Altcoin

SEI Network surges on the back of DeFi integration – All the details

Sei Network’s DeFi integration has fueled its latest price surge, with technicals hinting at sustained growth.

- At the time of writing, SEI was testing the key resistance at $0.40, with indicators showing potential bullish momentum

- Whale accumulation and rising Open Interest signaled confidence, but volatility risks remain

Sei Network has made a bold move in the DeFi space, integrating with Orderly’s cloud liquidity to connect over 30 decentralized exchanges (DEXs) and 60 markets. Consequently, this integration has fueled a significant price surge, pushing Sei [SEI] up by 8.33% to $0.396 at press time.

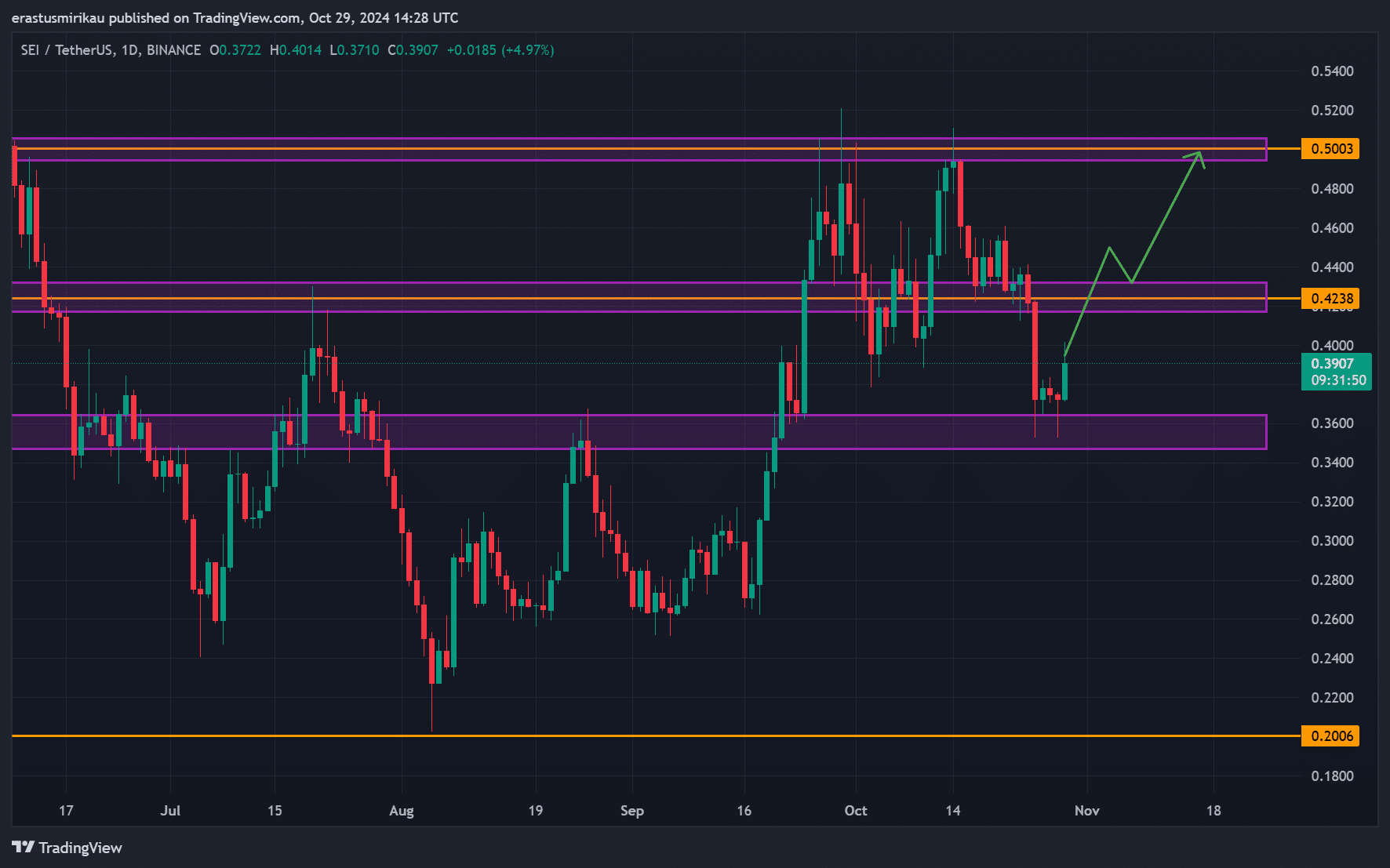

This rally propelled SEI towards its key resistance level at $0.42, a level that could determine its next trajectory. Breaking through this resistance might set it on a path to test the next major level near $0.50 – A bullish signal for investors.

However, failure to maintain the ongoing momentum could result in a pullback, with the altcoin potentially testing the lower support around $0.36. Therefore, SEI stands at a critical juncture where any movement could define its near-term outlook.

Technical indicators – Bollinger Bands and STOCH RSI

SEI’s technical indicators revealed insights into its prevailing trend. Bollinger Bands, with the upper band at $0.4296 and the lower band at $0.3565, highlighted volatility. SEI trading near the middle band suggested a neutral stance, one where breaking above could indicate a bullish move towards the upper limit.

Conversely, a drop could test the lower band, adding selling pressure.

Moreover, the Stochastic RSI, signaling momentum, underlined bullish divergence with values at 13.16 (K line) and 6.50 (D line). Rising from oversold territory, it indicated potential upward momentum.

However, this signal must sustain itself for the altcoin to avoid quick retracement, as seen in previous cycles. Therefore, monitoring these indicators is crucial for identifying trend shifts.

SEI whale activity – Are top holders backing this rally?

Additionally, whale activity highlighted strong backing for SEI. At the time of writing, 59.22% of stablecoin supply sat with wallets holding over $5 million – A sign of significant accumulation by large holders.

Consequently, whale support often reduces market supply, creating a scarcity that can drive prices higher. Therefore, sustained whale accumulation might reinforce SEI’s rally, providing a foundation for further growth in the DeFi sector.

Open Interest analysis – Rising interest and its implications

Furthermore, Open Interest increased by 9.93% to $144.47 million, reflecting heightened interest from traders. Higher Open Interest is a sign of confidence in the altcoin’s future price movement and aligns with its recent volume surge.

However, while growing Open Interest typically signals market strength, it also hints at potential volatility, as more traders anticipate major moves. Therefore, careful observation of Open Interest could provide insights into SEI’s next significant price direction.

Realistic or not, here’s SEI’s market cap in BTC’s terms

Can SEI maintain its momentum?

Sei Network’s strategic DeFi integration, bolstered by whale interest and rising Open Interest, supported a bullish case for SEI. Technical indicators and whale backing further highlighted its potential.

However, surpassing the $0.40 resistance remains essential for sustained momentum. If it can secure this level, it could solidify its position as a notable DeFi player, fostering further investor confidence and growth.