SEC fines against crypto firms rise 3018% in 1 year: Who faced the brunt?

- SEC imposed $4.68 billion in fines in 2024, setting a record for regulatory action.

- Crypto firms faced rising penalties, emphasizing the need for regulatory compliance and transparency.

In recent years, especially in 2024, the United States Securities and Exchange Commission (SEC) has increased its regulatory oversight of the cryptocurrency industry.

While this has led to tensions between crypto firms and the SEC, the regulatory body has remained steadfast in enhancing transparency, protecting investors, and enforcing legal standards.

This has resulted in substantial fines for companies violating regulatory requirements.

SEC fines report unveiled

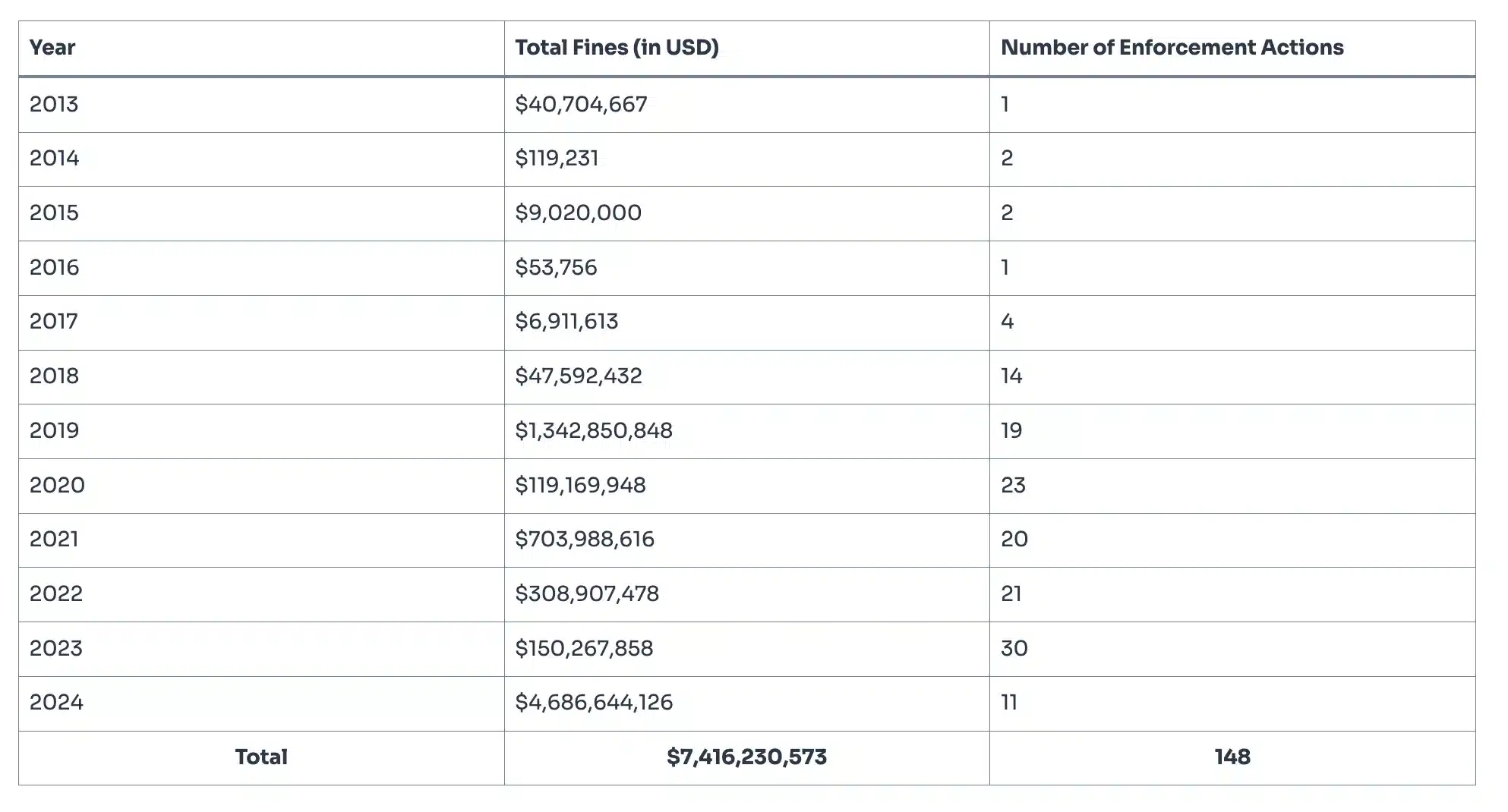

A recent report highlights the penalties imposed on major crypto firms from 2013 to 2024, shedding light on significant cases and the nature of the violations.

According to the report,

“Since 2013, the SEC has levied over $7.42 billion in fines against crypto firms and individuals, of which 63% of the fine amount, i.e., $4.68 billion, came in 2024 alone.”

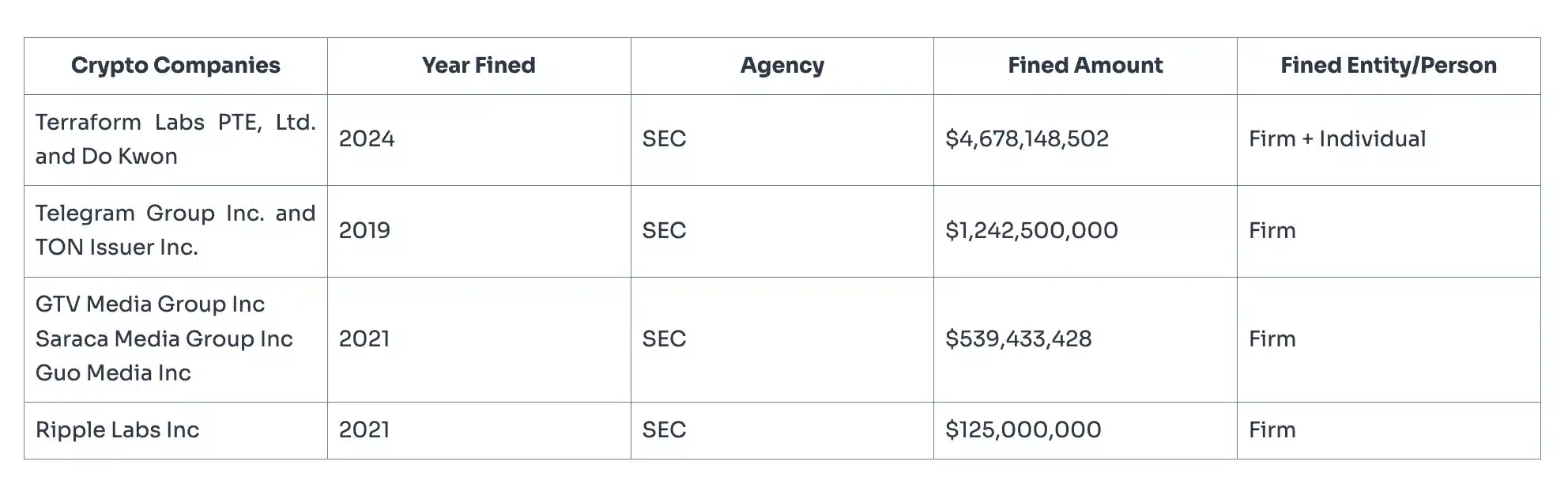

This highlights that 2024 witnessed a staggering $4.68 billion in fines. The major payers were Terraform Labs and its founder, Do Kwon.

This record-breaking penalty highlights the SEC’s most assertive approach to date, targeting high-profile cases and emphasizing violations related to unregistered securities.

It further added,

“From $150.26 million (2023) to $4.68 billion(2024), the amount of the fine increased by a staggering rate of 3018%.”

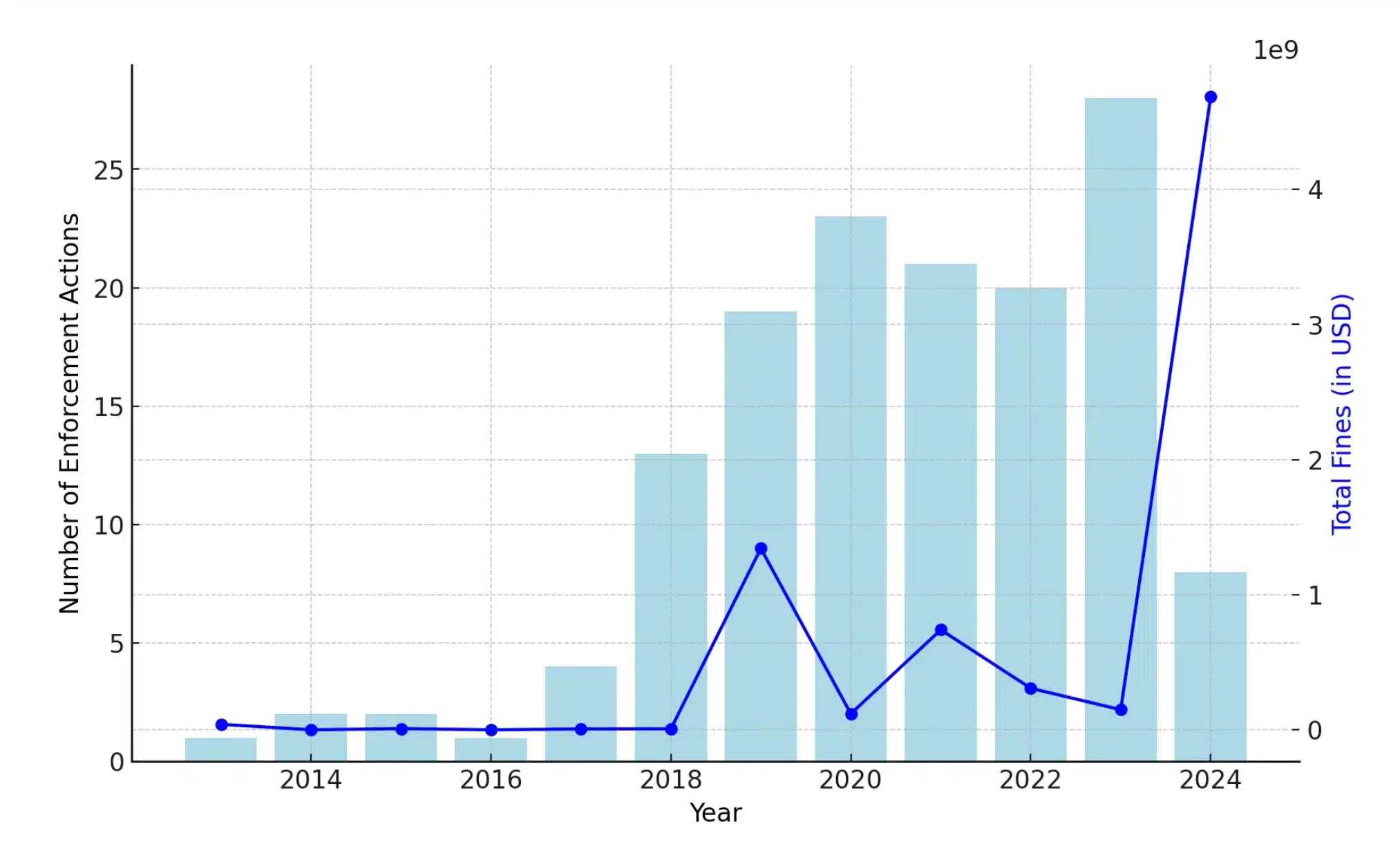

The rise in fines over the years

The increase in fines began in 2019 with major actions like the $1.24 billion penalty against Telegram Group, leading to a massive rise in the average fine.

Even though the numbers dipped in 2020, fines rebounded in 2021 with cases like Ripple Labs.

By 2024, the average fine surged to an unprecedented $426 million, largely driven by the historic $4.68 billion fine imposed on Terraform Labs and Do Kwon.

Major players such as Ripple [XRP], Telegram, and Terraform Labs were targeted for their involvement in unauthorized token offerings.

That being said, since 2022, the SEC has taken a more assertive stance, not only imposing penalties on companies but also holding their top executives accountable, underscoring its commitment to stricter oversight in the crypto industry.

As financial penalties have increased, the significance of regulatory compliance has become crucial for cryptocurrency firms.