Roaring Kitty in trouble? GME frenzy slows as regulators step in

- GME surged 1,500% post-Roaring Kitty’s post, showing high volatility.

- Massachusetts regulator to probe Roaring Kitty’s GameStop trades.

After seeing a surge of over 300% in the value of GameStop [GME] memecoin on 3rd June, GME dropped by 25.27% in the past 24 hours.

While the surge was attributed to posts by Keith Gill, aka Roaring Kitty, the subsequent drop followed news that financial services firm E*Trade is considering banning him, according to The Wall Street Journal.

Reportedly, Massachusetts Secretary of State, Bill Galvin, the state’s top securities regulator, also plans to look into Gill’s trading activities.

The community is not happy!

However, not everyone was happy with Gill’s ban, as highlighted by an X user Quiver Quantitative, who noted,

“We have caught dozens of suspicious stock trades by politicians, and none of them have been investigated.”

Joining similar line of thoughts, another user Dave Portnoy expressed his aggression and said,

“E*Trade doesn’t want you to make money. E*Trade is the worst.”

The impact

Despite GME’s current downturn, it experienced a remarkable rise of over 1,500% following Roaring Kitty’s post in May.

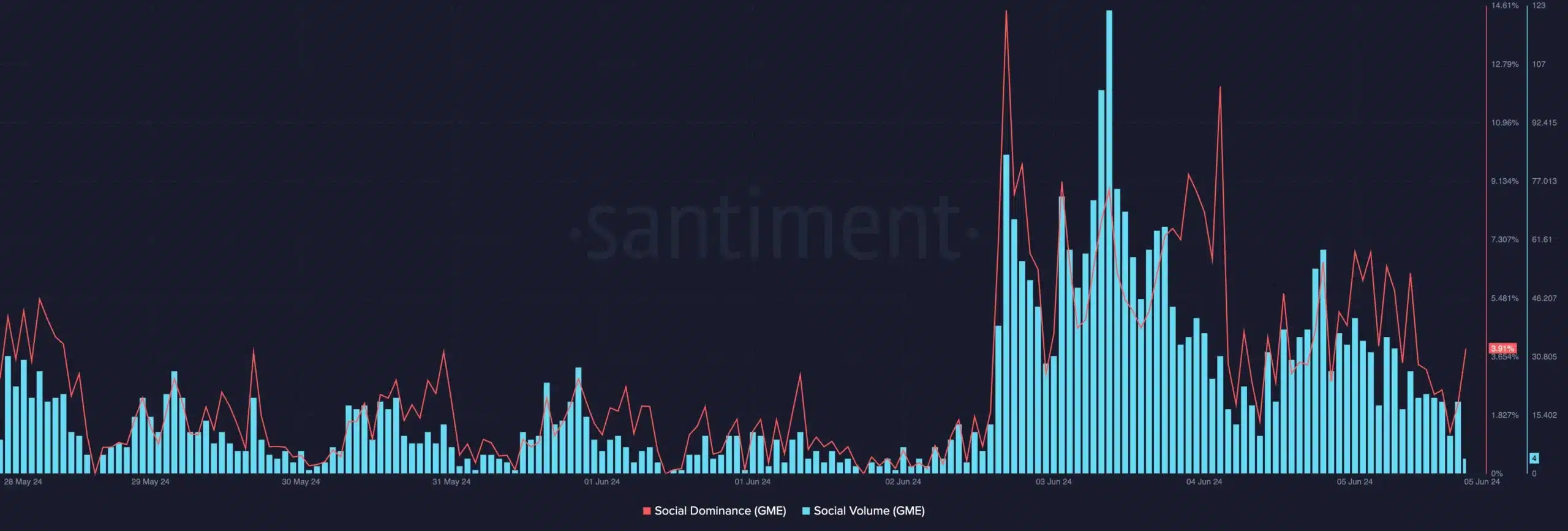

However, AMBCrypto’s analysis of recent data indicates a decline in both social volume and social dominance.

Interestingly, the drop in GME’s price did not impact the overall memecoin market, which saw a 4.3% increase in the last 24 hours, bringing the market cap to $68.7 billion as per CoinGecko.

Major memecoins like Dogecoin [DOGE], Shiba Inu [SHIB], Pepe [PEPE], and Floki [FLOKI] displayed green candlesticks on their daily charts, with several coins experiencing gains of over 20% in the past 24 hours.