Ripple’s Q2 2024 report – Good news or bad news for XRP’s price?

- Ripple Labs released its Q2 report for 2024 on 2 August

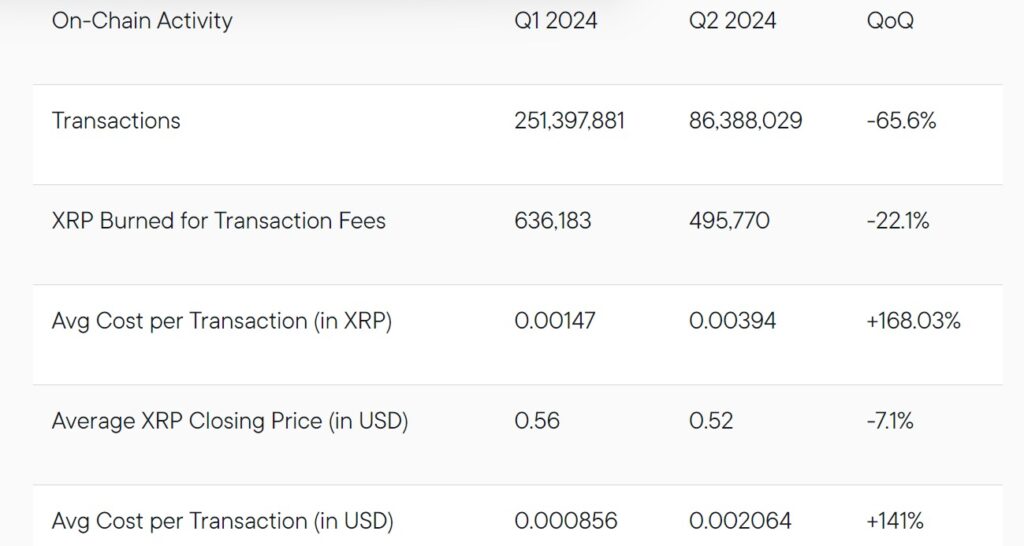

- Report highlighted a 65% decline in on-chain transactions, 168% hike in transaction costs

Blockchain firm Ripple Labs has released its latest quarterly report for Q2 2024, with the same expanding on detailed market trends, revenue, regulatory wins, and critical industrial progress.

The timing here is especially important since the report comes on the back of immense regulatory pressure on crypto firms. In fact, there’s a lot of tension between the likes of Ripple and the SEC too.

What did the report say?

According to Ripple Labs, XRPL’s on-chain activity was significantly affected over the previous quarter. The firm noted a 65% decline in transactions in Q2, compared to Q1.

During Q1 2024, XRPL had a figure of 251,397,881. However, it soon declined to 86,388,029 in Q2.

Underlining the same in its the official report, Ripple Labs claimed,

“Activity across most major protocols decreased in Q2. XRPL was no exception, with on-chain activities noticeably lower in Q2 as compared to Q1.”

The firm went on to say that this decline in transactions arose from higher average transactional costs. The report indicated that transaction costs increased from 0.00147 to 0.00394 – A 168% surge.

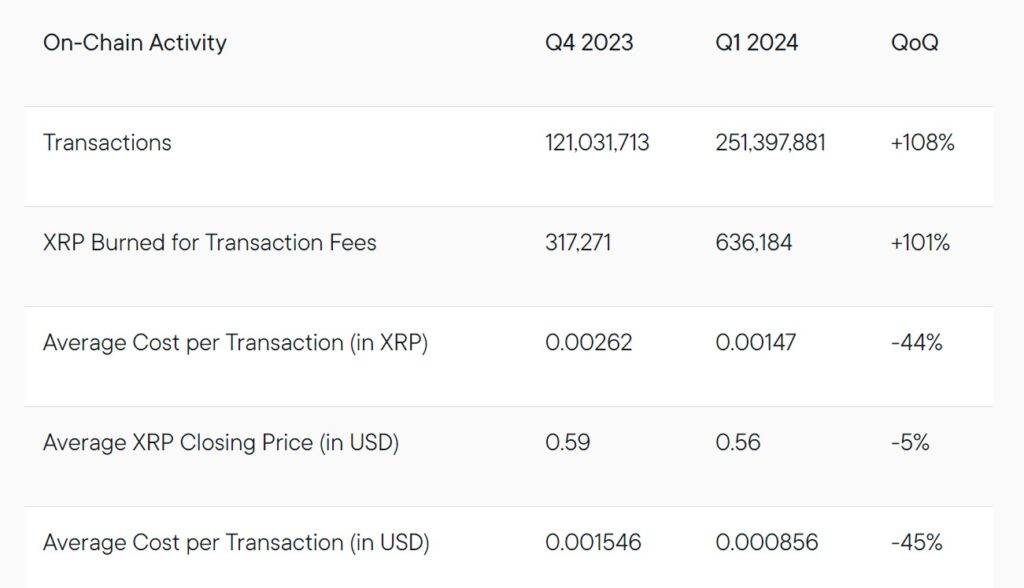

This trend defied Q1 2024 and Q4 2023 market trends. Especially since during the previous quarter, XRPL reported a 108% hike in on-chain transactions.

Tokenized US T bills on XRPL

Despite the decline in on-chain transactions, XRPL has been working to develop its ecosystem and integrate real-world assets into its operations. On 1 August, for example, the firm announced its plans to launch tokenized U.S treasury bills. This will help Ripple initiate the connection between traditional finance and DeFi.

It will also establish a fund to allocate $10M to the treasury bills. Owing to the same, tokenized T-bills for XRPL will be next in the institution’s list of plans. This will allow users to mint using Ripple USD when it launches this year.

Regulatory concerns and developments

Notwithstanding the ongoing bearishness of the crypto-market, Ripple and XRP are still at the end of a legal tussle with the United States’ SEC. In fact, such is the scale of this issue that the firm is spending $50M to push policy changes, according to the Q2 2024 report.

This investment will see the firm support only pro-crypto candidates for the upcoming general elections. Equally, it’s worth pointing out that Ripple Labs has expressed concerns over the lack of regulatory clarity in the U.S, arguing that other countries are taking advantage of it.

Impact on price charts

At the time of writing, XRP was trading at $0.5754 after a hike of 1.22% in 24 hours. These gains on the daily charts arose after the report was shared since on the weekly timeframe, the altcoin was still down by over 4%.

Will the altcoin build on this brief hike though?

Well, after Q1 2024’s report was released, XRP’s price appreciated for 48 hours. However, it then declined for nearly 2 months t0 hit $0.43 on 19 June.

Hence, nothing can be said with much certainty.

Despite the aforementioned gains though, there has been a sustained downtrend on the altcoin’s charts. For instance – AMBCrypto’s analysis revealed that the Directional Movement Index indicated a downtrend. The negative index at 32.96 sat above the positive index at 23.35 – Sign of a strong bear market.

This was further confirmed by the Aroon lines as the Aroon Down was at 100% and sat above the Aroon Up line at 78.57%.

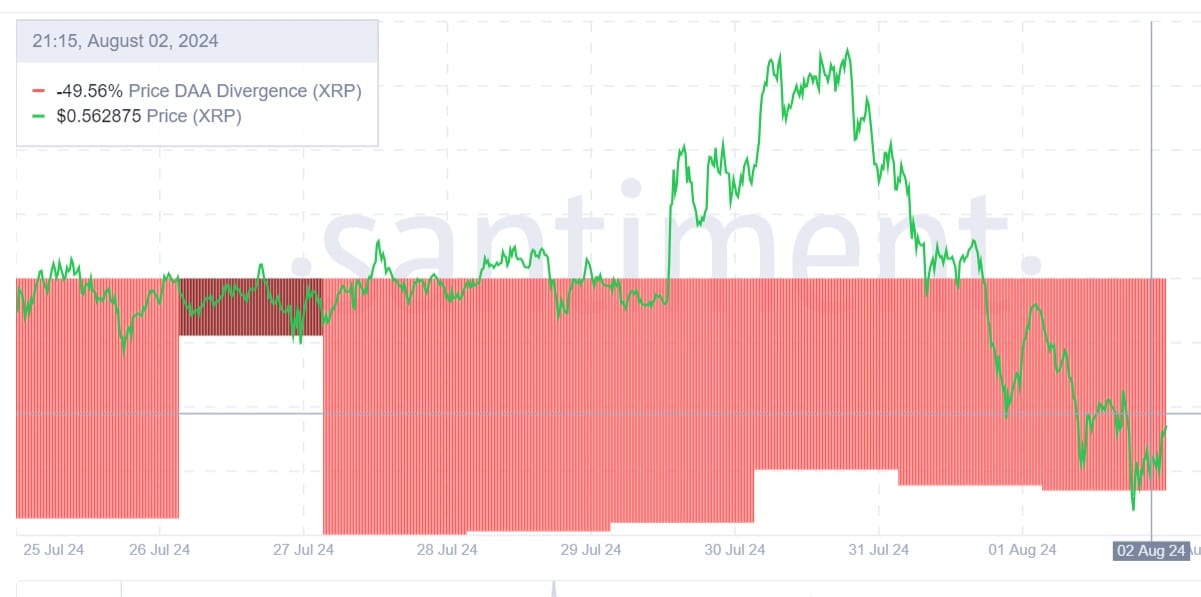

AMBCrypto’s analysis of Santiment revealed that the Price DAA divergence was negative at -49.56%. This suggested that the price gains on daily charts were driven by speculation, without user demand.

Thus, the price might decline because it’s not supported by growth in on-chain activity.

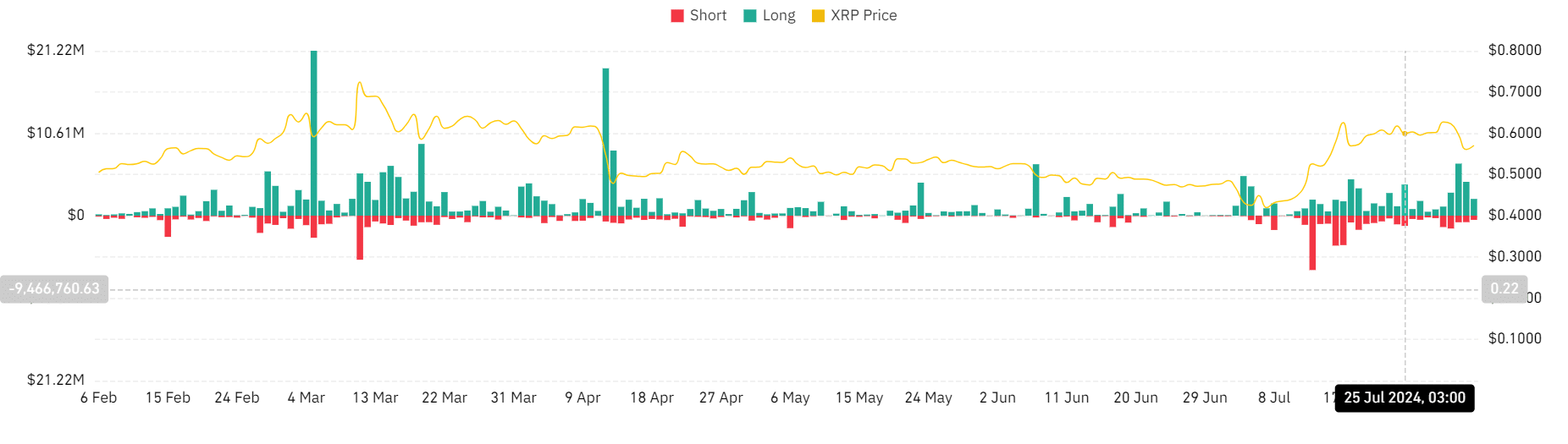

Finally, Coinglass data pointed to greater liquidations for long positions. A hike in long position liquidations is a sign that investors have been overly optimistic about price increases, pushing them out of their positions.

Therefore, although XRP has gained on the daily charts following Q2 report’s release, the overall market sentiment will remain bearish in the near term.