RUNE faces volatility after whale’s panic sell-off: What about recovery?

- RUNE saw a sharp 15% drop, likely triggered by panic sell-off by a major whale.

- Price action has started recovery and increased volume could spark a real bounce.

RUNE, the native token of THORChain, experienced a sharp 15% drop in the past 24 hours as of press time, likely triggered by panic following a major whale’s sell-off on Kraken.

As of press time, the whale had withdrawn 2.85 million RUNE, valued at approximately $12.35 Million, and sold a portion of it through ThorSwap for Bitcoin [BTC].

The whale has since converted 9.69 BTC, which was moved entirely to Kraken, while the remaining 2.7 million RUNE tokens were sent over to Binance.

Impact of whale sell-off on RUNE’s price

The whale sell-off had an immediate effect, pushing the price of RUNE downward. However, it did not seem to pose a significant long-term threat to the token’s future value.

THORChain, being a Layer-1 Blockchain DEX with extensive usability, has continued to support cross-chain swaps, especially for major Layer-1 blockchains, sustaining its strong adoption potential.

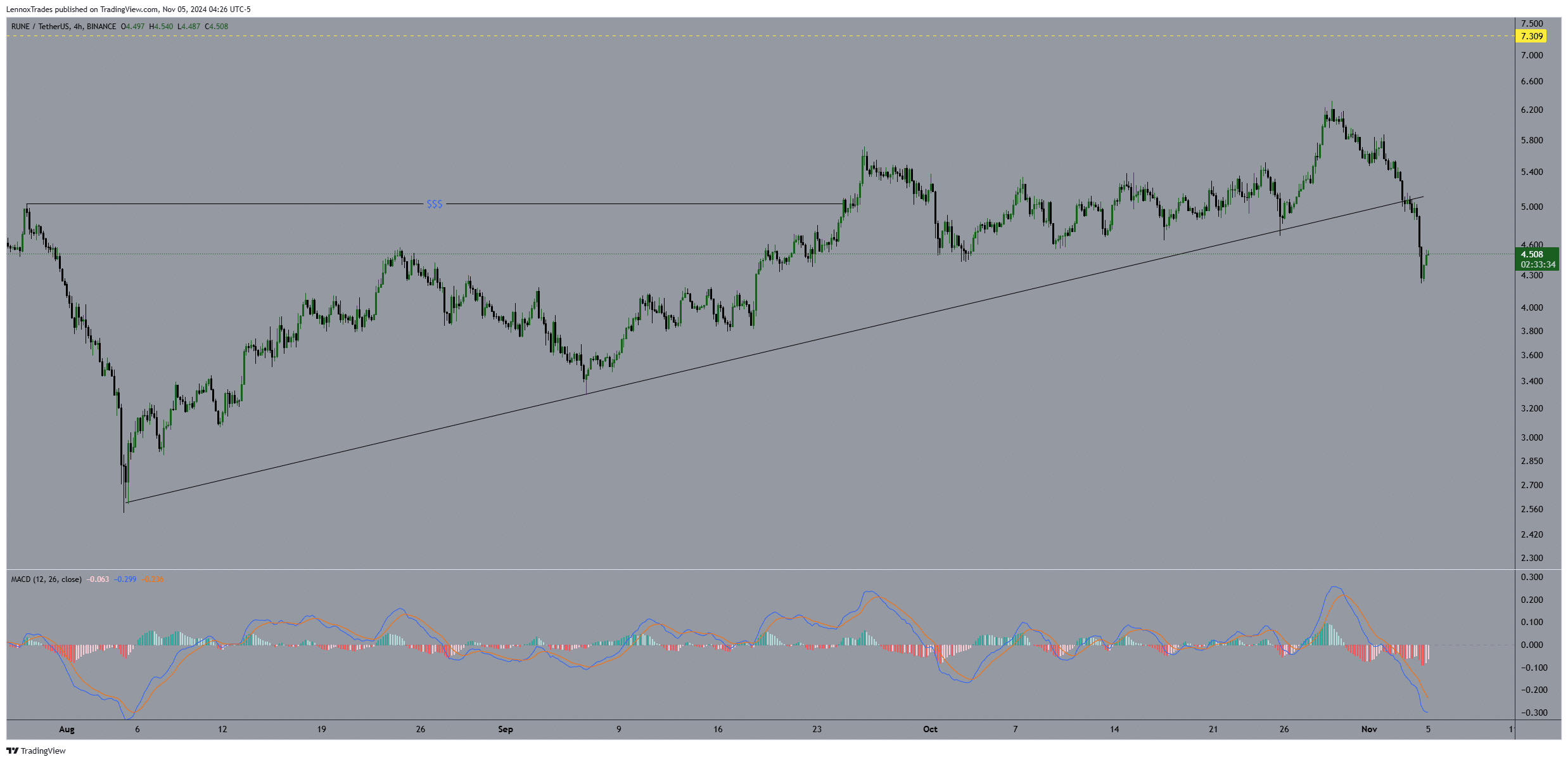

The RUNE price on the 4-hour timeframe began showing signs of a recovery despite a lack of a clear signal from indicators, which often react more slowly to abrupt price shifts.

RUNE/USDT hinted at a recovery attempt after it bounced from the $4.50 range highlighting early buying interest. A suggestion that this level could serve as a new support region.

After failing to maintain its support at the ascending trendline, RUNE fell below the $5 level and subsequently stabilizing around $4.50.

The MACD indicator showed a negative crossover, confirming that bearish pressure had dominated the recent market action.

Nevertheless, the recent histogram bars indicated a potential slowdown in selling momentum, which gave hope to investors about a gradual recovery.

However, the previous ascending trendline, which once acted as a support level, turned into resistance, and now RUNE needs to regain momentum and break above this level to signal a bullish reversal.

If RUNE managed to sustain a move above $5.5, it could eventually climb towards $7.30, the prior high. However, a confirmed reversal would require more buying volume and a clear breakthrough of these resistance levels.

Volume and TVL

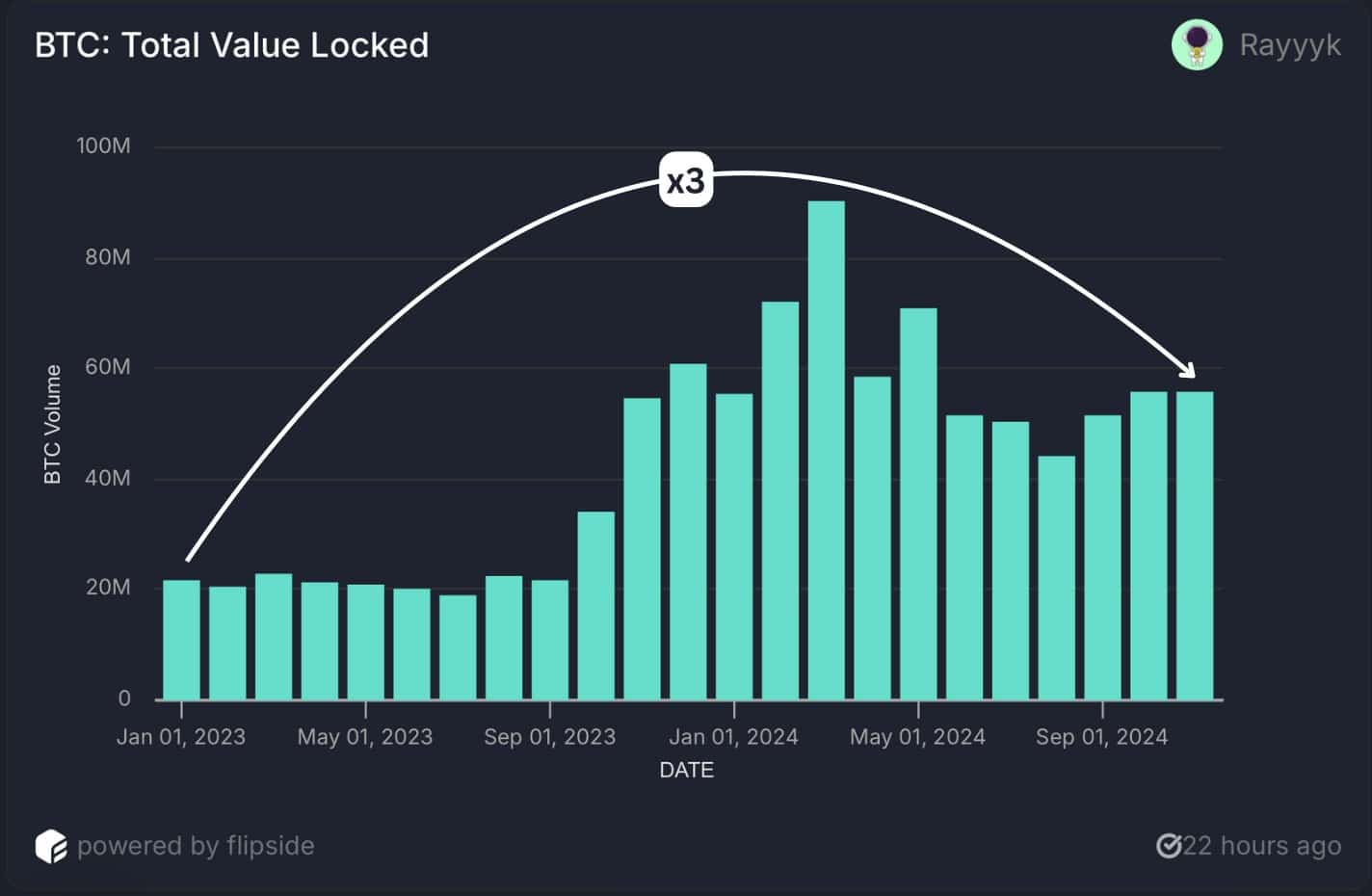

Meanwhile, the weekly trading volume for RUNE surged to an all-time high of $78 million, reflecting growing market interest despite recent volatility.

Additionally, the total value locked (TVL) of Bitcoin on THORChain has tripled since 2023, underscoring the increasing adoption of THORChain’s cross-chain liquidity services.

These factors suggest that although RUNE faced short-term selling pressure, the long-term fundamentals remained intact, and future price action could benefit from renewed market confidence.