‘Safety net’ Solana could be the key to next altcoin season – Analyst

- Analyst believes altcoins might continue to underperform against Bitcoin as the market deviates from previous patterns

- Solana might be the reason why the altcoin market cap has not formed lower lows

Altcoins have underperformed against Bitcoin (BTC) this year with most of the top ten altcoins, besides Binance Coin (BNB) and Toncoin (TON), failing to reclaim their previous highs.

In fact, according to Andrew Kang, Partner at Mechanism Capital, the market has not been following its previous patterns. Traditionally, whenever Bitcoin forms a new all-time high, altcoins follow suit. However, this failed to happen for most altcoins earlier this year when BTC hit an ATH of $73k on the charts.

“Altcoin market caps (and ETH) should be making new highs in new cycles. It’s increasingly clear that this is not the case… Even if Bitcoin goes to new highs this doesn’t mean altcoins will keep up.”

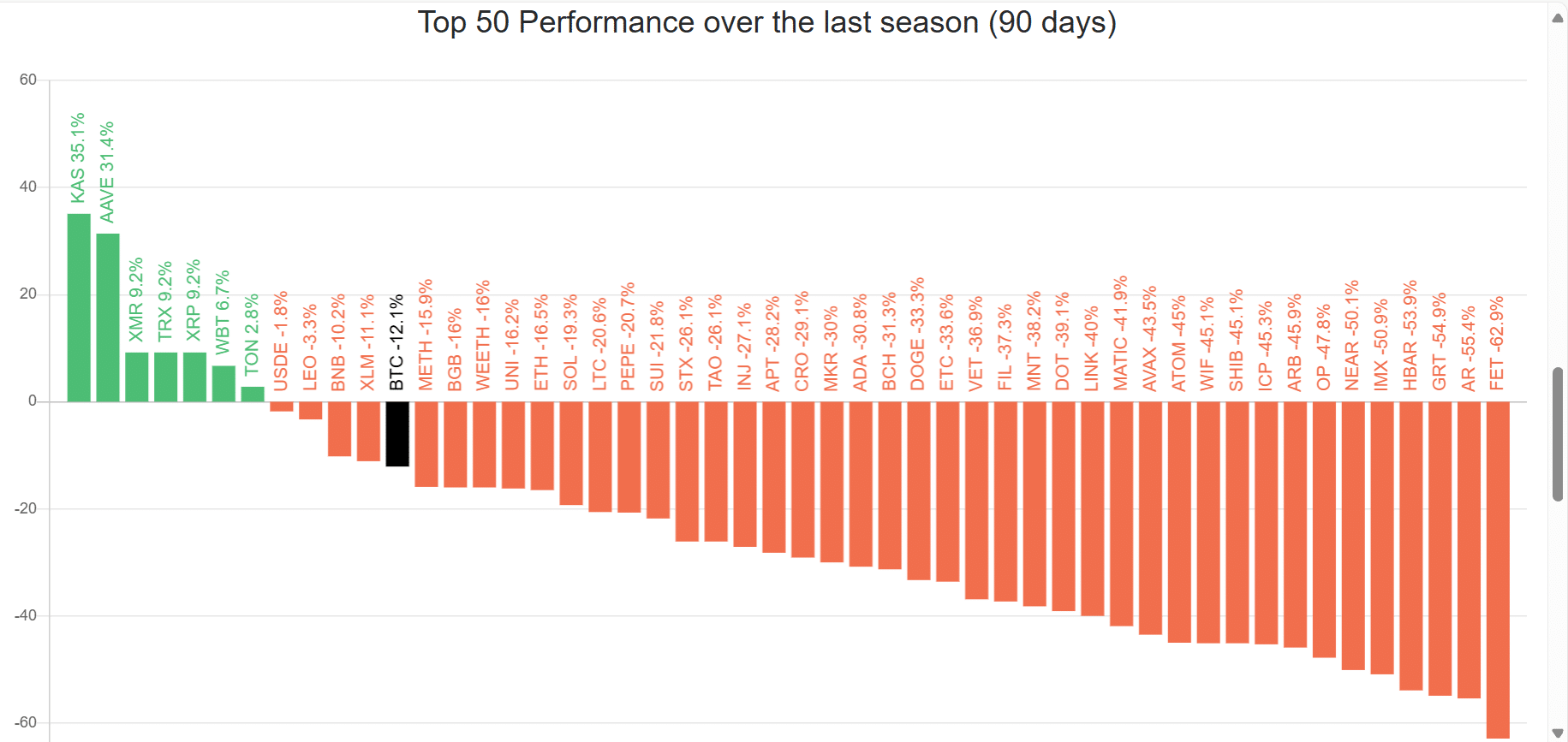

A look at data from Blockchain Center revealed that only 11 out of the top 50 altcoins outperformed Bitcoin over the last 90 days.

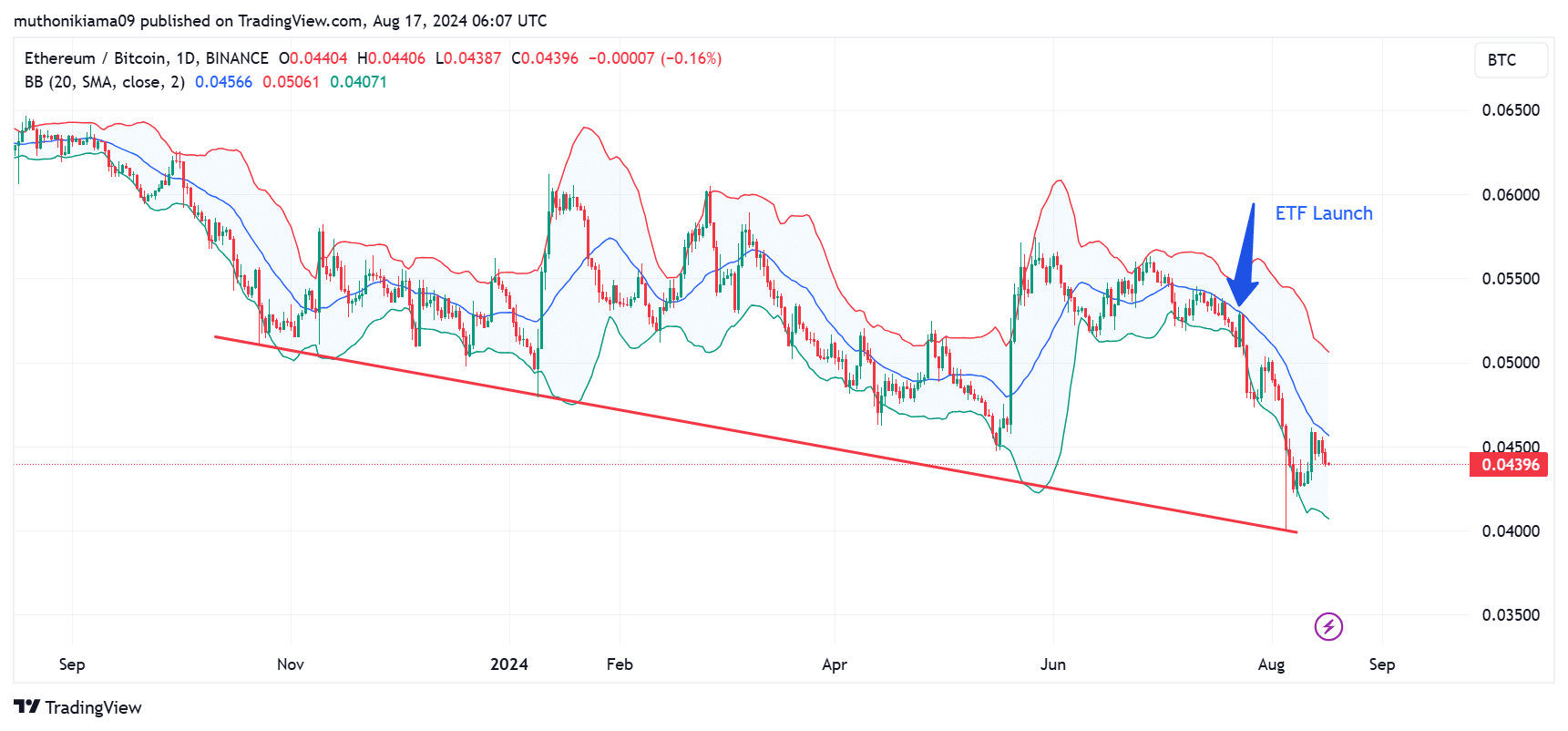

ETH forms yearly lows against Bitcoin

Kang’s analysis comes on the back of Ethereum forming a yearly low against Bitcoin on 9 August. The ETH/BTC daily chart also revealed that the largest altcoin has been forming lower lows against BTC since October last year.

Moreover, since spot Ether exchange-traded funds (ETFs) started trading in July, ETH has failed to bounce from the middle Bollinger band (20-day Simple Moving Average). This is just another sign of underperformance.

According to Kang though, altcoins will likely find a bottom in 2025, before making a bullish rebound.

Solana is the safety net?

That’s not all though as Kang believes that Solana (SOL) is the sole reason why altcoins’ market cap, currently at around $1 trillion, has not formed a lower low on the charts.

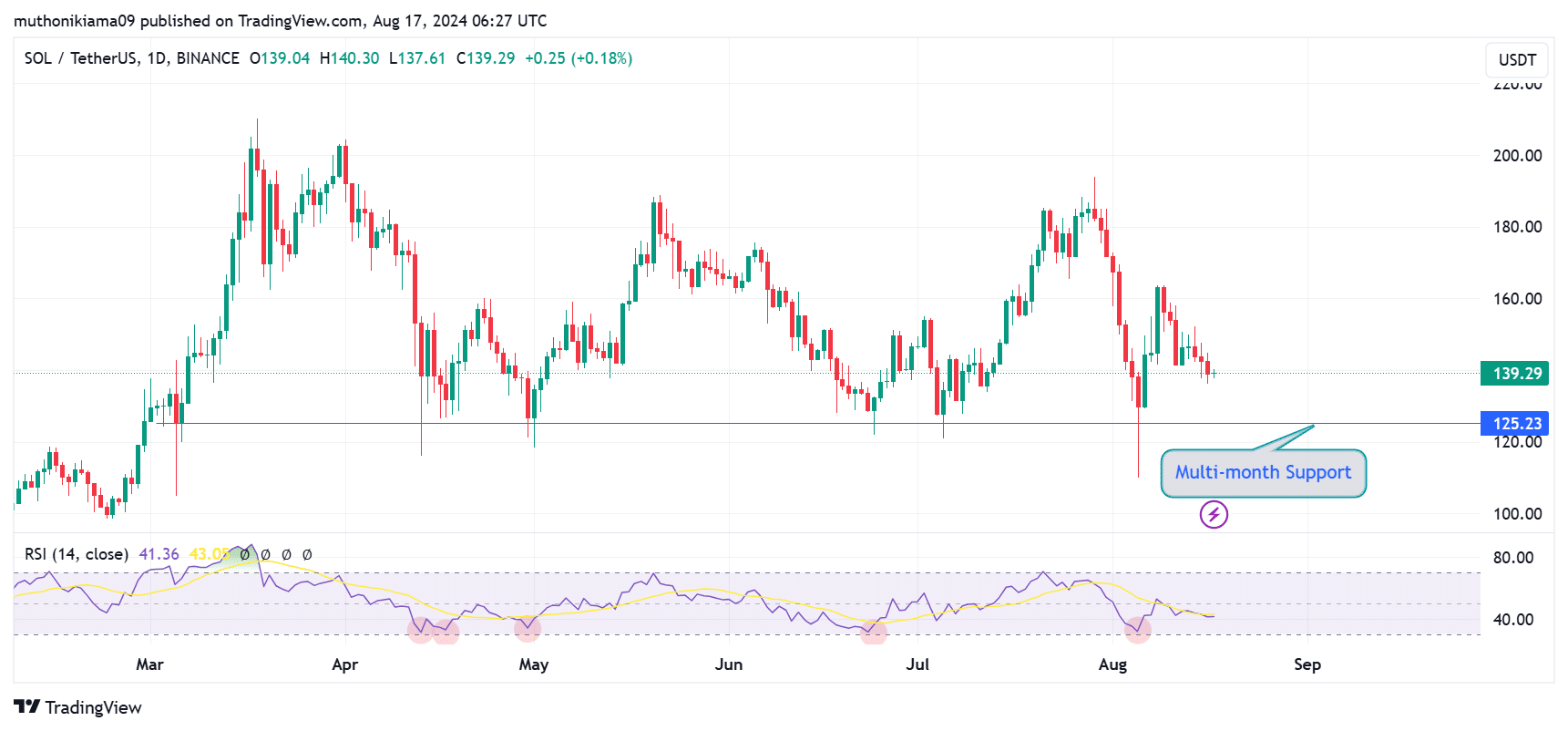

In fact, Solana has defended a multi-month support level at $125 since March 2024.

The $125 psychological level is a crucial price to watch as it showed that despite downward pressure, SOL has established a stable base preventing steep declines.

The Relative Strength Index (RSI) has also sustained levels above 30 since March – A sign that SOL has not been oversold for an extended period.

This trend indicated that buyers have prevented significant downside risk. This strong support for SOL supports Kang’s thesis that Solana’s price is less likely to form a lower low.

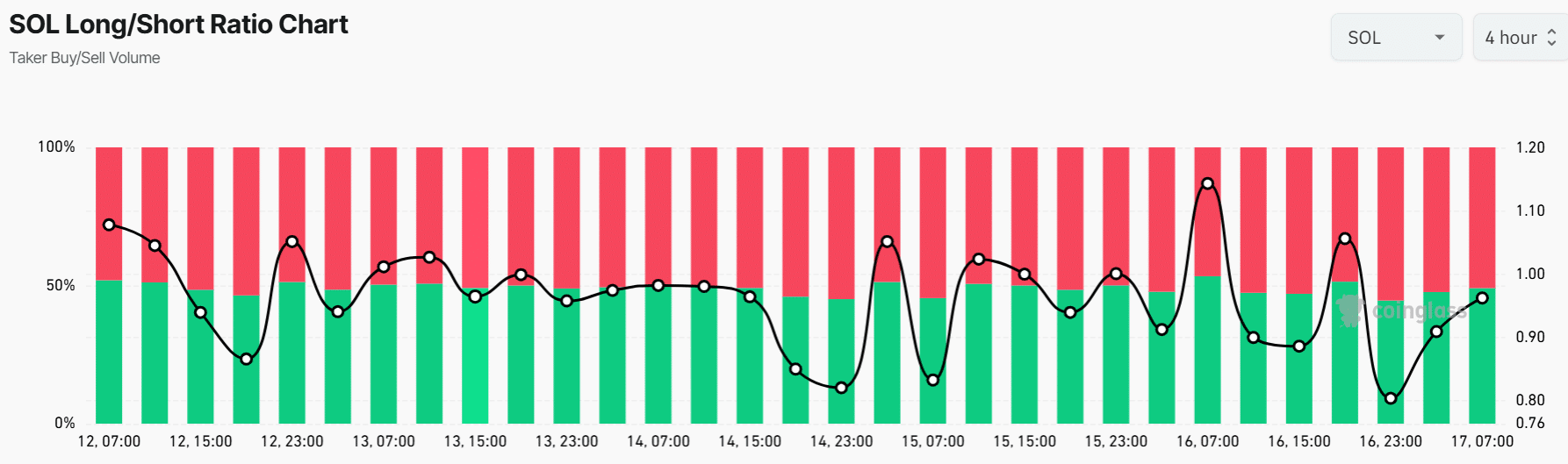

Additionally, the Futures market demonstrated a nearly balanced sentiment around SOL by traders. The long/short ratio for SOL, at press time, was at 0.97, indicating short positions are slightly higher than long positions.

Nevertheless, Solana’s strength has not been enough to support the altcoin market. At the time of writing, the Altcoin Season Index had a value of 22, suggesting that the market is favoring Bitcoin over altcoins right now.