RUNE: Can no-liquidation loans fuel recovery after April’s beat up

Thorchain’s native cryptocurrency RUNE is off to a healthy start this month given that it is already up by roughly 10% in the first two days of May. A refreshing change from RUNE’s heavily bearish performance in April.

RUNE’s price action has been quite volatile in the last few months. For example, it delivered a solid bull run which started towards the end of February from as low as $3.01 to a $13.2 high at the end of March.

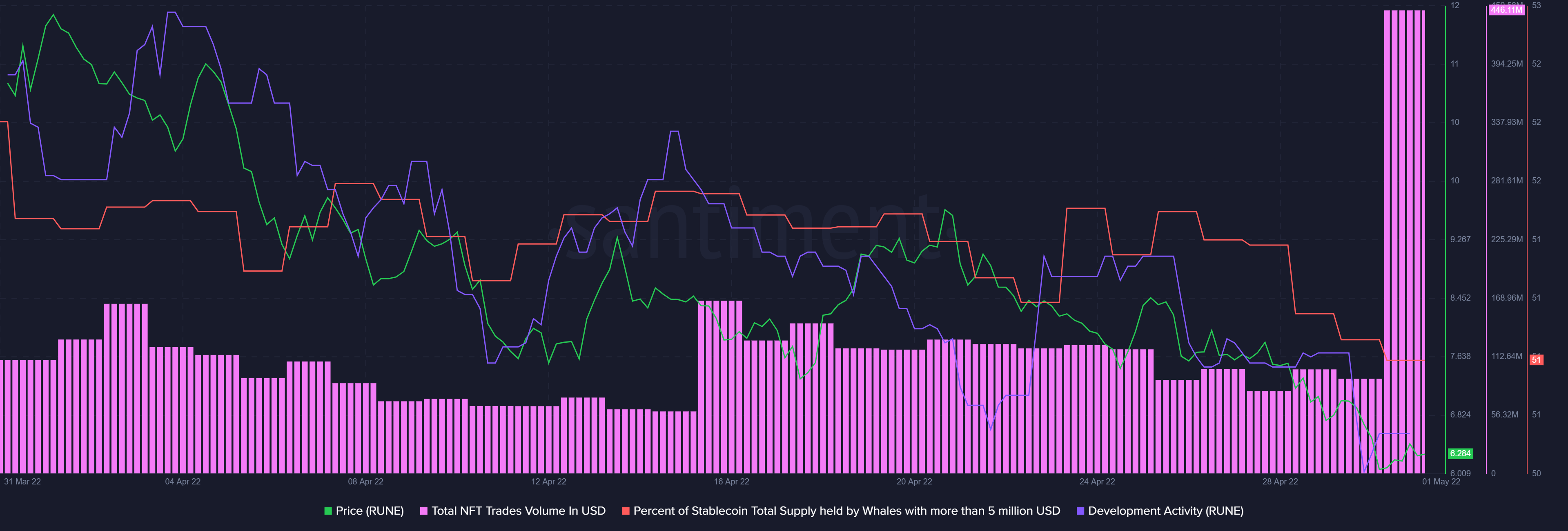

It lost a significant chunk of those gains when the market turned bearish in April, during which RUNE’s price dropped by 52%.

RUNE’s overextended pullback has not only pushed it below its 50-day moving average but also its 200-day MA. Its attempted rally seems to have been shot down after approaching the $6.90 price level which aligns with the 38.20% Fibonacci retracement line.

Key price levels to watch out for

If RUNE maintains its bullish momentum and manages to push through the 38.2% Fibonacci level, then it will likely face resistance near the 50% line. The latter aligns with the $8.09 price level which has previously been tested as a support and resistance zone.

RUNE still has a considerable probability of more downside below its April low. This is because the price has already broken through the current Fibonacci level and it is still not oversold.

It hovered just above the RSI’s oversold zone despite the deep selloff, especially towards the end of April. If the price continues pushing downwards and finally attains oversold status, then it will likely counter-support near the 23.60% retracement line. The latter means the price would be within the $5.42 price range.

The possibility of more downside is further supported by the continued drop in the supply held by whales. The latter is currently at its lowest level in the last four weeks. Interestingly, NFT trade volume has increased at RUNE’s lower price range.

Thorchain’s developer activity metric has been tapering out along with the price. This might be a sign that developers have been winding up on a major development.

Although nothing has officially been confirmed, Thorchain revealed through a tweet on 1 May, that it is working on no-liquidation loans. Such a development may contribute to more utility on its network.

THORFi made no-liquidation loans a design goal for this reason.

Simpler and makes more sense.

Onwards https://t.co/2IoqXLZogX

— THORChain #THORFI (@THORChain) May 1, 2022