SEI crypto up 34% in 7 days: Time to sell or HODL?

- SEI’s trading volume surged by 245.93%, reaching $961.82 million, driven by significant TVL growth.

- Bullish liquidation trends and rising open interest suggest continued upward momentum for SEI.

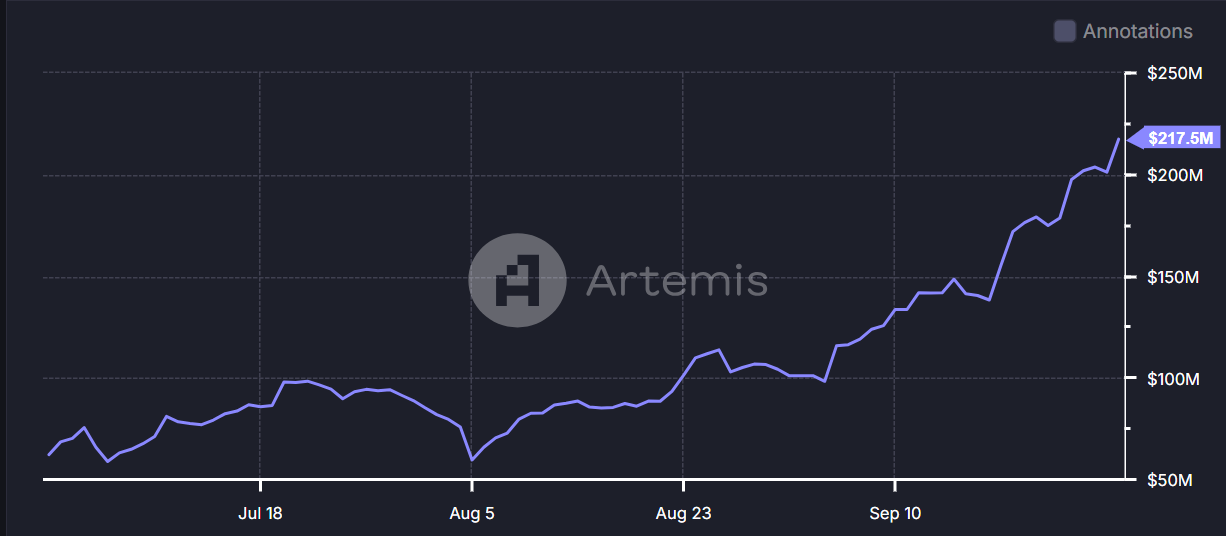

Sei crypto [SEI] continues to dominate the crypto space, hitting an all-time high in Total Value Locked (TVL) at $217.5 million, doubling its growth over the past month. This impressive surge has positioned SEI as one of the most promising DeFi projects, capturing the attention of both retail and institutional investors.

As this momentum builds, the big question is whether SEI can sustain this growth or if it’s approaching a peak.

What’s behind the massive volume surge?

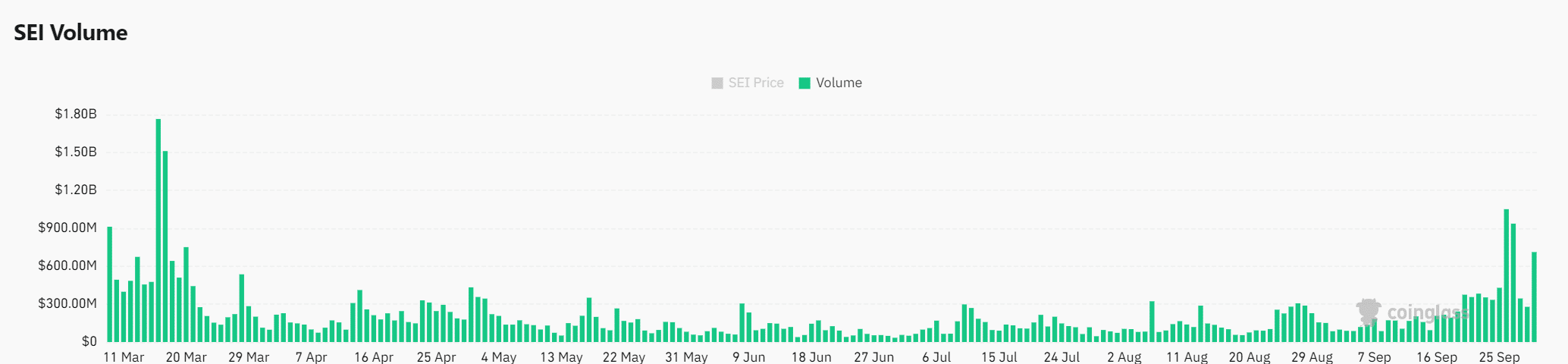

At press time, SEI was trading at $0.4949, reflecting a 7% increase in price over the last 24 hours. More importantly, trading volume has surged by a staggering 245.93%, reaching an impressive $961.82 million.

This volume spike indicates a substantial rise in market activity, likely due to SEI’s rapid TVL growth and the increasing attention from traders. Therefore, this surge highlights growing investor confidence, as large volumes often reflect strong buying pressure.

Liquidation trends: What does the data show?

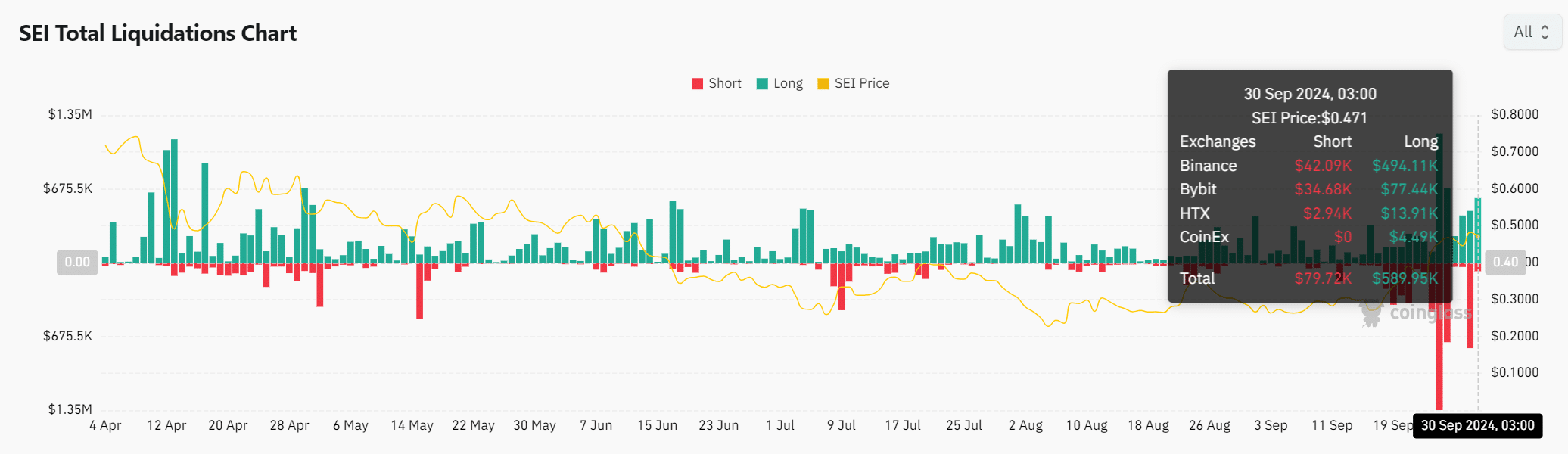

Liquidation activity has been primarily skewed toward long positions, with $79.72K in shorts and $589.95K in longs being liquidated in the past 24 hours. The liquidation chart reveals that long positions are dominating, reflecting widespread bullish sentiment.

Additionally, SEI’s current price of $0.471 shows strong support, suggesting that traders expect further price increases.

However, if SEI fails to break through significant resistance levels, liquidation spikes could signal market reversals.

Rising open interest: A sign of more gains for SEI crypto?

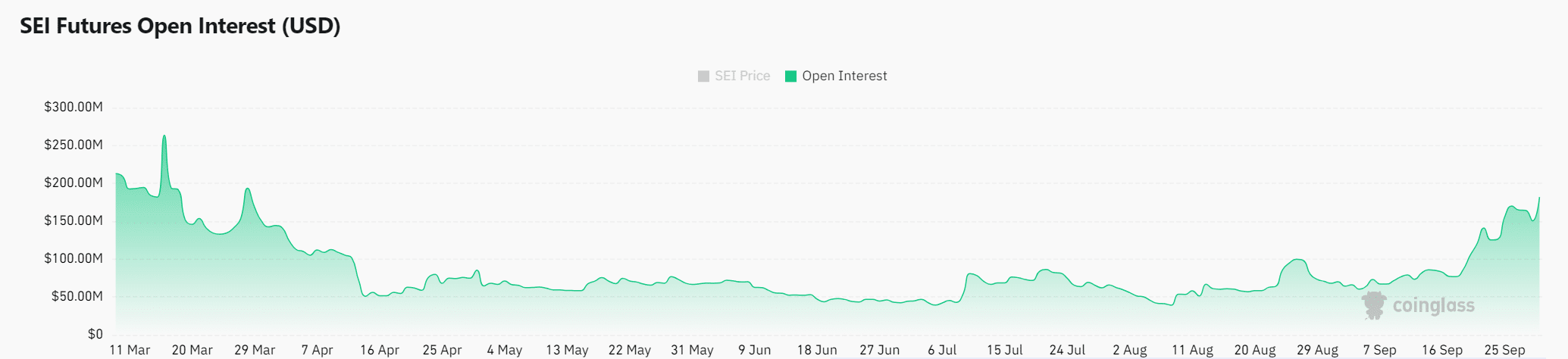

Open interest has also surged by 14.17%, now standing at $173.08 million. This increase points to more capital being committed to SEI’s futures contracts, signaling that traders expect further upward movement.

Consequently, this rise in open interest, combined with the volume spike, suggests that SEI is poised for further gains. Investors and traders alike are likely to continue pushing SEI higher, particularly given its recent market performance.

Realistic or not, here’s SEI’s market cap in BTC’s terms

SEI’s explosive growth, marked by its rise in TVL, trading volume, and open interest, strongly indicates that the project will maintain its momentum. The bullish sentiment dominating the market suggests SEI will likely continue to break new ground.

Although volatility is always a factor, SEI appears 80% likely to sustain this upward trend, with only a 20% chance of short-term correction. However, investors should remain cautious and monitor key resistance levels for any signs of reversal.