Rocket Pool’s debut on zkSync means this for its users

- The deployment would bring about a decline in liquid staking fees and congestion on the Ethereum network.

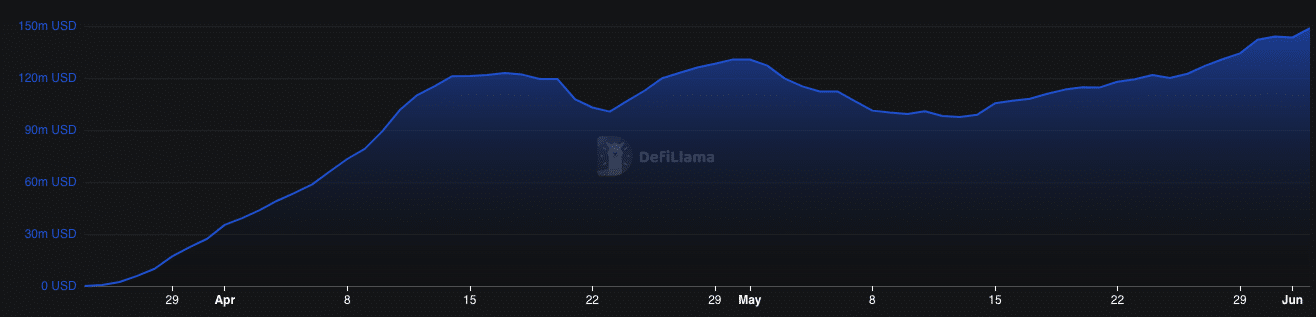

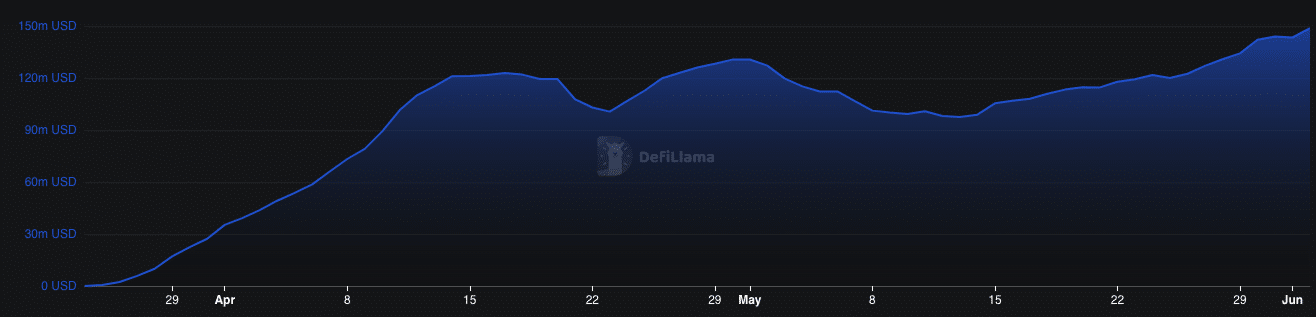

- Both RPL and zkSync Era’s TVL increased despite reduced market participation with the latter.

Rocket Pool [RPL], a decentralized Ethereum [ETH] staking platform, has announced its deployment on zkSync Era, the L2 scaling solution. According to the announcement, the collaboration would allow Rocket Pool users to stake their ETH on the L2 platform.

Liquid staking allows users to stake their ETH and receive a representation of their staked assets in the form of a token.

This token, often referred to as a “liquid staked asset” or staked Ether [stETH] can be freely traded or utilized within the Ethereum ecosystem. Moreso, it helps in providing liquidity and unlocking additional earning opportunities for stakers.

By integrating with zkSync, Rocket Pool noted that it would aim to leverage the scalability and low transaction costs offered by the L2 solution.

For context, zkSync utilizes Zero-Knowledge (ZK) proofs to enable fast and secure transactions. This significantly reduces fees and congestion on the Ethereum network. zkSync’s statement read,

“As Ethereum’s most decentralized liquid staking protocol, we’re also researching how zero-knowledge proofs can be used in other parts of the protocol to provide decentralized security”

Following the disclosure, Rocket Pool’s Total Value Locked (TVL) rose by 2.83%. This brings the total hike in the last 30 days to 16.29%.

Hikes and drawbacks

The TVL describes the number of smart contracts deposited into a protocol. Therefore, this hike implied that market participants have been contributing to the protocol’s health.

Despite rising as high as $1.81 billion, Rocket Pool’s TVL has not yet matched that of Lido Finance [LDO]. In fact, Lido was far ahead with $13.4 billion.

The partnership between Rocket Pool and zkSync reflects the growing interest and demand for innovative solutions that bridge the gap between Ethereum 2.0 staking and DeFi applications.

Consequently, zkSync Era’s TVL also rose to $1348.75 million. An in-depth evaluation of the data showed that many of the leveraged farming, cross-chain, and lending platforms under the chain added to the increase.

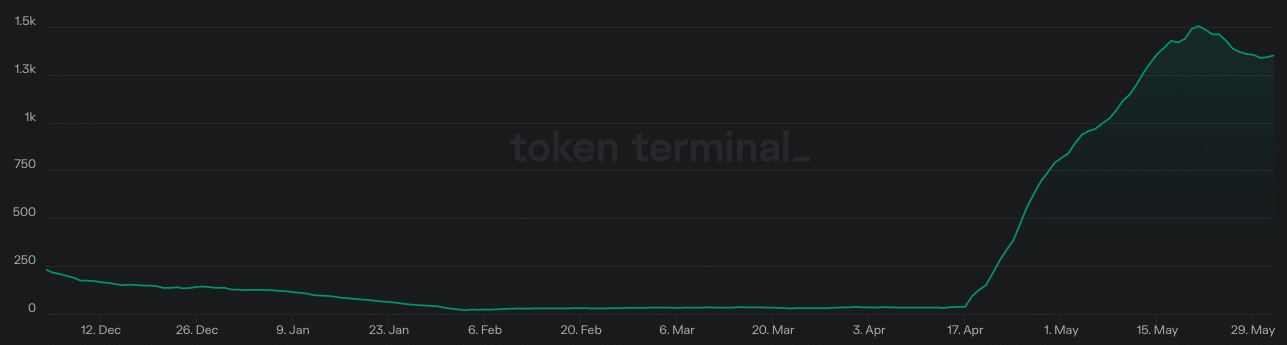

However, Rocket Pool’s monthly active users have decreased from the yearly high recorded on 21 May. At the time of writing, the metric was around 1,400.

Realistic or not, here’s RPL’s network in ETH terms

Monthly active users represent the collation of all addresses that either sent or received a token via a particular network. Thus, it can be understood that transactions with RPL and other tokens on the Rocket Pool network have decreased.