Ripple’s subtle rebound: Mapping XRP’s potential trajectory

![Ripple [XRP]’s subtle rebound – Will strong derivatives bets trump weak on-chain signals?](https://ambcrypto.com/wp-content/uploads/2025/04/E3CB2045-31A3-4BD4-B5BC-2142FF334BE1-1200x675.webp)

- Ripple has seen a decline in key metrics, including the number of transactions completed on its platform.

- In the derivatives market, interest in XRP remained high, with the potential for more buying activity.

Ripple [XRP] has maintained a relatively low decline following the recent market turbulence, with several assets recording major losses.

In the past 24 hours, sentiment has turned bullish, with XRP recording a 2.35% gain—its first positive rally compared to its past week and month of decline.

However, the market remains uncertain about the asset’s next move, as key metrics indicate mixed signals. Still, derivatives traders are betting on a rally.

AMBCrypto analyzed how this could play out.

Key metrics show a sharp drop

On-chain insights suggest fading interest among market participants over the past few days, as notable metrics tracking activity and engagement have declined.

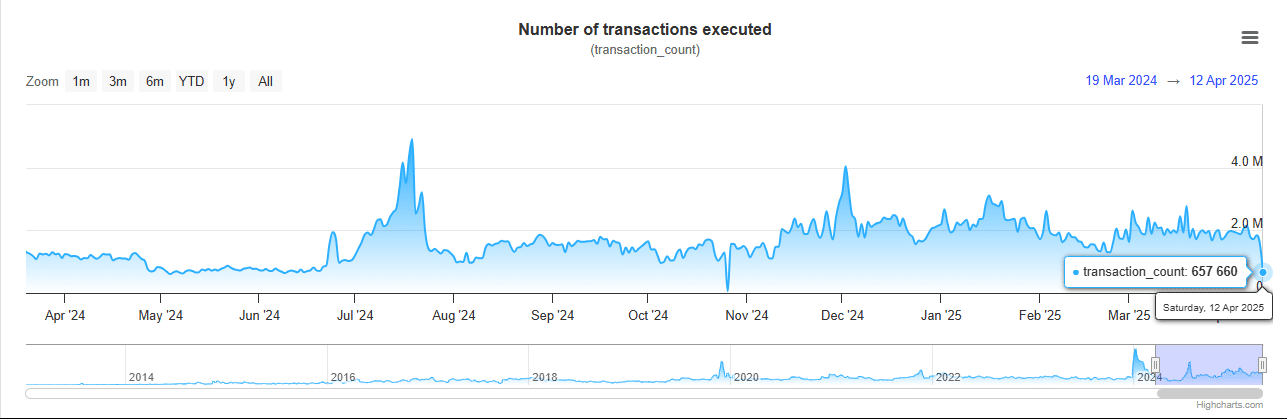

In the past 24 hours alone, the number of transactions executed has dropped significantly—from approximately 1.4 million to 657,000 completed transactions.

This decline indicates reduced network activity and suggests waning interest.

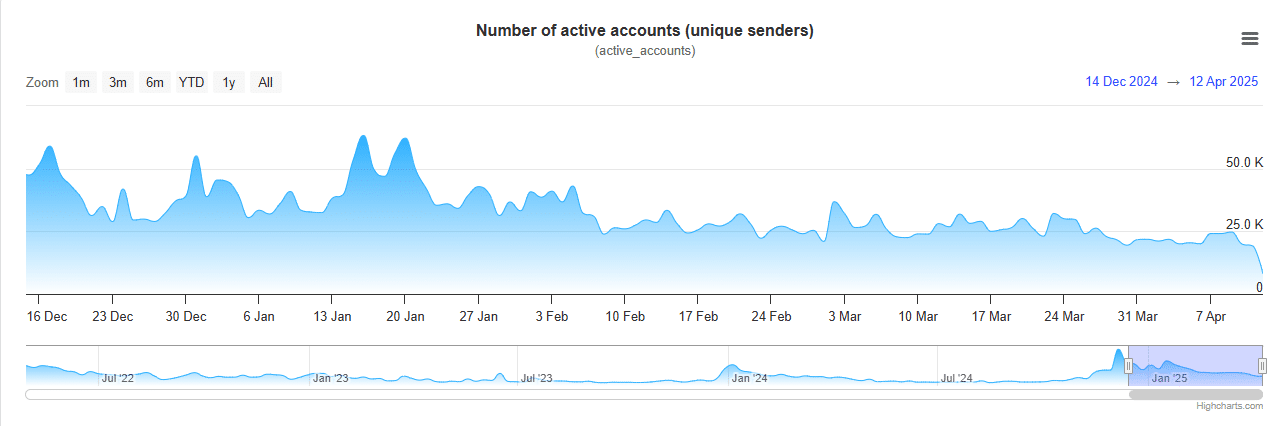

The drop in transactions can be traced to a sharp fall in the number of unique accounts interacting with XRP, which declined by more than half—from 19,018 to 8,039.

Lower market activity could impact XRP’s trajectory, limiting its potential for a near-term rally.

Bullish narrative builds in the derivatives market

Traders in the derivatives market are presenting a contrasting narrative, with long (buy) contracts taking the lead.

Open Interest (OI) has been steadily increasing in both futures and options markets. In the futures market, OI has risen by 2.15%, reaching $3.18 billion, while the options market has seen a remarkable growth of 108.93%, climbing to $242,000.

Moreover, the Funding Rate of 0.0091% over the past 24 hours indicates that long traders hold a substantial portion of these futures and options contracts.

The Open Interest Weighted Funding Rate, which offers a clearer picture of the market’s sentiment, remains positive and is rising quickly. At the time of writing, it stood at 0.0078, indicating a bullish bias.

If sentiment remains strong, it could drive XRP’s price higher.

Where is XRP heading?

A major obstacle lies ahead for XRP at the resistance level of $2.1004.

If bullish momentum is not strong enough to push the asset beyond this level, a price drop may follow.

Potential support levels for a pullback include $1.923, $1.850, or $1.759, where the asset may stabilize before attempting a rebound.

On the upside, a decisive break above the $2.233 resistance level could send Ripple even higher on the chart.