Sellers, look out for these signs on Monero’s [XMR] price charts

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

- Monero [XMR] registered conflicting trends across different timeframes

- The recent break in structure on the lower timeframe meant the market might have shown its hand

Monero [XMR] recorded a bearish trajectory on the higher timeframe charts. In contrast, it posted significant gains of 9.14% over the last four days, before facing rejection around the $155-zone. But is this a sign that sellers are gaining strength or can bulls expect further gains?

Read Monero’s [XMR] Price Prediction 2023-24

Bitcoin is also likely to have a say in the matter, but the price action showed that XMR is likely to retrace the gains it made over the last four days.

Despite the bounce from $144, the bias has shifted to bearish favor

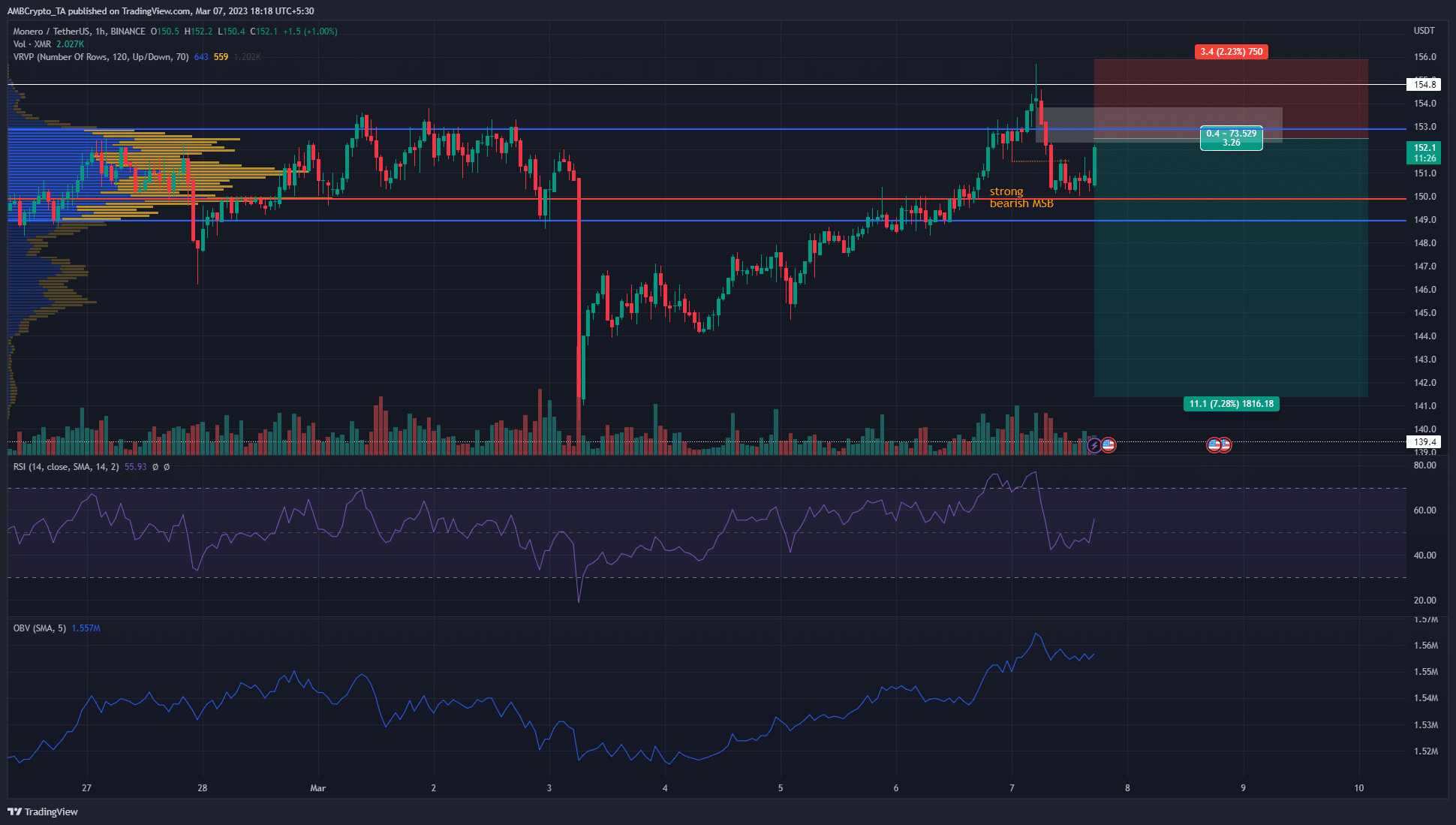

The Volume Profile Visible Range tool highlighted three levels of importance. The Value Area High and Low at $153 and $149, respectively, and the Point of Control at $151.1. At the time of writing, the price was shooting north after nearing the POC as support.

Although the bounce from $144 was strong, recent price action revealed bears have seized control. The market structure break highlighted in orange showed a shift in bias on the lower timeframes. Moreover, this was in agreement with the higher timeframe downtrend, such as on the daily chart.

The $152-$155 area has acted as resistance since 24 February. On the day of writing, the price pushed as far north as $155.7, before tumbling to $150.4. This sharp rejection saw a fair value gap (white) form on the chart. This area had confluence with the resistance of the past ten days.

How much are 1, 10, 100 XMR worth today?

The OBV has trended upward since 4 March, when the prices bounced from $144. The RSI has also been above neutral-50 for the majority of the past week. However, in the house before press time, the same recorded a sharp plunge.

Taken together, the evidence revealed that demand has been steady over the past few days. And yet, the strong break in structure means XMR could retrace most, if not all of its recent gains. A short position can be considered if Monero sees a rejection around the FVG. Invalidation of this idea would be a session close above $155.7.

What does the Cumulative Volume Delta say about demand?

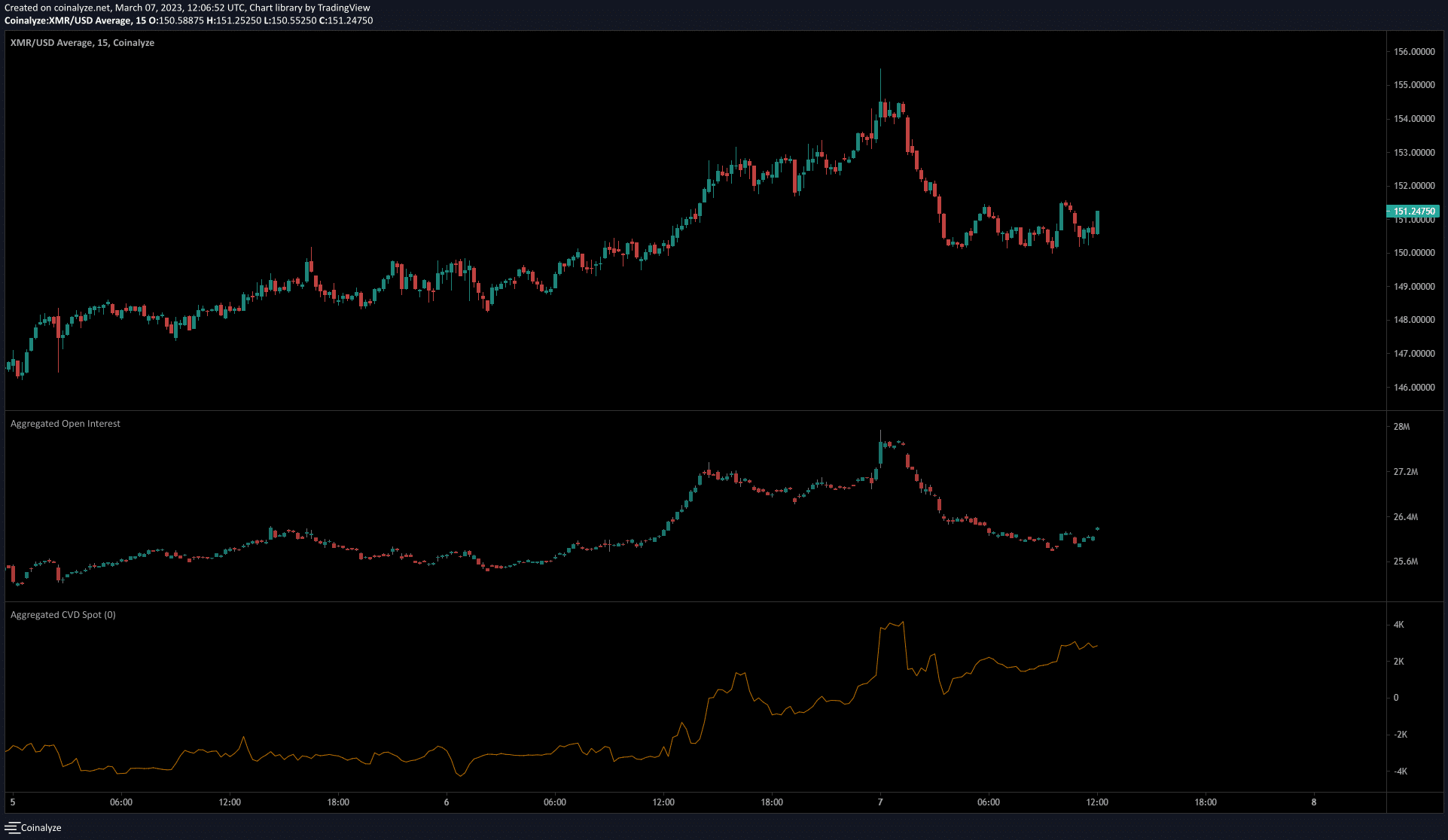

Source: Coinalyze

The spot CVD has been on the rise over the past couple of days. The 15-minute chart attached herein highlighted that despite the rising CVD, the sentiment could have shifted in favor of the sellers. When Monero noted rejection near $155, the OI crashed. Nearly $3 million worth of OI evaporated to signal discouraged buyers – A sign that bearish sentiment had taken root.

If this trend of a falling OI continues, it would support the bearish notion presented above. Hence, the OI could help sellers reach a bias as well.