SEC vs Binance update – Judge dismisses parts of the SEC’s claims

- Judge Amy Berman Jackson dismissed parts of the SEC’s lawsuit against Binance

- Crypto community remains optimistic, despite ongoing legal proceedings between Binance and SEC

The long-standing legal battle between cryptocurrency exchange Binance and the U.S. Securities and Exchange Commission (SEC) appears to be edging towards a conclusion. In fact, if the developments over the last 24 hours are taken into consideration, it would seem that this conclusion may just be in Binance’s favour.

A win-win for Binance?

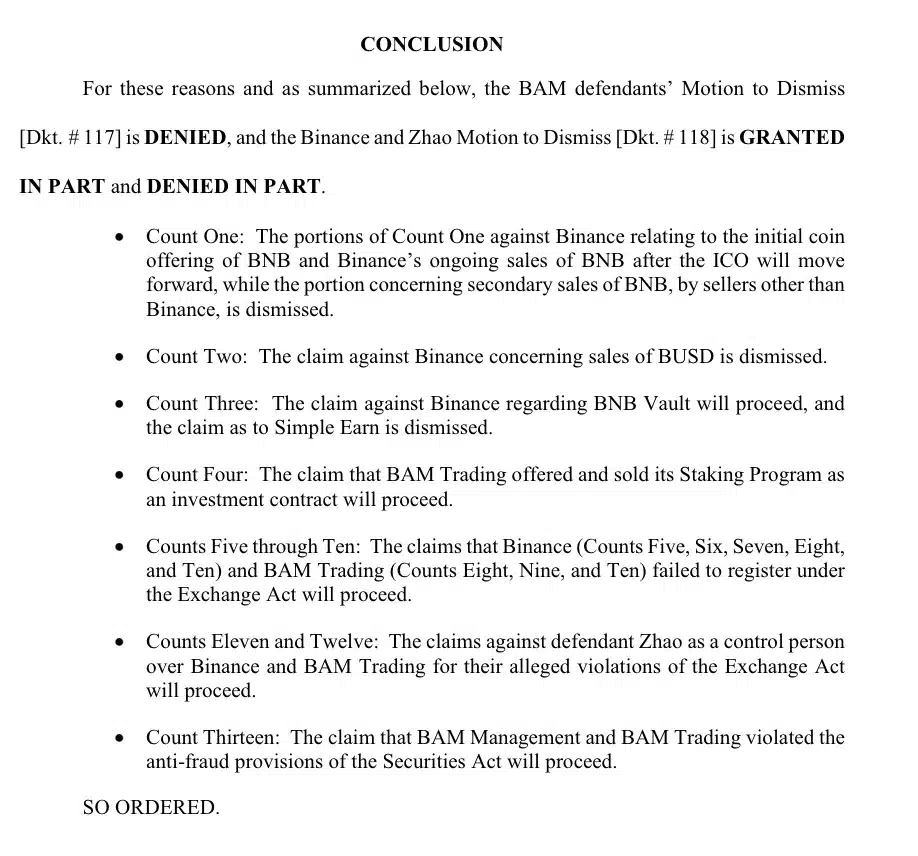

According to a recent court ruling dated 28 June, Judge Amy Berman Jackson has dismissed portions of the SEC’s lawsuit against Binance and its founder, Changpeng Zhao.

Explaining the reasons behind the same, Judge Jackson noted,

“To survive a motion to dismiss under Federal Rule of Civil Procedure 12(b)(6), ‘a complaint must contain sufficient factual matter, accepted as true, to state a claim to relief that is plausible on its face’.”

However, she permitted other charges, including those targeting the holding company of Binance.US, and the one against ex-Binance CEO Changpeng ‘CZ’ Zhao who is alleged to have operated as a “control person.”

The case arguing that Binance needed to register under the Securities Exchange Act of 1934 was also allowed to proceed by the court.

Charges filed against Binance

For context, the SEC had filed 13 charges against Binance, BAM Trading Services Inc. (Binance.US), and Changpeng Zhao for securities law violations.

These charges included operating unregistered exchanges, broker-dealers, and clearing agencies. Additionally, they were also accused of misrepresenting trading controls on Binance.US and engaging in unregistered sales of securities.

The court filing concluded by affirming its decision and stated,

This mixed ruling marks a significant development in the ongoing conflict between the popular crypto exchange and the United States’ premier regulatory body.

Crypto community’s enthusiasm

Despite the lack of closure to the legal proceedings, many voices within the crypto community remain confident and optimistic.

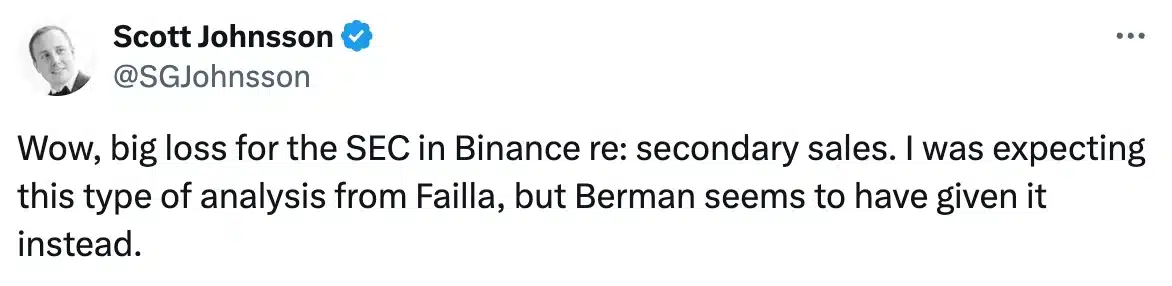

One of them was, Scott Johnsson, an associate at Davis Polk & Wardwell LLP, claimed,

The primary reason behind execs celebrating this as a win-win for Binance is that Judge Jackson dismissed a key claim by the SEC against the exchange. It ruled that the secondary sales of Binance’s BNB coins do not qualify as securities under the Howey Test.

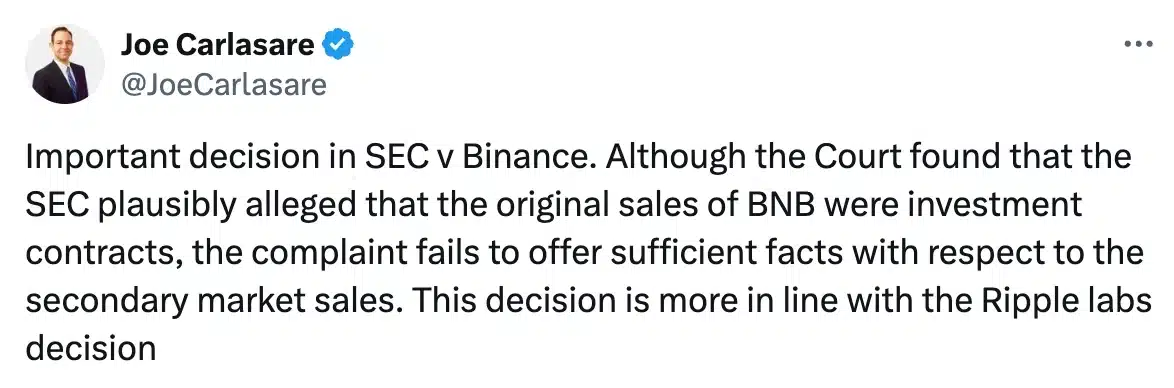

This decision parallels a similar ruling by Judge Analissa Torres in Ripple’s case against the SEC, emphasizing the importance of evaluating the economic substance of token transactions when applying the Howey Test.

Remarking on the same, Joe Carlasare, Partner at Amundsen Davis LLC added,

This case’s outcome will likely shape future digital asset regulations and investor confidence, regardless of who wins it.

![Three days ago, Uniswap [UNI] attempted a breakout from a parallel channel, surging to hit a local high of $7.6. However, the altcoin faced strong rejection.](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-83-400x240.jpg)