SEC’s lawsuit cut down the number of XRP exchanges, but will things change?

XRP has had arguably the hardest time among top cryptos due to the Securities and Exchange Commission’s (SEC) lawsuit against Ripple Labs a few years ago. In fact, since the lawsuit was filed, there has been a fall in the number of XRP exchanges around the world too.

Read Ripple’s [XRP] Price Prediction 2023-24

XRP Exchanges’ decline affected XRP’s reach

Soon after the lawsuit was filed in 2020, the number of XRP exchanges saw a significant decline. Several exchanges, including big shots like Coinbase, Crypto.com, and OKCoin, announced that they would suspend trading XRP on their platforms. The delisting definitely had a negative impact on the token’s global reach as these exchanges are very popular worldwide.

In its official announcement, Coinbase mentioned, “In light of the SEC’s lawsuit against Ripple Labs, Inc, we have made the decision to suspend the XRP trading pairs on our platform. Trading will move into limit only starting December 28, 2020 at 2:30 PM PST, and will be fully suspended on Tuesday, January 19, 2021 at 10 a.m. Pacific Standard Time.”

However, trading suspension did not affect customers’ access to XRP wallets, which remained available for deposit and withdrawal functionality after the trading suspension.

However, it is interesting to note that as the years passed, a few of the exchanges such as Crypto.com re-listed XRP, giving their users access to trade the token. The year 2023 can turn out to be instrumental for XRP, especially since many believe the lawsuit is reaching its endgame soon. If XRP manages to win the case, the probability of exchanges re-listing XRP are high. This can, in turn, shower blessings on the token’s price action.

A look into history

The SEC’s litigation against Ripple Labs, which has been affecting XRP since 2020, has been a significant setback for the company and its native token. To begin with, the SEC charged Ripple and its employees, Christian Larsen and Brad Garlinghouse, with public sales of unregulated securities worth more than $1.3 billion.

The lawsuit undoubtedly hurt XRP since it may have caused investors to lose faith in the token. The lawsuit caused XRP’s price to decline sharply, as is evident from the chart. However, the token was quick to recover as it registered gains in the following days. Nonetheless, the fact that negative sentiment around XRP spiked during that period can’t be overruled.

The road ahead looks like…

Ripple CEO Brad Garlinghouse, in a recent interview with CNBC, cited that the company will have spent $200 million defending itself against a lawsuit from the U.S. Securities and Exchange Commission by the time it is over in 2023.

This can be a game changer for Ripple, as speculations have emerged of late that the lawsuit can end soon. If the judgment is passed in Ripple’s favor, several exchanges might re-list XRP once again. This might be enough to create hype and pump the token’s price over the subsequent months.

#XRP #XRPCommunity

Hoping Judge Torres rules any day now or a settlement is announced, but in the meantime i have set myself imagined timelines for the case to end. From my list in March only 2 remain. I have removed May 29th as that is Memorial day. So June 5th and June 21st…… https://t.co/UUrjf3lcKS— Ashley PROSPER (@AshleyPROSPER1) May 1, 2023

XRP’s current state

XRP’s performance has not been on par for quite some time now. Its development activity plummeted, which in general is a negative sign. XRP’s performance on the social front is also not up to the mark, as evident from a decline in its social volume.

At press time, according to CoinMarketCap, XRP was down by more than 7% in the last seven days. In fact, it was trading at $0.4245 with a market capitalization of over 22 billion, making it the 6th largest crypto by market cap.

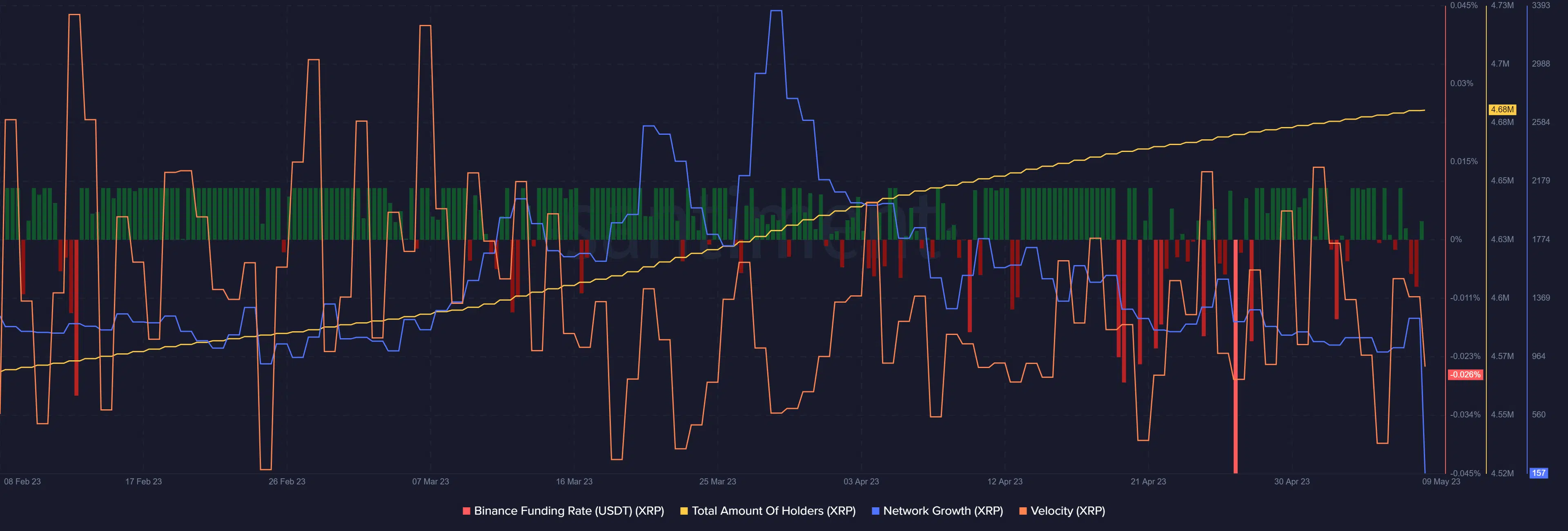

Though XRP’s demand in the derivatives market remained pretty stable, it tumbled during the concluding weeks of April. The same can be evidenced by its red Binance funding rate. XRP’s network growth and velocity also declined over the last 3 months.

The decline indicated that fewer new wallets were created and the token was not transferred among wallets at a higher rate. Nonetheless, investors’ confidence in XRP remained unaffected as the total amount of holders increased.

A quick look at XRP Futures market

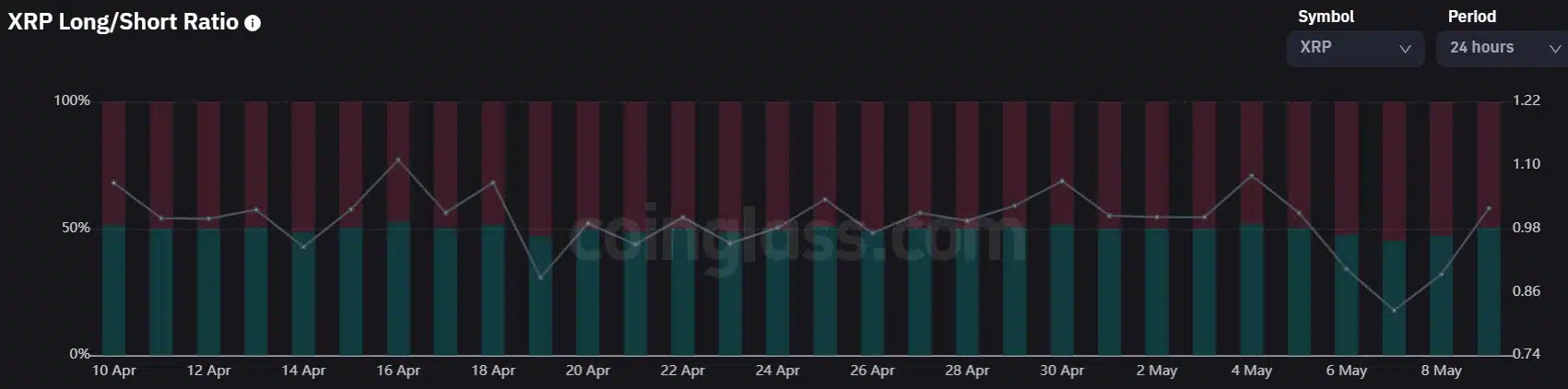

According to Coinglass, after a decline on 7 May, XRP’s long/short ratio registered a hike. A greater long/short ratio indicates that more long positions are being held relative to short positions. This may be due to volatility, making short sales riskier investments, or because investors are unsure how new short sale regulations will affect the market.

In addition to that, XRP’s open interest is also falling. Declining open interest usually suggests that the market is liquidating, indicating that the on-going price trend is coming to an end. This seemed bullish for XRP as at press time, its price action was negative, precipitating the likelihood of a trend reversal.

How much are 1,10,100 XRPs worth today

Is a trend reversal inevitable?

Though the open interest looked bullish, the actual trend reversal might happen over the coming days and not immediately. This possibility was suggested by most of the market indicators.

For instance, XRP’s Relative Strength Index (RSI) was down and heading towards the oversold zone. The Money Flow Index (MFI) was also below the neutral zone, which was bearish. As per the Exponential Moving Average (EMA) Ribbon, the bulls and the bears were engaged in a fight. Which of the two turns out to be victorious is a question only time can answer.