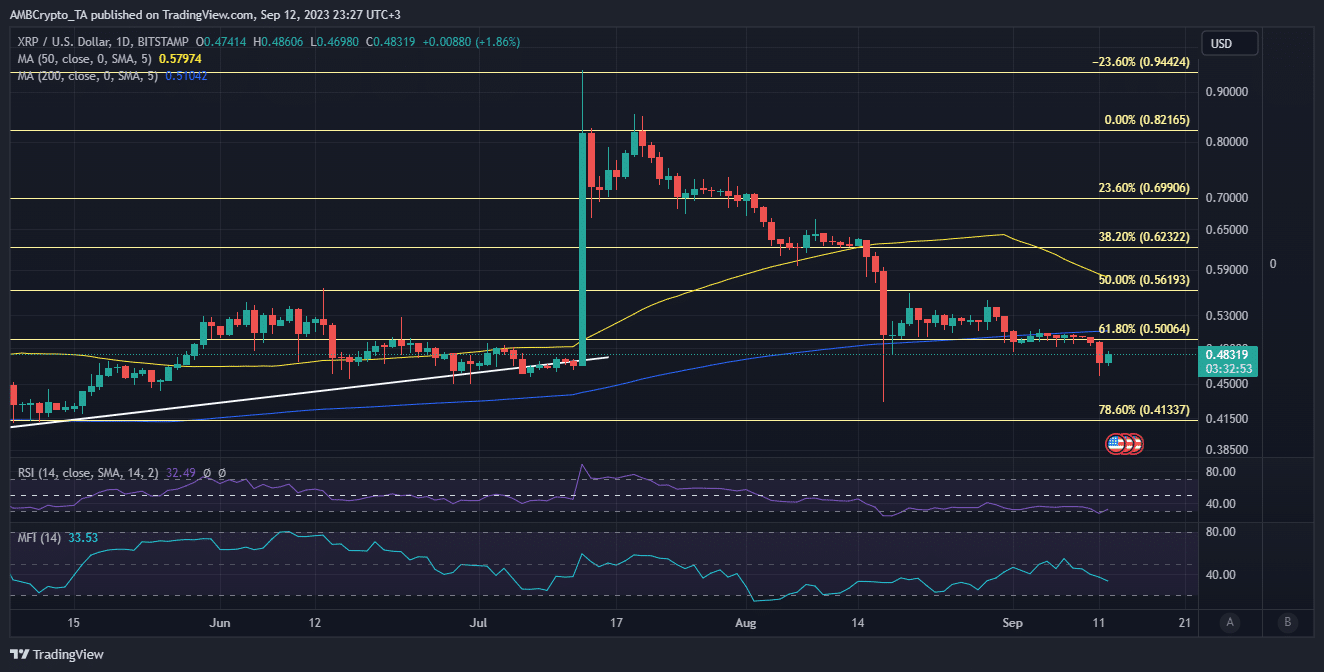

Although the above announcements underscore a bright future for Ripple, XRP’s performance remains wanting. In fact, it fell to a noteworthy price point during Monday’s (11 September) trading session. XRP fell as low as $0.45, a price level previously seen before Ripple’s victory against the SEC was announced. It exchanged hands at $0.48 at the time of writing.

On a positive note, those who thought that they missed the boat during the previous rally now have a chance to get in at pre-rally levels. Nevertheless, prices could still drop further. Short-term prospects remain uncertain judging by some of XRP’s metrics.

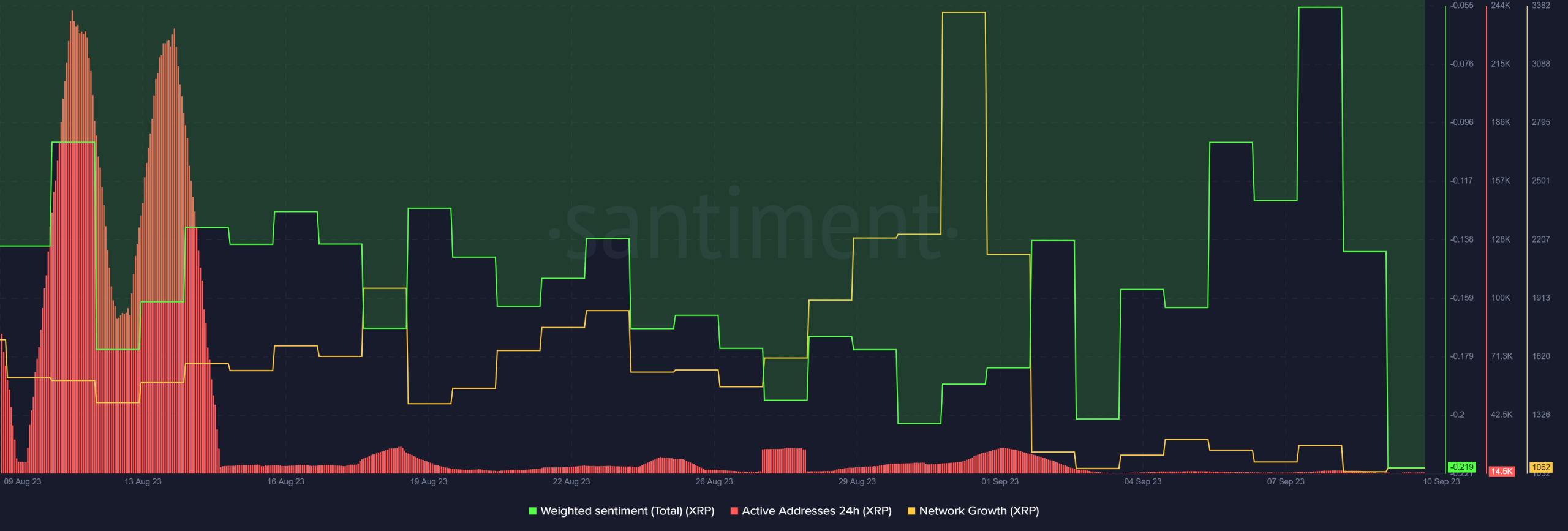

XRP’s investor sentiment, at the time of writing, was at its lowest point in the last four weeks. Not only a reflection of the bearish price action, but it also suggested that investors were still sitting on the sidelines. This was most likely because of the SEC’s decision to appeal.

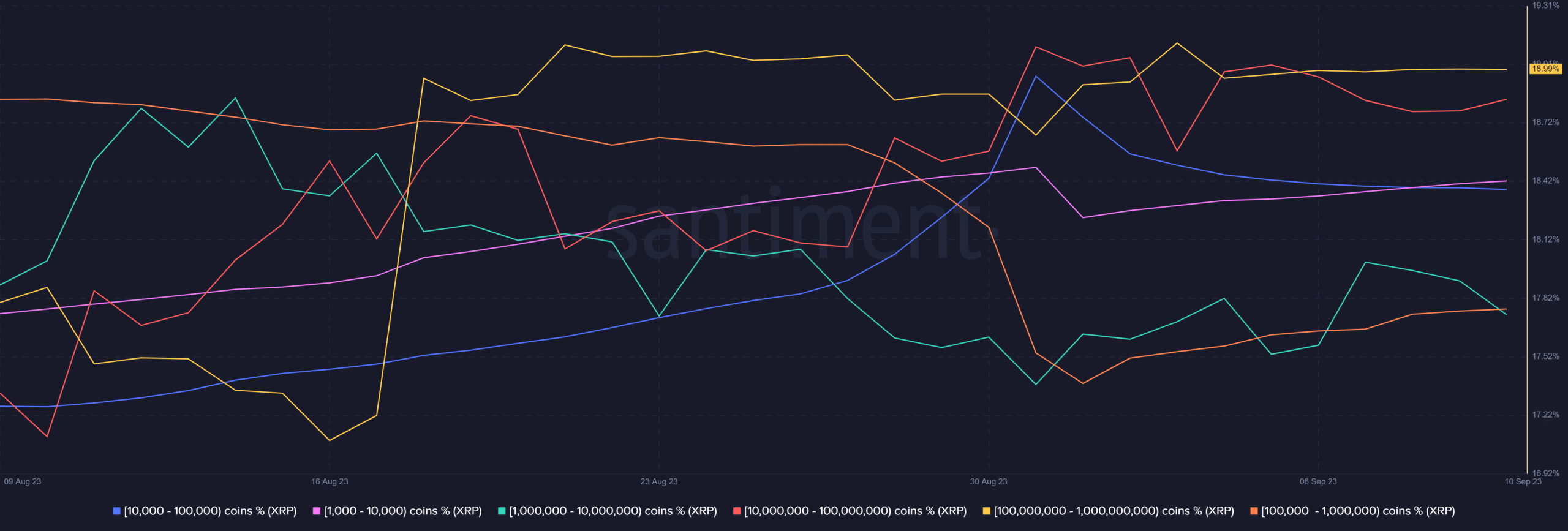

Unsurprisingly, on-chain volume remained within a low range for the month and the same applies to network growth. We sought to establish whether accumulation is gaining traction at the low range. XRP’s supply distribution metric revealed mixed reactions.

Realistic or not, here’s XRP market cap in BTC’s terms

Most whale categories that previously registered outflows over the last few days leveled out and some were even seen re-accumulating. This includes addresses holding from 10 million to 100 million XRP (red). Addresses holding between 10,000 and 100,000 XRP (blue) have been easing off the selling pressure.

Now that some of the whales previously contributing to sell pressure are shifting gears, XRP might find support at the same level as it did in July. On the other hand, there was still a considerable amount of selling pressure coming from addresses in the 1 million to 10 million XRP (green) category. XPR could still lose its current support if sell pressure intensifies.