Analysis

SEI price prediction: Will Q3 trend repeat and extend recovery to 35%?

SEI recovery could eye a 35% gain, but only on one condition.

- SEI’s current trend mirrors Q3 recovery patterns.

- Will the altcoin extend recovery gains to +35%?

Sei [SEI] saw double-digit gains during this week’s relief rally and looked poised for an extra uptrend. The layer 1 altcoin flipped the short-term supply zone at $0.28 into support and has been consolidating below $0.30 for two days.

SEI tucked a 15% gain, rising from $0.25 to $0.30 earlier in the week. Can bulls continue with the winning streak?

SEI: The calm before the storm?

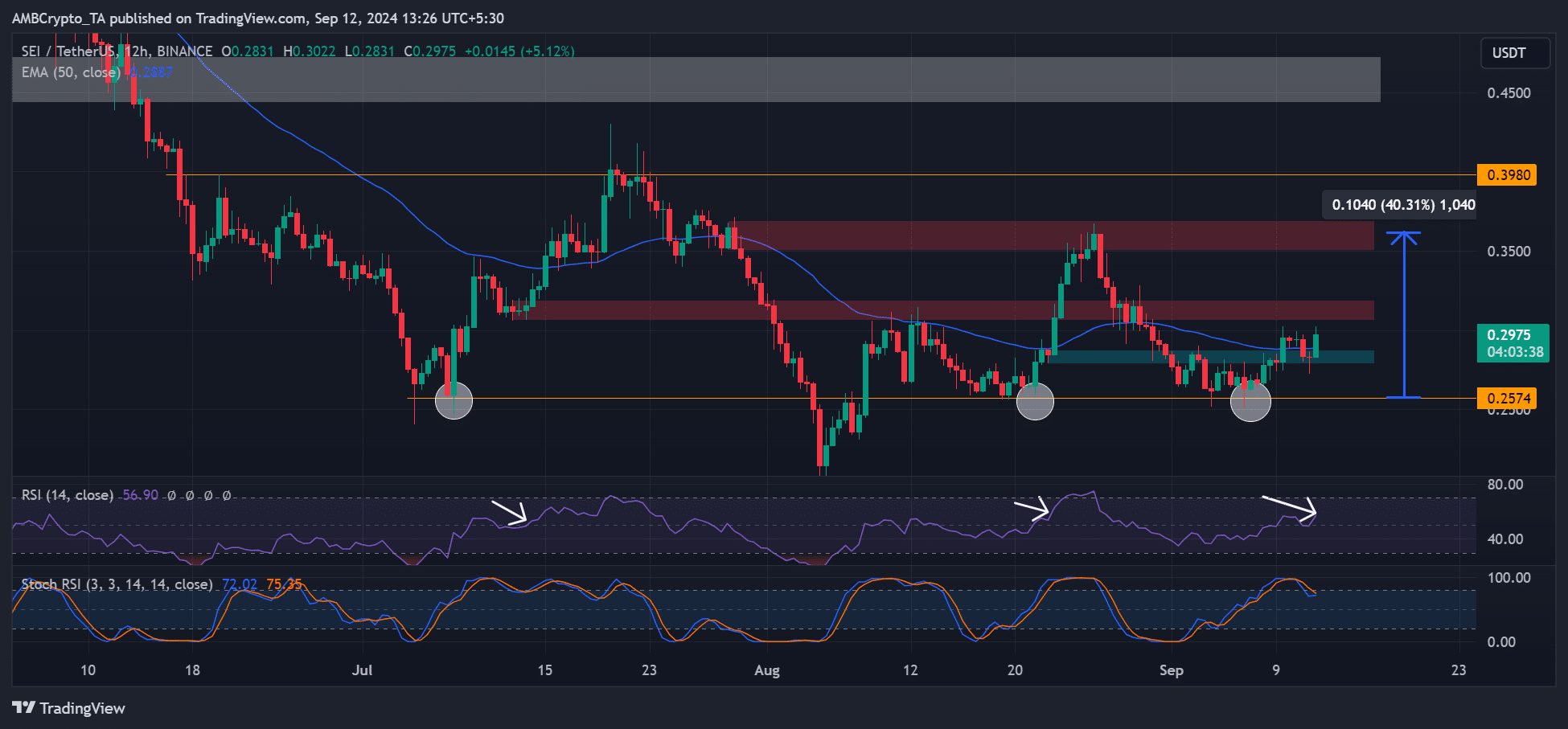

In Q3, SEI printed a consistent price action trend. Every price dump was reversed at $0.25 in July, August, and September, making it a crucial Q3 support.

In the past two rebounds at the support, SEI eyed $0.35, triggering +35% gains in each rally after clearing the hurdle at $0.30 (marked red).

The current trend appeared to mirror the past two Q2 patterns. The early-week recovery already tipped 15% gains to SEI. However, at press time, the $0.30 hurdle had not been cleared yet.

But technical chart indicators suggested that SEI could push forward to $0.35. For example, the RSI (Relative Strength Index) was below overbought conditions, indicating more room for recovery extension.

If the Q3 trend repeats, late SEI bulls could seek market entry upon breakout retest at $0.30. The immediate targets would be $0.35 and $0.39.

However, a break below the Q3 support would invalidate the above bullish outlook.

On-chain and derivatives data say…

According to Artemis data, daily active addresses in the Sei network also showed a remarkable uptick from early September.

The metric jumped below 25K to above 55K in the past few days. This indicated network growth and activity and could boost the price recovery.

On the daily front, SEI was up about 5% on Friday. This uptick was marked by an 8% uptick in open interest rates (OI) and +41% in trading volume across the derivatives market.

Read Sei [SEI] Price Prediction 2024 – 2025

This illustrated that SEI attracted significant liquidy injection from speculators expecting further price appreciation. The dominant bullish sentiment on the altcoin was further confirmed by long positions that dominated at 52%.

However, any sharp losses from Bitcoin [BTC] could drag SEI and invalidate the bullish thesis.